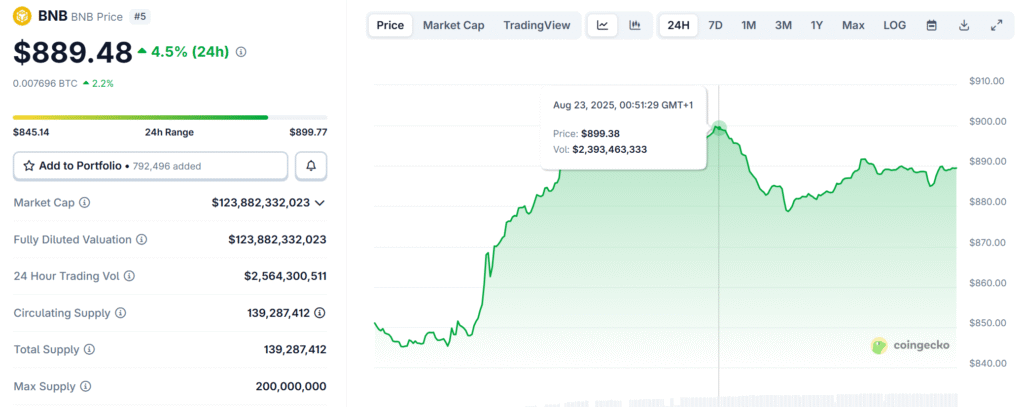

Binance Coin (BNB) achieved a historic milestone, surpassing its previous all-time high of $899 on August 22nd and generating considerable excitement regarding its price movement in the crypto markets.

The price movement delivered a 4.5% gain for BNB in a single-day trading session, and it now has a market capitalization of close to $124.7 billion, making it the fifth-largest cryptocurrency.

The additional surge has generated solid speculation among traders and analysts if BNB is the next primary token to hit the all-important symbolic price level of $1,000 after getting close $899.66 in intraday trading.

Now that the torch is lit, we wait to see if BNB can continue its price momentum and push into new price territory.

Institutional Adoption Fuels Structural Demand

A lot of BNB’s price action has stemmed from corporate adoption and institutional inflows. Nasdaq-listed BNB Network Corporation (BNC) announced an immediate plan to buy 200,000 BNB tokens for $160 million. They are now the largest corporate holder of BNB.

BNC also suggested they may hold a total of 325,000 BNB in the future, similar to MicroStrategy’s method of accumulating Bitcoin.

Along with BNC, other institutions have cashed in. UnoCrypto reported that Nano Labs invested $500 million in BNB.

Also, we reported that Windtree Therapeutics planned a $520 million fundraising for a BNB treasury, and plans to continue to add BNB to their treasuries despite external factors.

Overall, these actions suggest that institutions are increasingly confident in BNB as a longer-term digital asset while reducing circulating supply and providing some structural support for price appreciation.

Also Read: BNB Chain Posts Mixed Q2 Results: Market Cap +7.5% to $92.6B, Revenue Down 37.5% To $44.1M

Ecosystem Strength and On-Chain Growth Add Tailwinds

Aside from corporate buying, BNB’s ecosystem has strong fundamentals.

According to on-chain data, BNB Chain has processed more than 115M transactions in the past week, a 12% month-on-month increase.

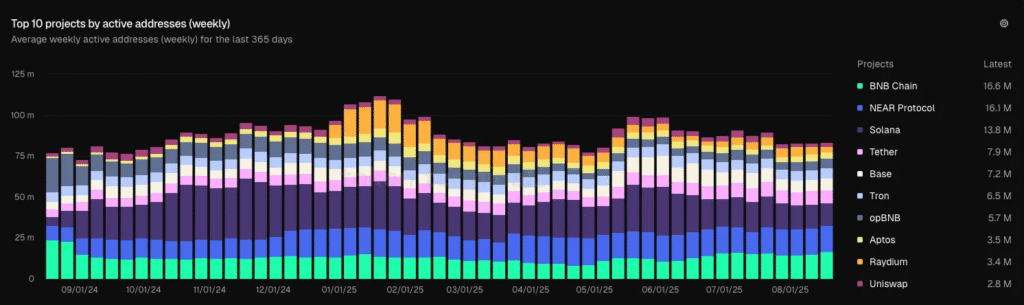

As a blockchain, BNB Chain still leads user activity, which ranks as No.1 for weekly active addresses at 16.6M, followed by NEAR (16.1M), and Solana (13.8M).

Daily active wallets also saw a spike to 2.3M on August 21, affirming the platform’s utility and adoption.

The Binance HODLer Airdrop team had distributed 150 million Plume (PLUME) tokens in just the last campaign to BNB stakers.

These incentives lock up liquidity in the system, tightening the supply on exchanges, causing bullish price pressure on the token.

Conditional Indicators Suggest More Bullish Momentum Ahead

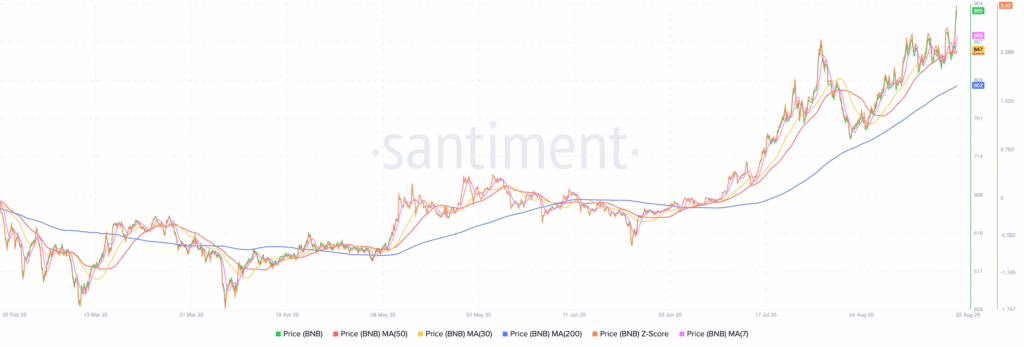

A technical perspective suggests that BNB trades above all major moving averages, confirming a substantial uptrend.

As a reference, the 30-day moving average band is at $847.8, the 50-day moving average is at $845.2, and the 200-day moving average is at $802.8.

Also, the price of BNB is currently below these moving averages and significantly above recent volatile prices. The short-term scenario continues to favour the upside, with the 7-day moving average at $865.

As for the conditional indicators, they also support bullish indicators, with the MACD at 28.2 vs. 24.8 for the signal line indicating a bullish crossover, and the RSI reading 68.45 suggesting there is more to go to the upside for shares before being overbought.

Also Read: Nano Labs Acquires $5M CEA Industries Inc. Shares Under BNB Strategic Reserve Framework

Analysts Eye $1,000 Milestone Amid Crypto’s Bullish Wave

Analysts are watching the $880 mark as key support. If BNB continues to close above that level, it could reach several higher targets, such as the Fibonacci extension at $923 or even $950–$1,000 in the short term.

Conversely, if BNB fails to remain above $880, it could drop back down to $848–$862, and even down into the $830s if any momentum stalls.

BNB continues to surge against the backdrop of the broader crypto market, creating all-time highs: Ethereum just came off a new all-time high of $4,885.61 on August 22, and Bitcoin hit a record of $124,128 on August 14, scaling to record highs due to ETF inflows and robust on-chain activity.

With BNB current trading at $892.74 and continuing to generate a 5% gain on the daily chart, the climb to $1,000 does not seem insurmountable as more and more institutions adopt BNB and grow the ecosystem while technical pressure builds.