A remarkable development in the artificial intelligence sector has emerged with Chinese startup DeepSeek achieving the number one position on the Apple App Store with a relatively modest investment of $10 million.

The achievement stands in stark contrast to ChatGPT’s massive $17 billion fundraising and $150 billion valuation, highlighting a potential shift in market dynamics.

The disparity between these valuations has contributed to growing skepticism about AI valuations in the broader market, leading to a selloff in AI-related stocks.

The market sentiment has created a ripple effect, influencing cryptocurrency prices and generating increased volatility in digital asset markets, demonstrating the increasingly interconnected nature of technology sector sentiment.

Bitcoin Market Dynamics and Institutional Behavior

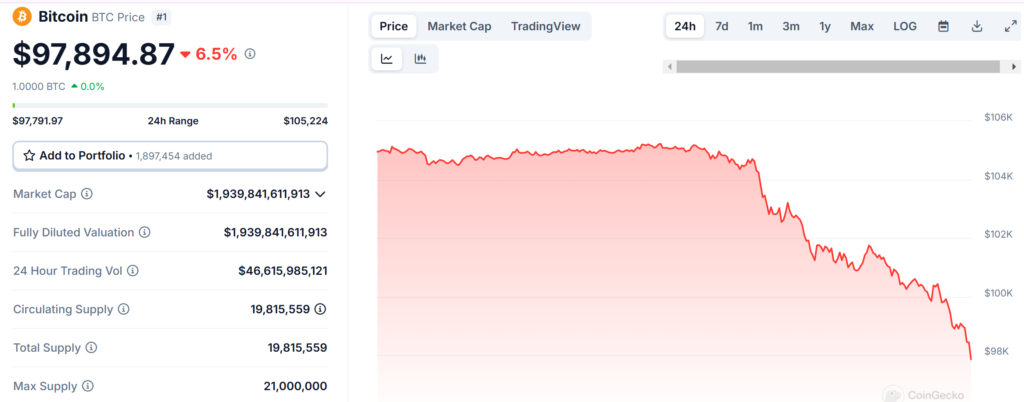

The cryptocurrency market has experienced significant price action, with Bitcoin currently trading at $98,303.64, representing a 6.29% decline over 24 hours and an 8.80% decrease over the past week.

The total market capitalization stands at $1.939 trillion, with a substantial 24-hour trading volume of $46.61 billion.

However, beneath these surface-level price movements, a fascinating divergence is occurring between retail and institutional behavior.

While retail investors appear to be selling in response to market volatility, institutional investors are actively accumulating Bitcoin at record levels.

The result suggests a sophisticated long-term strategic approach to digital asset investment rather than reactive trading based on short-term price movements.

Global Government Integration of Digital Assets

A remarkable shift is occurring in government approaches to cryptocurrency, particularly Bitcoin.

Several notable developments highlight this trend, Senator Cynthia Lummis of Wyoming has proposed that the Federal Reserve should consider selling gold reserves to acquire Bitcoin.

The development emerges in line with President Donald Trump’s vision of making the United States the global cryptocurrency leader.

Internationally, Bhutan’s Gelephu Mindfulness City has announced plans to include Bitcoin, Ethereum, and BNB in its strategic reserves, building upon the country’s already substantial digital asset holdings.

Hong Kong’s legislators are exploring the integration of Bitcoin into their Exchange Fund, while Japan maintains a more cautious stance.

On the other hand, Prime Minister Shigeru Ishiba expressed concerns about Bitcoin’s volatility and regulatory compatibility with existing financial systems.

Strategic Vision and Market Leadership

The evolving landscape has attracted commentary from influential figures in the cryptocurrency space, notably MicroStrategy’s Michael Saylor, who has expressed strong support for the establishment of strategic Bitcoin reserves in the United States.

Saylor’s vision aligns with broader institutional movements, suggesting that current market conditions represent an opportunity for strategic positioning rather than cause for concern.

The perspective is particularly relevant given the total market dynamics, where institutional accumulation continues despite retail market uncertainty.

The situation presents a clear dichotomy between short-term market reactions and long-term strategic positioning by both institutional investors and government entities.