CleanSpark, Inc. (Nasdaq: CLSK) shares fell sharply on Tuesday after the bitcoin-mining company disclosed plans for a potential $1 billion private offering of convertible senior notes due 2032.

Convertible Notes Offering

The Nasdaq listed company declared that they want to offer the first buyers a $1 billion total principal amount of convertible senior notes due in 2032 for resale in a private offering, subject to market circumstances and other considerations.

According to Rule 144A of the Securities Act of 1933, it is for those who are deemed to be qualified institutional purchasers.

Also Read: CleanSpark Disputes $185M Tariff Claim Over Imported Bitcoin Mining Equipment

Additionally, CleanSpark plans to give the initial buyers of the Convertible Notes the chance to buy up to an additional $200 million in the total principal amount of the Convertible Notes within 13 days starting on and including the day the Convertible Notes are issued.

The firm would repurchase shares of its common stock (the “common stock”) from investors in the Convertible Notes using up to $400 million of the net proceeds from the offering.

The remaining net proceeds will be utilised for general business needs, the construction of data centre infrastructure, the growth of the company’s land and power portfolio, and the settlement of any outstanding amounts on the line of credit secured by bitcoin.

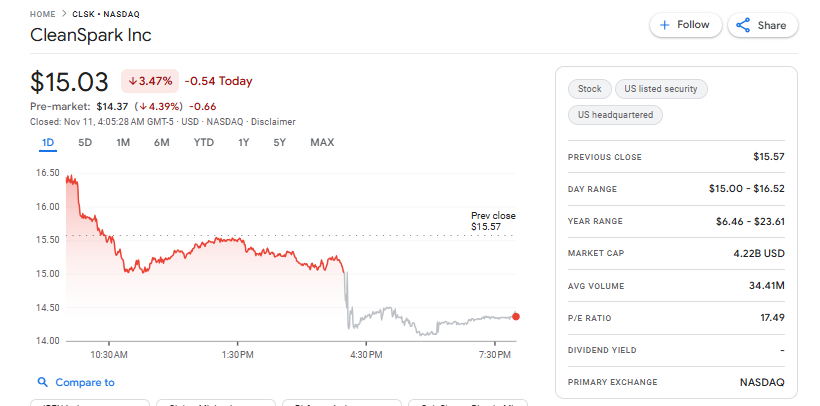

CLSK price dropped around 4%

The stock closed at $15.03, dropping 3.47% (down $0.54) from Monday’s close of $15.57.

In pre-market trading, the share price weakened further to about $14.37, a decline of 4.39% (roughly $0.66) from the prior close.

The company has a market cap of $4.2 billion while its trading volume stands at 34.41M

CleanSpark’s financial strategy

The company’s senior unsecured debt will be represented by the Convertible Notes. The Convertible Notes will not earn regular interest or see a rise in their principal amount.

The Convertible Notes will mature on February 15, 2032, unless they are redeemed, repurchased, or converted in accordance with their terms. The Convertible Notes will be convertible at any time until the close of business on the second scheduled trading day immediately preceding the maturity date after August 15, 2031.

Before that date, the Convertible Notes will only be convertible upon fulfilment of specific conditions and during specific periods.

At the company’s discretion, the Convertible Notes may be converted into cash, shares of common stock, or a mixture of both. The initial conversion rate and other parameters of the Convertible Notes will be decided upon during pricing discussions with the Convertible Notes’ original buyers.

The issuing of convertible notes is consistent with CleanSpark’s overarching plan to promote its long-term growth by making effective use of money. In order to guarantee the success of its offering and its continued operations, the firm will keep a careful eye on market circumstances as it proceeds.

Also Read: Cleanspark Secures $100 Million Bitcoin Backed Loan From Coinbase, Share Price Jumps By 5%