According to a recent report by Ali Charts, Bitcoin whales have sold over 20,000 BTC in the last 24 hours, valued at approximately $1.28 billion. This activity has raised concerns and prompted discussions about the potential direction of the cryptocurrency market.

Whale Activity as a Market Indicator

Whales in the crypto market are frequently seen as important indications. A bullish feeling in the market can be inferred when more Bitcoin is moving into these sizable wallets than out, which usually indicates confidence in the asset’s future worth.

However, according to current data, the rate at which Bitcoin whale accumulation has accumulated has slowed down from earlier in the year, which some analysts may interpret as a gloomy indication.

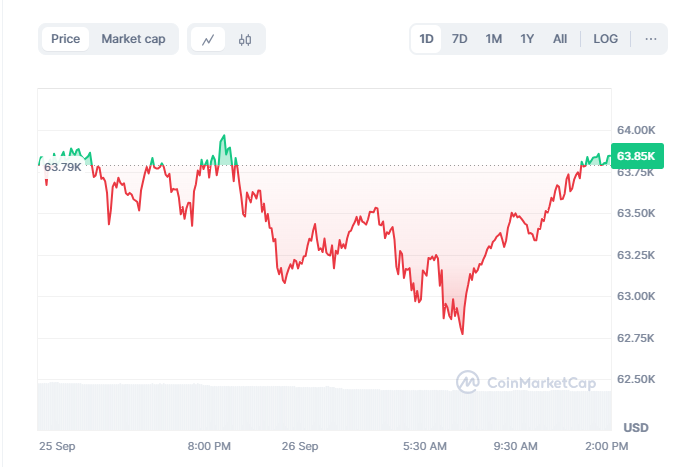

As of right now, the price of Bitcoin is $63,689.83, having just reached $64,000. The cryptocurrency has increased in value by almost 3% over the previous week, despite a tiny decrease of 0.20% during the last day. Additionally, trading volume has decreased by 17.73% to $24.47 billion.

Large Whale Sale-Offs Raise Questions

Just hours before a big price collapse, a large Bitcoin whale carefully sold 500 BTC, worth about $30 million. The community has expressed concerns about this action, with some hypothesising that the whale may have exhibited extraordinary market timing or insider knowledge.

According to blockchain analytics company Lookinchain, this whale made three significant trades, only one of which resulted in a $30 million profit. Losses from the other two deals were more than $6 million. The whale still owns 259.6 Bitcoin, which is currently worth $15.15 million, despite the setbacks.

Another interesting incident involved the re-surface of a long-dormant Bitcoin whale, which moved a stockpile of the cryptocurrency that had been unclaimed for more than ten years.

After 10.9 years, an address holding 81 Bitcoin, or around $5.19 million, was activated, according to Whale Alert. With its 2013 valuation of just $44,707, Bitcoin has experienced an incredible rise of 11,507% in its holdings.

Institutional Investment and Supply Concerns

Because big U.S. financial institutions have made considerable investments, the price of bitcoin has stayed close to its all-time high. Businesses that have been investing billions of dollars in Bitcoin include Greyscale, BlackRock, and Fidelity, who have positioned themselves as “Bitcoin whales” in the process. The bitcoin market now feels more legitimate and confident thanks to this inflow of institutional capital.

The limited supply of Bitcoin is a significant feature that enhances its appeal. There will only ever be 21 million Bitcoins, of which 19 million have already been mined. However, a large percentage of these Bitcoins are reportedly lost or locked up, which means they are probably never going to be available again.

As more institutions and whales accumulate Bitcoin, the limited supply becomes an even more pressing issue, potentially driving the price up in the future.