Yorkville Acquisition Corp., Trump Media & Technology Group and Crypto.com said today they have struck a deal to form Trump Media Group CRO Strategy, Inc., a public company that will build a large treasury of CRO, the native token of the Cronos blockchain.

The business combination will be done through Yorkville, a SPAC, and aims to fund the new firm with a mix of CRO tokens, cash and a large credit line so the company can buy and manage CRO as its core asset.

Offer details and structure

Under the agreement, the new entity will be majority owned by Yorkville, Trump Media and Crypto.com as founding partners. Funding is expected to include $1,000,000,000 in CRO, equal to about 6,313,000,212 CRO and representing roughly 19% of CRO’s market capitalisation at announcement.

The plan also calls for $200,000,000 in cash and $220,000,000 in cash-in mandatory exercise warrants. An affiliate of Yorkville, YA II PN, Ltd., is committed to a $5,000,000,000 equity line of credit to back further CRO purchases.

Backstop and listing moves

YA II PN, Ltd. also entered a backstop to buy Class A ordinary shares that are validly submitted for redemption by public shareholders, subject to a cap that would limit its beneficial ownership to no more than 9.9%.

Yorkville said it will seek a Nasdaq listing under the ticker MCGA before the business combination closes. That symbol would then transfer to Trump Media Group CRO Strategy when the deal is complete.

Lock-ups and timelines

The founding partners agreed to an initial one-year lock-up on their shares and warrants after closing. That lock-up will be followed by a further restrictive release schedule over three years.

The measures are framed as a way to show long-term commitment from the partners.

$CRO’s Price Actions

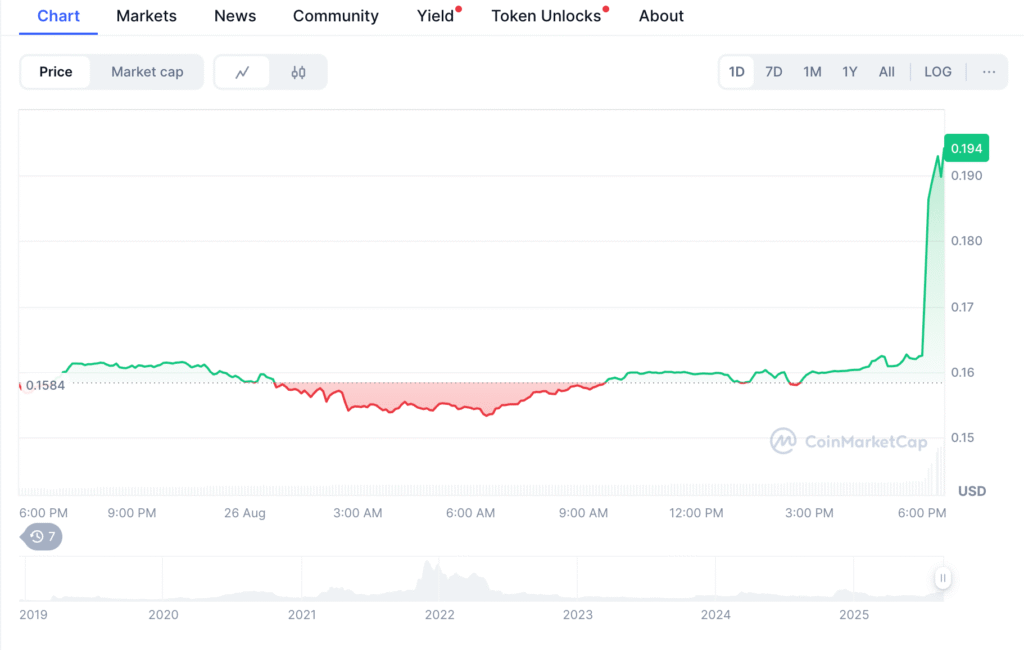

The announcement sparked strong market moves for CRO. The token traded at $0.1918 and rose 21.66% on the day. Market capitalisation moved up to $6.44 billion, a gain of about 21.89% for the session.

Reported 24-hour trading volume jumped sharply, rising about 548% to roughly $258 million. CRO’s fully diluted valuation stood at $19.21 billion, and the token ranks about 23rd on many market lists and shows interest from roughly 795,000 watchers on one tracking platform.

Why the partners want CRO?

The new company will make CRO its treasury asset, the backers say Cronos offers low-cost, fast transactions and cross-chain links that let tokens move with ease between networks.

The plan is to operate a validator node and to stake CRO to earn rewards. Those rewards would be reinvested to grow holdings over time. The founders argue this approach aims to turn cash reserves into a yield-producing crypto position tied to network activity.

How the strategy will work in practice?

After closing, the company expects to convert most of its cash into CRO. It will run a validator to help secure the Cronos network and to collect staking yield.

A crypto native team will manage the node and seek to attract outside CRO delegations. The stated goal is to compound CRO holdings through staking and to use the token both for governance and for on-chain utility.

Questions and risks ahead

The plan raises several big questions, and holding such a large share of any token can affect price and liquidity. Pledging most cash to a single digital asset carries concentration risk for shareholders.

Operating a validator can produce rewards, but it also brings technical, security and regulatory tasks. The equity line of credit and the lock-up schedule are meant to support market confidence, but investors will watch closely for how token purchases are executed.

What the partners said?

Trump Media’s chair highlighted the move as part of a wider shift toward digital finance and said the group remains bullish on crypto.

Crypto.com’s leadership noted the size and scope of the plan, pointing to the mix of token commitments and cash as making the treasury effort notable among digital asset treasuries.