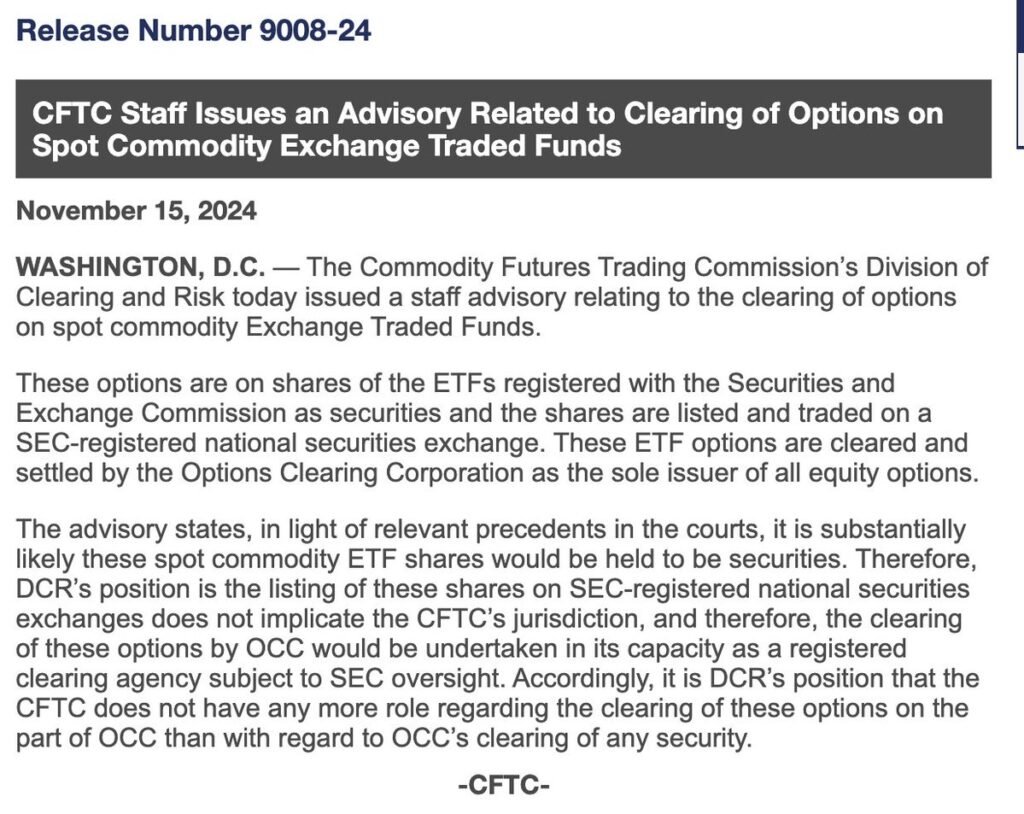

The cryptocurrency market witnessed a significant regulatory development as the Commodity Futures Trading Commission’s Division of Clearing and Risk (DCR) issued a crucial staff advisory (9008-24) on November 15, 2024.

This advisory specifically addresses the clearing procedures for options on spot commodity Exchange Traded Funds, marking a pivotal moment in the evolution of cryptocurrency investment vehicles.

Bloomberg analyst Eric Balchunas highlighted the significance of this development, noting that this CFTC clearance represents the second major regulatory hurdle cleared, with only the Options Clearing Corporation (OCC) listing remaining as the final step in the process.

Regulatory Framework and Jurisdictional Clarity

The advisory provides crucial clarification regarding the regulatory framework for ETF options trading, specifically addressing ETF shares registered with the Securities and Exchange Commission (SEC).

These shares, actively traded on SEC-registered national securities exchanges, will be cleared and settled exclusively through the Options Clearing Corporation.

The DCR’s position, based on established court precedents, classifies spot commodity ETF shares as securities, effectively placing them outside the CFTC’s direct jurisdictional scope.

This classification streamlines the regulatory oversight process, with the OCC handling clearing operations under SEC supervision, while the CFTC’s involvement remains limited to standard security clearing operations.

Also Read: Wall Street Giant Goldman Sachs Confirms $710 Million Bitcoin ETF Holdings

Market Response and Bitcoin Price Movement

The cryptocurrency market has shown notable resilience despite initial concerns following Federal Reserve Chairman Jerome Powell’s cautionary remarks in Dallas on November 14.

While Bitcoin experienced a temporary decline of 2.79% to $86,979 following Powell’s speech, the market has demonstrated remarkable recovery strength.

Current data shows Bitcoin trading at $91,418.19, representing a significant 4.14% increase in 24-hour trading volume of $71.7 billion.

The weekly performance is even more impressive, with a 19.61% price increase over the past seven days, reflecting strong market confidence in the wake of positive regulatory developments.

Market Capitalization and Trading Metrics

Bitcoin’s market position remains robust, with current metrics indicating substantial market depth and liquidity.

The cryptocurrency’s market capitalization stands at an impressive $1.8 trillion, supported by a circulating supply of 20 million BTC.

The substantial 24-hour trading volume of over $71 billion demonstrates active market participation and strong investor interest.

These metrics, combined with the positive price movement and regulatory clarity from the CFTC, suggest a maturing market infrastructure that could support the successful integration of new investment products like spot Bitcoin ETF options.

Also Read: Bitcoin ETFs See Heightened Demand With 5% Supply Under Belt