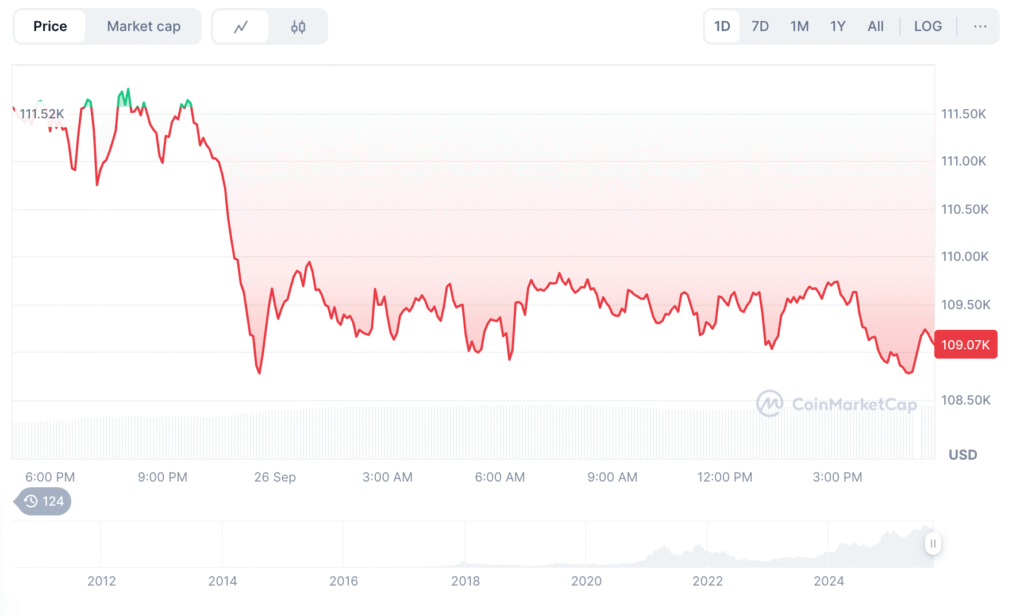

Bitcoin fell on Friday as traders pulled back ahead of the U.S. core PCE inflation report, with spot bitcoin ETFs seeing net outflows and nearly $1 billion in liquidations hitting the crypto market in 24 hours.

The move left BTC trading near $109,200.43, down about 2% on the day and almost 6% for the week.

U.S. spot bitcoin ETFs posted roughly $258 million of net outflows on Sept. 25, and spot ether ETFs saw about $251 million in withdrawals the same day.

Derivatives liquidations approached $1 billion, largely tied to long positions, driving forced selling across the market.

$BTC’s Price Actions

Bitcoin traded under $109,000 during the drop, and the global crypto market cap sits near $2.17 trillion. The last 24-hour trading volume was about $74.7 billion.

Over the past week, BTC lost close to 6% even though it remains up around 4.5% for September so far. That leaves the market in a fragile state where small moves can trigger big reactions.

ETF flows and investor behaviour

U.S. spot bitcoin ETFs saw net outflows of roughly $258 million on Sept. 25, data shows. BlackRock’s iShares Bitcoin Trust was the only fund to record net inflows that day.

Spot Ether ETFs had about $251 million in net outflows, marking a fourth straight session of withdrawals. The swings in ETF flows have added to uncertainty.

Some days see inflows. Other days bring large outflows. That back and forth has made it harder for traders to pick a clear direction.

Derivatives squeeze and liquidations

Derivatives markets bore the brunt of the unwind, as CoinGlass data pointed to nearly $1 billion in liquidations over 24 hours, mostly long positions. That means many leveraged traders were forced out of bets when prices moved down.

Forced selling amplifies moves and can push prices through short-term support levels. The result this week has been a leveraged washout that pushed BTC lower than recent floors.

This price action follows the post-FOMC shakeout earlier in the week, and analysts say the drop put some key levels back into play. One researcher, Timothy Misir, noted that BTC briefly touched $108,652 before finding some stability.

He said the market still needs a clear breakout to lift sentiment, and Misir also pointed out that long-term flows and seasonal trends still offer a medium-term positive case for crypto. But he warned that the market is fragile and traders should protect their capital.

Whales and holder behaviour

On-chain flows show that whales have been net sellers since Aug. 21. At the same time, some long-term holders have taken profits. That mix of selling by large players and profit-taking by older holders has put pressure on spot prices.

The result is a market where ETF flows and on-chain moves both matter. A steady return of ETF inflows would help calm things. Until that happens, price swings may remain sharp.

What traders can watch

Analysts say confirmation will come if ETF flows stabilise and BTC reclaims the $113,500 to $116,000 range with strong volume. Until that happens, the market may struggle for direction.

Many investors are watching for reduced liquidations and steadier net flows as signs that selling pressure has eased.

Also Read: Coinbase CEO Brian Armstrong Projects Bitcoin To Reach $1 Million By The Year 2030