Changpeng “CZ” Zhao’s crypto investment firm $10 billion YZi Labs, is considering plans to broaden access to external investors, according to Ella Zhang, who leads the fund.

YZi Labs has so far kept its capital base mostly private, managing Zhao’s personal wealth as well as some funds from a few of the early Binance insiders, such as co-founder Yi He.

The fund accepted approximately $300 million from outside sources for a short time in 2022, but eventually returned part of it after realizing the size of the assets in the fund was quite overwhelming.

According to Ella Zhang, it was stated that while there is interest from outside investors, the firm thinks the timing of opening the fund more broadly is just “not there yet.”

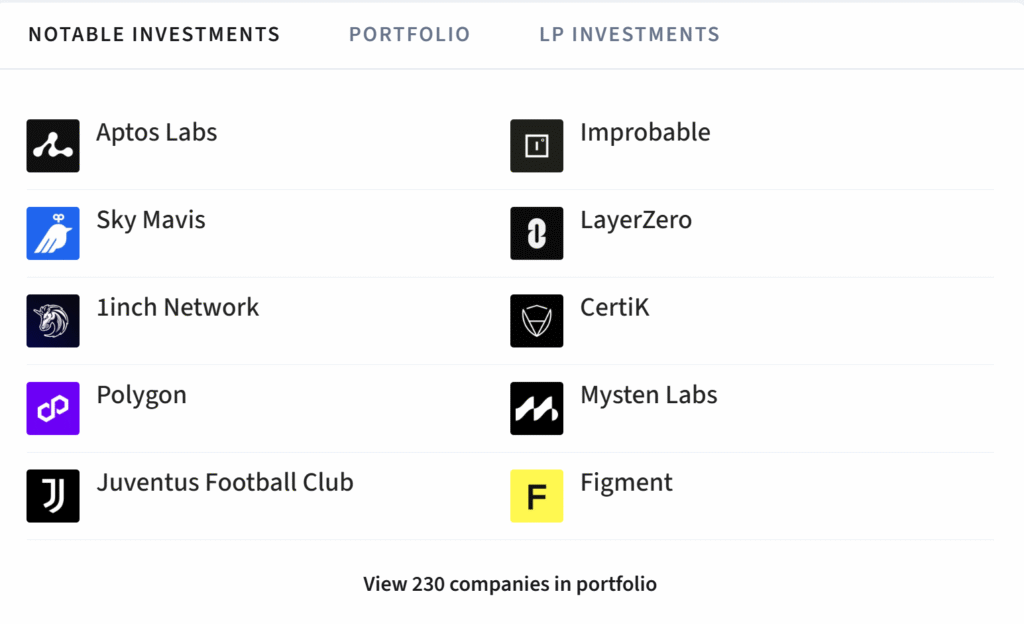

Web3 and Crypto Portfolio

YZi Labs has quietly become one of the most significant investors in the digital asset space and manages a portfolio of more than 230 companies.

The firm has invested in new high-profile blockchain projects like Aptos Labs, Polygon, and 1inch Network, as well as major Web3 gaming companies like Sky Mavis.

The company also has exposure to infrastructure and security with its early investments in LayerZero, Mysten Labs, and CertiK.

The investments reflect Zhao’s efforts to support both platforms that are consumer-facing, but also to invest in the vital backend technologies that will be the foundation of a crypto economy.

Aside from portfolio management, YZi Labs has been making strategic investments in the blockchain and digital asset ecosystem.

UnoCrypto reported key investments by YZi Labs earlier this year in March, we reported the investment in Plume Network to bridge RWA, and also invested in Tensorplex Lab to boost decentralized AI.

Furthermore, on July 3rd, the firm participated in $135 million Series E funding round in Digital Asset, whose business is scaling the Canton Network, which is already facilitating trillions of dollars in real-world transactions, according to UnoCrypto.

And recently, on September 19th, we reported that YZi Labs further supported Ethena, the issuer of the stablecoin USDe, as it saw its market cap surpass $13 billion, becoming the third-largest U.S. dollar-denominated asset in crypto.

This has been to demonstrate YZi Labs’ continued intent on putting itself firmly at the center of blockchain infrastructure and financial innovation, even while the firm considers making a material structural change to allow for outside investors.

SEC Shows Interest in YZi Labs’ Portfolio Amid Regulatory Shifts

In a noteworthy turn of events, the U.S. Securities and Exchange Commission (SEC) has sought a private demonstration of YZi Labs’ portfolio companies after its chair missed the company’s presentation at the New York Stock Exchange.

Zhang described the communication as showing that U.S. regulators under the Trump administration were now more open-minded.

SEC chair Paul Atkins, who took over in April 2025, was described as actually wanting to meet with top crypto projects and firms.

This is an implied change in regulatory tone after many years of heightened scrutiny and may present an easing of the environment for firms like YZi Labs to have a bigger role.

Also Read: Bitcoin Programmable Layer Hemi Secures $15 Million Financing Led By Binance Co-founder’s Yzi Labs

CZ’s Legal and Personal Challenges Cast a Shadow

Even though there are a number of positive indicators, Changpeng Zhao’s past legal troubles remain an overhang for his business undertakings.

Zhao resigned from his position as Binance CEO in 2024 after pleading guilty to charges related to poor anti-money laundering (AML) controls at the exchange.

He served a four-month prison sentence and is now trying to apply for a pardon from President Donald Trump.

He no longer holds an executive position at Binance, but he is still the largest shareholder, meaning that he remains actively engaged in the crypto ecosystem.

With this historical backdrop still pressuring the future state of YZi Labs, it complicates any prospects for its future potential as an external-facing investment powerhouse.

Also Read: YZi Labs Invests in OneKey to Boost Global Crypto Self-Custody Solutions