According to the official announcement from Binance earlier today, the cryptocurrency exchange will be automatically settling and delisting three perpetual contracts – USDⓈ-MXEMUSDT, ORBSUSDT, and LOOMUSDT. This action will take effect at 09:00 UTC on December 9, 2024.

Binance has advised users to close all open positions in these perpetual contracts before 08:30 UTC on the same day to avoid automatic settlement.

From 16:30 GMT+8 on December 9, 2024, users will no longer be able to add new positions in these U-margined perpetual contracts.

Binance’s Funding Rate Arbitrage Robot will close all existing arbitrage strategies for the XEMUSDT, ORBSUSDT, and LOOMUSDT trading pairs and perform automatic settlement starting at 17:00 ET on December 9, 2024.

Impact on Token Prices

The announcement of Binance’s decision to delist these perpetual contracts has already had a significant impact on the prices of the underlying tokens.

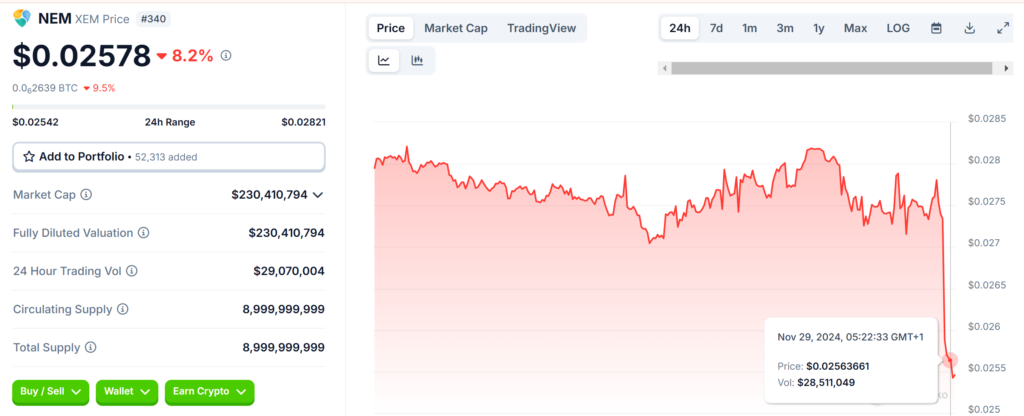

NEM (XEM) has seen a 8.21% price decline in the last 24 hours, with the token currently trading at $0.02578.

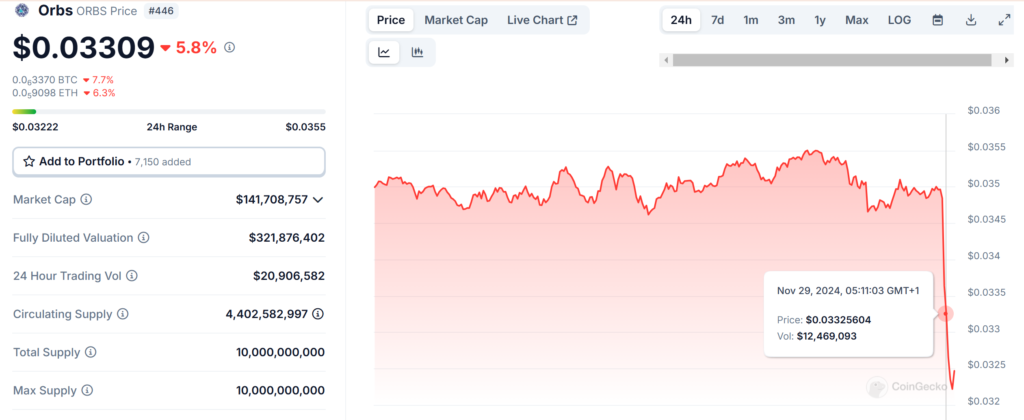

Orbs (ORBS) has also experienced a 5.63% price drop, now priced at $0.03316.

Similarly, Loom Network (NEW) (LOOM) has seen a 4.68% decline, trading at $0.0736.

These price movements reflect the immediate market reaction to the news of the perpetual contract delistings.

Reasons Behind the Delistings

While Binance has not explicitly stated the reasons for delisting these perpetual contracts, the decision likely stems from a combination of factors.

These may include low trading volumes, lack of liquidity, or a strategic shift in Binance’s product offerings.

Perpetual contracts are complex financial instruments, and their delisting could be part of Binance’s efforts to streamline its derivatives portfolio and focus on more liquid and established cryptocurrencies.

Also Read: OKX Delists Gifto Token Leverage and Perpetual Contracts, $GFT Plunges 35%

Impact on Traders and Implications

The delisting of these perpetual contracts will have a direct impact on traders and investors who have open positions in these instruments.

Binance has urged users to close their positions before the automatic settlement to avoid potential liquidation.

The loss of these trading pairs may also affect the broader ecosystem, as it could reduce the overall trading activity and liquidity for the affected tokens.

However, Binance’s decision is likely driven by a desire to maintain a robust and reliable trading platform, prioritizing user protection and market stability over the continued support of these particular perpetual contracts.