A significant cryptocurrency investor has executed a notable accumulation strategy for Chainlink (LINK) tokens over a 17-day period.

The whale, identified through wallet address 0xa4….ebc9b, withdrew 226,340 LINK tokens from Binance earlier today the 10th of January, representing an investment of approximately $4.74 million at an average price of $20.95 per token.

However, this substantial position has faced immediate challenges, with the investor currently experiencing a paper loss of $289,000 due to market volatility.

Market Context and Trading Dynamics

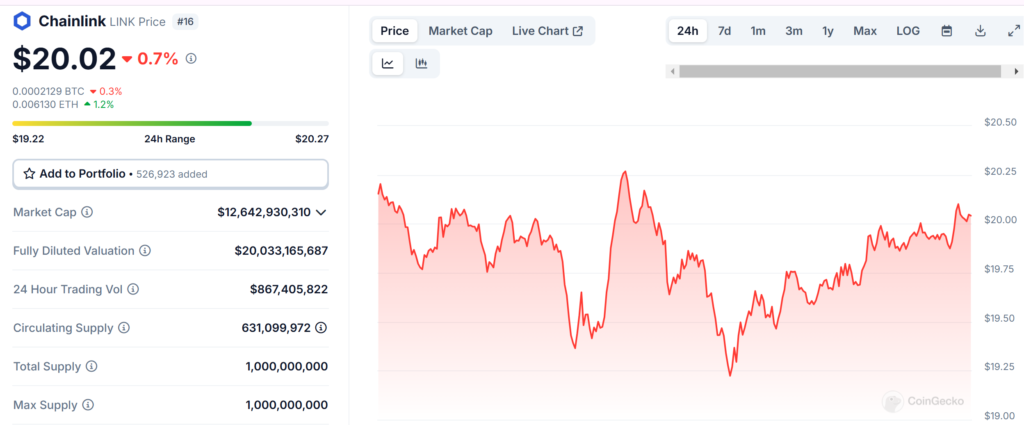

The loss stems from LINK’s price decline to $20.02, marking a -0.70% decrease in 24 hours and a more substantial -9.14% drop over the week.

Chainlink’s current market metrics paint a picture of significant trading activity and institutional interest.

The cryptocurrency maintains a substantial market capitalization of $12.64 billion, supported by a circulating supply of 630 million tokens.

Trading volume has remained robust at $867.4 million over 24 hours, indicating active market participation despite recent price pressures.

These figures demonstrate Chainlink’s continued importance in the cryptocurrency ecosystem, even as the token navigates through a period of price correction and market uncertainty.

Broader Whale Activity and Market Impact

The cryptocurrency community has witnessed various high-profile LINK trading activities concurrent with this accumulation.

Notable among these is another Chainlink whale who recently deposited 250,000 LINK tokens (valued at $5.37 million) to Binance and OKX, resulting in a significant $4.5 million trading loss.

Additionally, institutional interest has been demonstrated through World Liberty, a Trump-family associated cryptocurrency project, which made substantial purchases of LINK alongside other cryptocurrencies like AAVE, investing approximately $1.3 million in these assets through Cow Protocol.

Market Sentiment and Recent Developments

The market has shown mixed signals, with some investors displaying strong confidence through significant accumulation while others face substantial losses.

A particularly interesting development involves a dormant whale wallet that invested $2.58 million to acquire 93,271 LINK tokens at an average price of $27.71, coinciding with a 27% price surge.

These varied trading activities reflect the dynamic and sometimes contradictory nature of cryptocurrency markets, where large-scale accumulation can occur simultaneously with significant selling pressure.

The current market environment suggests a period of price discovery and repositioning among major holders, with implications for LINK’s short-term price action and longer-term market structure.

Also Read: Chainlink Surges 35% in a Week, Nears 3-Year High With Rising Institutional Push