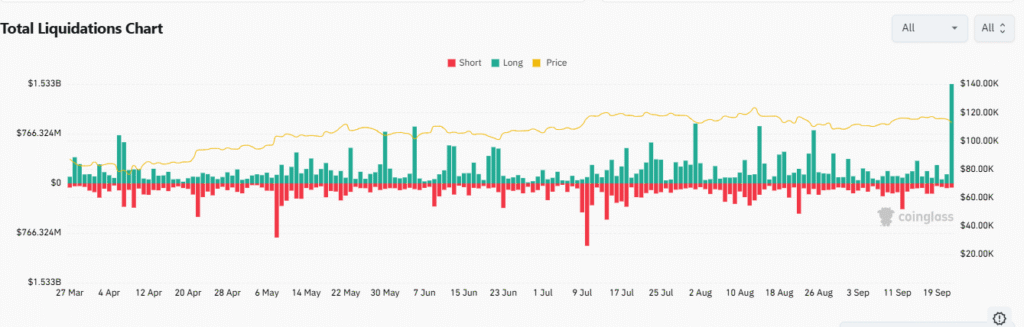

Late Sunday night, Bitcoin slid about 3% as traders and crypto investors pared back hopes from the recent 25-basis-point Fed rate cut. The fall hit markets worldwide. Heavy selling pushed prices down and forced liquidations on many leveraged positions.

Gold rose to around $3,725 as investors sought a safe place to park money amid policy uncertainty and slower-than-expected rate cuts. Traders worried about inflation, and as some pulled back from risky assets like crypto, demand for gold pushed its price higher.

Weekend pullback

Bitcoin was trading near $112,879.08 as of this report, down roughly 3% over the last day. Volume rose sharply, with 24-hour trading activity up about 124% as traders adjusted positions.

The market had climbed earlier in the week to around $118,000 after the Federal Open Market Committee cut rates by 25 basis points. That move briefly lifted risk appetite, but the rally did not hold.

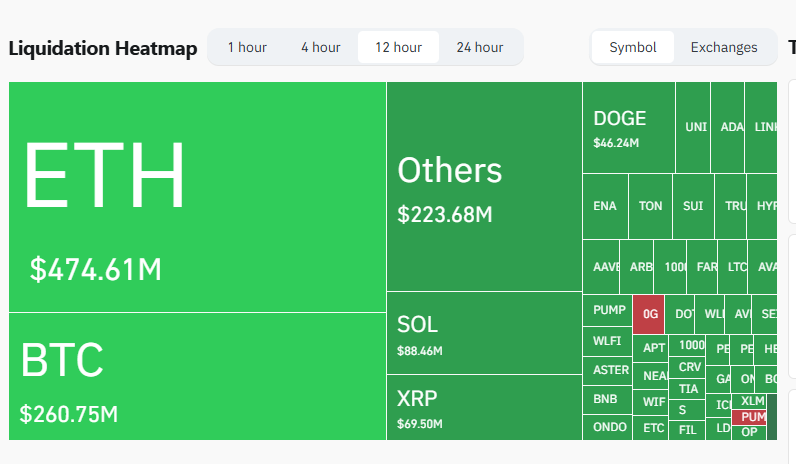

Liquidations and short-term flows

A snapshot of liquidations shows strong activity on the long side over the past day. Over 24 hours, Bitcoin long liquidations totalled $280.08M while short liquidations were $7.43M and 396,313 traders were liquidated.

On a four-hour basis, $BTC long liquidations hit $5.01M and shorts were $693.66K.

In the past hour, long liquidations were $33.20K against $505.02K in short liquidations. The total liquidation view also listed the Bitcoin price at $112,748.8 with a 24-hour move of -2.48% in that feed.

The bulk of the action came from long positions being closed out. That pushed some stop-loss orders and margin calls into motion and helped feed the pullback. Still, short liquidations in some windows show traders were also taking quick bets on a deeper drop.

Fed move and market mood

The Federal Reserve said it will review policy meeting by meeting, which left the market with less clarity on future cuts.

Many traders had hoped the September decision would spark a steady easing path and a sustained crypto rally. Instead, the Fed’s cautious stance encouraged some to take profits and others to trim risk.

Jeff Mei, COO at BTSE, described the weekend dip as a sign of caution. He noted the Fed’s meeting-by-meeting approach makes rapid easing unlikely. That has traders watching each new data point more closely than before.

Some analysts also say the broader bull cycle may have already peaked. With fewer fresh buyers and more profit-taking, moves like this weekend’s pullback become more likely.

Bitcoin and gold, in contrast

Gold and Bitcoin moved in different directions over the same period. Gold reached a new all-time high near $3,725, drawing buyers who see it as a store of value. Bitcoin fell, losing ground after its short-lived rise to about $118,000 earlier in the week.

Both assets can attract safe-haven demand, yet they often respond differently to policy signals and traders’ risk appetite.

The contrast highlights how investors split capital in times of uncertainty. Some shifted toward gold as a hedge, while others pared back crypto exposure. That reallocation can push gold higher even as Bitcoin cools.

What to watch next?

Traders will focus on macro data and any new comments from central banks. For Bitcoin, the near-term story will depend on whether buyers return to defend the $110,000 area or if sellers push the price lower.

Liquidity in futures and derivatives markets will be another key factor. High liquidation totals show the market still runs on leverage. That can speed moves in either direction.

Also Read: British Bitcoin Firm Treasury B HODL Lists On London’s Aquis (AQSE) After £15.3M Raise