On Monday, Bitcoin continued to be under pressure, dropping below $92,000 and the price coming down to $89,300, thus increasing its losses from October’s record highs to almost 26%.

The decline is raising concerns about whether this is just a short-term correction or if it’s the start of another four-year cycle that will result in a longer-term sell-off.

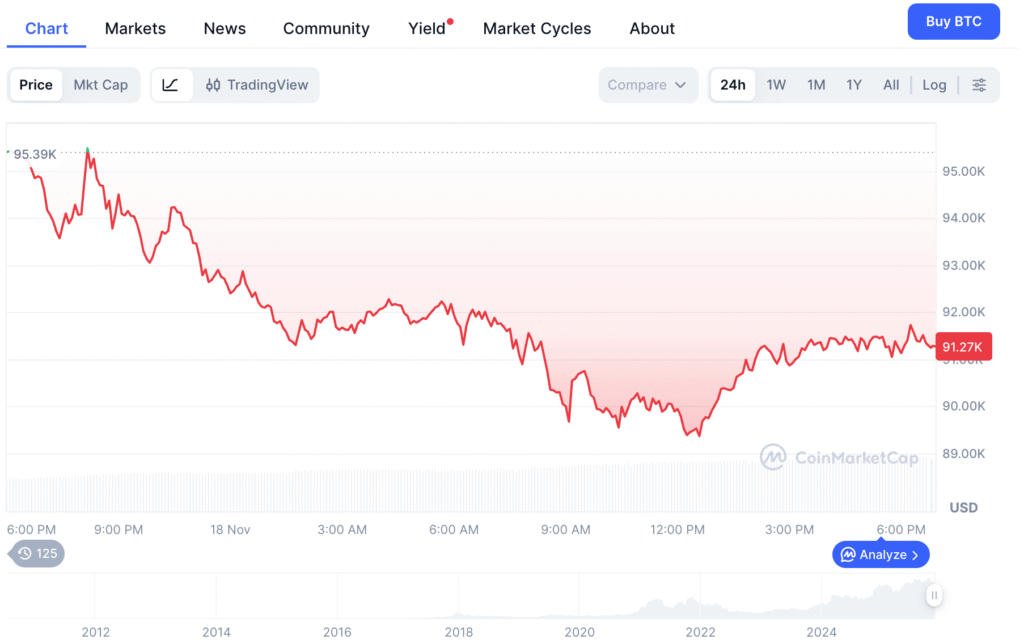

Bitcoin’s price actions

Bitcoin is trading at $91,259.67 now and is down by almost 4% in the last 24 hours. The global market cap is at $1.82 trillion and the 24-hour trading volume is 55.52%.

Since $19 billion in leveraged bets were liquidated last month, the coin has experienced a significant fall, which was made worse by long-term investors taking gains. Additionally, the interval during which bitcoin typically peaks, roughly 400–600 days following its most recent halving event, which took place in April 2024, coincides with the present sell-off.

The Fear & Greed Index

We reported yesterday that the Crypto Fear & Greed Index dropped to 10, its lowest level since July 2022, as traders wiped out $617.45 million in liquidations in a single day.

“This self-fulfilling prophecy has led to a market sell-off for bitcoin in Q4’25,” Bernstein analysts led by Gautam Chhugani wrote. “However, we believe, the following evidence points to a short-term consolidation into a new local bottom and not the historical 60-70% drawdown seen in previous cycles.”

The use of ETFs by institutional investors has increased, according to the experts, indicating “higher quality and consistent ownership” of bitcoin. Positive factors for a bull run include the Clarity Act legislation in Congress and the Trump administration’s support for Bitcoin.

“We are observing if Bitcoin can bottom close to ~$80K range seen immediately post the Trump election. We believe the current market weakness may provide an attractive entry for new investors,” he added.

Institutional support for Bitcoin

A certain amount of support is also provided by Strategy’s (MSTR) ongoing purchases of the cryptocurrency, as on Monday, the business disclosed that it had acquired an additional 8,178 tokens at an average price of $102,171 apiece, for a total of $835 million.

Gemini’s Cameron Winklevoss commented on the bear market and Bitcoin’s price by saying that this is the last time anybody can buy Bitcoin below the 100k level.

Binance CEO Richard Teng said, “Reminder for everyone in the space: In crypto markets, emotions are expensive. Volatility is part of the journey. The best defense is a clear strategy, patience, and diligent #DYOR. Focus on fundamentals, not the short-term noise.”

Peter Schiff said that Bitcoin dropped below $90,000 and that it’s down 28.5% from its high. But more significantly, with gold still trading above $4,000, Bitcoin is down 40% priced in gold.

So Bitcoin’s collapse relative to gold exposes the digital-gold hype as a fraud. Those who bought into it will sell, he noted.

The Fed’s more aggressive stance in recent days “has tilted the macro balance, leaving the market increasingly fragile,” according to 10X Research, as fresh buyer appetite actually stopped around October 10.