Cathie Wood’s ARK Invest had undertaken a significant portfolio reshuffle, unloading $148 million of leading tech and fintech names in anticipation of placing a high-risk, high-reward wager on Ethereum.

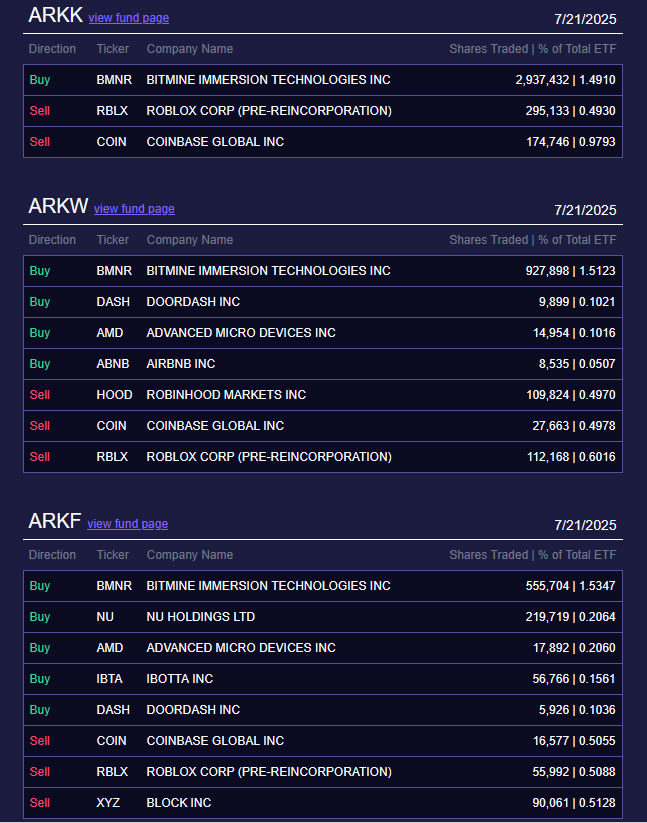

According to ARK’s trading report, the firm sold 218,986 shares in Coinbase (COIN) valued at approximately $90.5 million and 463,293 shares in gaming giant Roblox (RBLX) valued at $57.7 million.

The sudden strategic pivot is due to the company redirecting capital from outperforming equities into crypto infrastructure, representing a significant deviation from Wood’s investment thesis.

The investment exceeds a conventional rebalance; it is a strategic move towards blockchain-centric assets in the wake of rapid development in the Ethereum ecosystem.

$174M Investment in Bitmine: Bet on the Future of Ethereum

The market-moving news was ARK’s $174 million investment in Bitmine Immersion Technologies (BMNR), an Ethereum-centric treasury and mining firm led by Fundstrat’s Tom Lee.

The three ARK ETFs in question, ARK Innovation (ARKK), Next Generation Internet (ARKW), and Fintech Innovation (ARKF), have combined to purchase 4.4 million shares of Bitmine, which now accounts for 1.5% of each fund’s portfolio.

The recent development is the first time ARK has purchased Bitmine, following the company’s pivot from holding Bitcoins to Ethereum towards the end of June.

The strategic shift by the company is on the heels of growing optimism regarding Ethereum’s long-term infrastructure and staking economics, as Ether increasingly serves as the central store of value in DeFi and Web3 systems.

Also Read: Cathie Wood’s Ark Invest Acquires 84K Coinbase Shares For $13.3M Amid Market Slump

Bitmine’s Meteoric Rise and Ethereum Turn Spark Investor Frenzy

Bitmine Immersion Technologies experienced a meteoric rise following the announcement that it would be solely committed to Ethereum.

Since the June announcement, Bitmine shares have soared over 3,000%, reaching $135 on July 3 before stabilizing at a hold between $39.57, up over 400% year-to-date.

The shares’ rally has attracted heavyweight money, including billionaire venture capitalist Peter Thiel’s purchase of 9.1% of the company.

The Ethereum pivot represents a fundamental rebranding of Bitmine, positioning it in alignment with the rapidly evolving ETH 2.0 ecosystem.

Also, indicating broader institutional interest in Ethereum as an institutional-grade asset, beyond Bitcoin’s dominance.

Broader ARK Strategy: Cutting Coinbase, Robinhood, Circle, Doubling Down on Disruptors

The latest action follows a wider trend of strategic rebalancing among ARK’s funds.

Just last month, on June 17th, ARK offloaded 342,658 shares of stablecoin issuer Circle (CRCL) worth $51.7 million following a pop related to the rising adoption of USDC.

Subsequently, on July 1st, ARK offloaded $43.8 million worth of Coinbase shares as COIN approached its all-time high, reaping profits after a 42% surge.

These exits illustrate disciplined rotation out of hot property and into new opportunities like Bitmine, AMD, Doordash, and Airbnb, firms with exposure to disruptive tech or infrastructure plays that can influence the next decade.

ARK Funds Remain Highly Exposed to High Tech While Struggling with Ethereum

Despite the selloffs, ARK’s flagship funds are highly exposed to innovation and growth.

ARKK, with $6.8 billion AUM, still lists Tesla as its largest holding at 9.7%, with Coinbase and Roblox remaining substantial holdings.

Likewise, the ARKW fund, dedicated to next-generation technologies and cloud infrastructure with a $2 billion AUM, boasts Tesla, Robinhood, and Coinbase among its top three holdings.

The aim is to maintain overweight positions in e-commerce and technology giants such as Meta, Shopify, and Amazon.

However, the addition of Bitmine is a significant step in the direction of Ethereum’s infrastructure, indicating that Cathie Wood views cryptocurrency, and particularly Ethereum, in a favorable light.

Notably, this is not just as an asset class, but as a foundational building block for the future of digital innovation.