A significant Chainlink (LINK) whale has recently experienced substantial losses in their trading activities. The trader deposited 250,000 LINK tokens (valued at $5.37 million) to cryptocurrency exchanges Binance and OKX.

The action as reported by Lookonchain on X earlier today follows their previous withdrawal of 595,000 LINK tokens (worth $17.31 million) from Binance between December 14 and December 18, when they acquired the tokens at an average price of $29.1.

Given the current market conditions and price decline, this whale is now facing an approximate loss of $4.5 million on their LINK position, highlighting the volatile nature of cryptocurrency investments and the risks associated with large-scale trading.

Current Market Status and Price Analysis

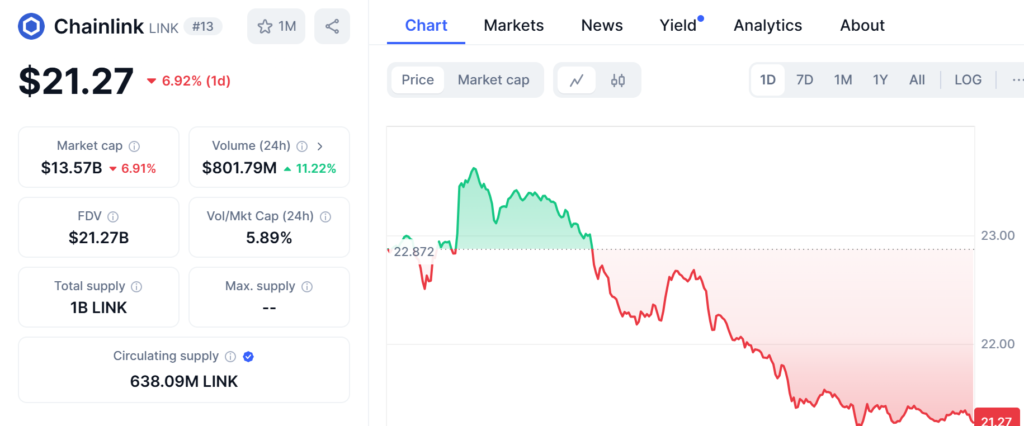

Chainlink’s current market performance shows significant downward pressure. The token is trading at $21.28, with a substantial 24-hour trading volume of $1,044,849,709.

The market has witnessed declines, with a 6.81% decrease in the last 24 hours and an 11.97% drop over the past week.

Chainlink’s market capitalization currently stands at $13,461,185,385, supported by a circulating supply of 630 million LINK tokens.

These metrics indicate a notable correction from recent highs, particularly impacting large-scale investors and traders in the ecosystem.

Historical Context and Recent Developments

The current market situation presents a stark contrast to earlier December developments. On December 7th, Chainlink experienced a remarkable 35% surge in value over a week, nearly reaching a three-year high.

The impressive rally was primarily driven by increasing institutional interest, evidenced by positive commentary from financial leaders.

The contrast between early December’s bullish momentum and the current market correction demonstrates the cryptocurrency market’s inherent volatility and rapid sentiment shifts, even for established projects like Chainlink.

Broader Market Context and Related Losses

The Chainlink whale’s losses are part of a broader pattern of significant cryptocurrency market losses affecting various tokens and traders.

Notable examples include an ETH whale’s liquidation of 6,429 ETH (worth $21.45 million) to repay WBTC loans, resulting in a substantial $68 million loss on their ETH/BTC position.

Similarly, a FARTCOIN holder faced an $87,000 loss after accumulating $1.02 million worth of tokens.

These parallel cases illustrate the widespread nature of current market challenges and the significant risks associated with leveraged positions and large-scale cryptocurrency investments, regardless of the underlying asset’s fundamentals or market position.