Bitcoin (BTC) has been experiencing a significant upward trend, recently reaching a 10-week high of nearly $68,000 on October 15. Despite some subsequent volatility, the cryptocurrency has stabilized around $67,700.

This recent surge has caught the attention of market participants and analysts alike, with many speculating that the long-awaited “Uptober”.The term was coined by the crypto community for historically bullish October performances, may finally be materializing.

The impressive resurgence has sparked optimism among investors and traders, setting the stage for potentially groundbreaking price movements in the coming weeks.

Polymarket Predictions and Trader Sentiment

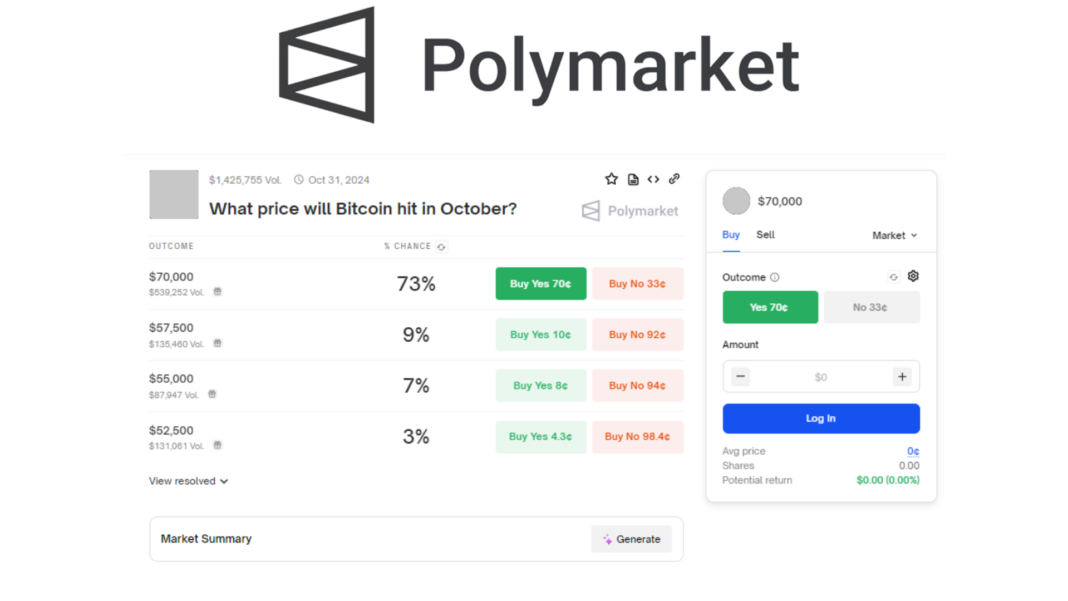

Data from the popular prediction market Polymarket has revealed growing confidence in Bitcoin’s potential for further gains. Based on a substantial trading volume of $539,252, the odds currently show a 68% chance of Bitcoin reaching the $70,000 mark by the end of October.

This bullish sentiment is significant, as it reflects the collective expectations of traders willing to put their money on the line. However, the market remains cautious, with alternative predictions still in play.

There’s a 10% chance that Bitcoin could settle at $57,500 and a 7% possibility of it ending the month at $55,000. These varied predictions highlight the inherent uncertainty in the cryptocurrency market and the range of potential outcomes that investors are considering.

Expert Analysis and Technical Perspectives

Ali Martinez, a well-known figure in the crypto analytics space, has suggested that Bitcoin can manage to break through the $67,400 resistance level.

This prediction calls out a very symmetrical setup with really good potential for significant upside if any of the key resistance levels get breached. Another analyst named Captain Faibik notes that Bitcoin is now testing a key resistance level of $68,000 for the sixth time.

This repeated testing of a key resistance level is often seen as a sign of strong bullish pressure, potentially setting the stage for a breakout if the level is successfully breached.

Political Implications and Broader Market Context

The cryptocurrency market’s performance is increasingly being viewed in the context of broader political and economic factors. Notably, former President Donald Trump has recently shifted his stance on cryptocurrencies, positioning himself as a pro-crypto candidate and promising to foster industry growth if re-elected.

This political dimension adds another layer of complexity to Bitcoin’s price predictions. According to Polymarket, Trump currently has a nearly 60% chance of winning the upcoming election, compared to 40.8% for his potential Democratic opponent, Kamala Harris.

However, national polls paint a different picture, with Harris leading slightly at 48.5% compared to Trump’s 46.1%. These political factors, combined with the technical analysis and market sentiment, create a multifaceted landscape for Bitcoin’s price trajectory in the coming months.