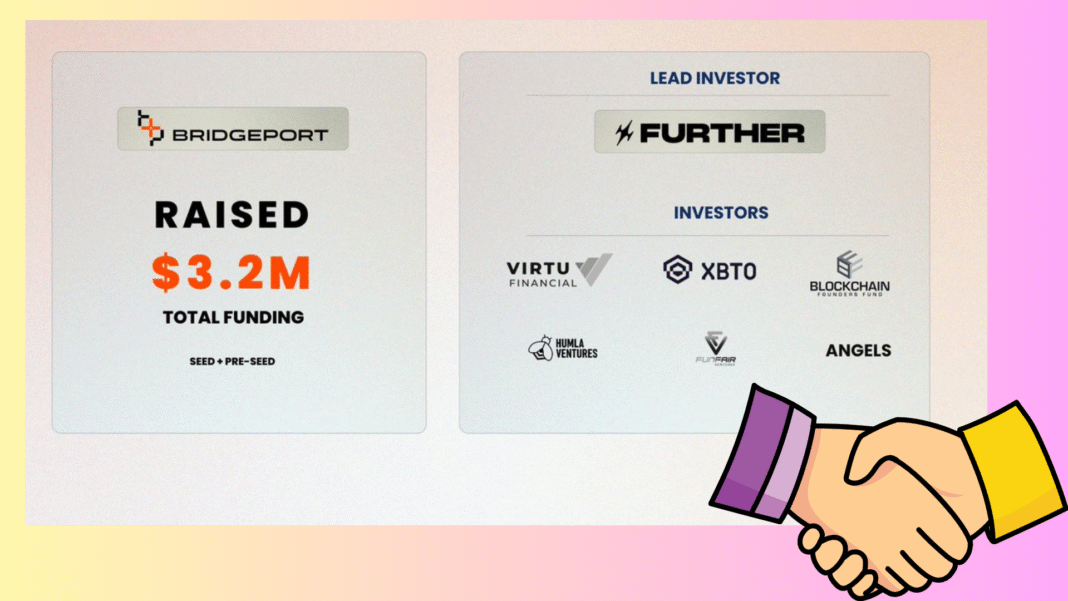

BridgePort, a cryptocurrency over-the-counter (OTC) settlement platform, has successfully raised $3.2 million in a seed funding round aimed at expanding its infrastructure and team.

The round was led by Further Ventures and supported by key investors including Virtu, XBTO, Blockchain Founders Fund, Fun Fair Ventures, and Humla Ventures.

The capital injection comes at a time of rising institutional demand for more efficient off-exchange settlement mechanisms in the digital asset market.

BridgePort’s mission is to resolve long-standing inefficiencies in crypto trade settlement, namely, the need for pre-funding, exposure to credit risk, and fragmented capital allocation processes.

Middleware Innovation for Seamless Capital Efficiency and Risk Reduction

BridgePort provides a middleware solution that serves as an agnostic connectivity layer between trading platforms, custodians, and institutional trading firms.

Its platform streamlines post-trade workflows by enabling real-time messaging and collateral management, reducing the need for prepayment and improving capital efficiency.

By focusing on eliminating operational frictions in trade settlement, BridgePort positions itself as a critical infrastructure provider in the evolving crypto market.

The platform not only mitigates credit and settlement risk but also enhances interoperability across fragmented venues, addressing one of the biggest bottlenecks in institutional crypto trading.

Production Launch Marks Milestone in Off-Exchange Coordination

The company has now officially launched its production platform, hosted on AWS and designed for scalability.

It supports integration via REST APIs, FIX protocol, and bespoke connectivity options, making it easy for trading platforms and regulated custodians to onboard.

BridgePort’s live infrastructure and rapid client onboarding underscore its readiness to deliver on the institutional demand for a secure, unified settlement layer.

According to CEO Nirup Ramalingam, the funding and platform launch represent a “major milestone” in realizing their vision of fixing capital inefficiencies and fostering seamless off-exchange coordination in the crypto market.

Also Read: Base Chain Gaming Platform Uptopia Secures $4M in Funding with Lead Investment from Pantera Capital

Backing from Traditional and Crypto Giants Signals Industry Confidence

The participation of institutional giants such as Virtu and XBTO reflects the growing importance of infrastructure solutions in digital asset markets.

Further Ventures’ Managing Partner Mohamed Hamdy commented that BridgePort is tackling one of the “most structurally limiting inefficiencies” in crypto, credit fragmentation and pre-funding burdens.

He emphasized the team’s deep background in ultra-low latency systems from traditional finance as a strategic edge in building the next-generation crypto market architecture.

Investors clearly see BridgePort as a foundational layer for the future of scalable and secure crypto settlement operations.

Also Read: Swedish Health Company H100 Group Share Soar by 45% Following $10M Funding For Bitcoin Investment

Crypto Funding Landscape Sees Broader Momentum Across Infrastructure Projects

BridgePort’s raise comes amid a broader resurgence in crypto infrastructure funding.

Other major updates from earlier this month, include Zama’s $57 million Series B round to bring encrypted smart contracts to public blockchains.

Zypher Network’s also had a $7 million round to scale its zero-knowledge, AI-integrated Web3 infrastructure.

Notably in the same path, YZi Labs’ investment in Digital Asset’s $135 million Series E to strengthen the Canton Network.

Collectively, these developments highlight renewed confidence in infrastructure-driven innovation as the next growth wave for digital assets.

BridgePort’s successful raise places it among a rising cohort of projects reshaping the foundational tools of the crypto economy.

Also Read: Melbourne-Based CloudTech Raises $14 Million Worth of Bitcoin and USDT in Series A Funding Round