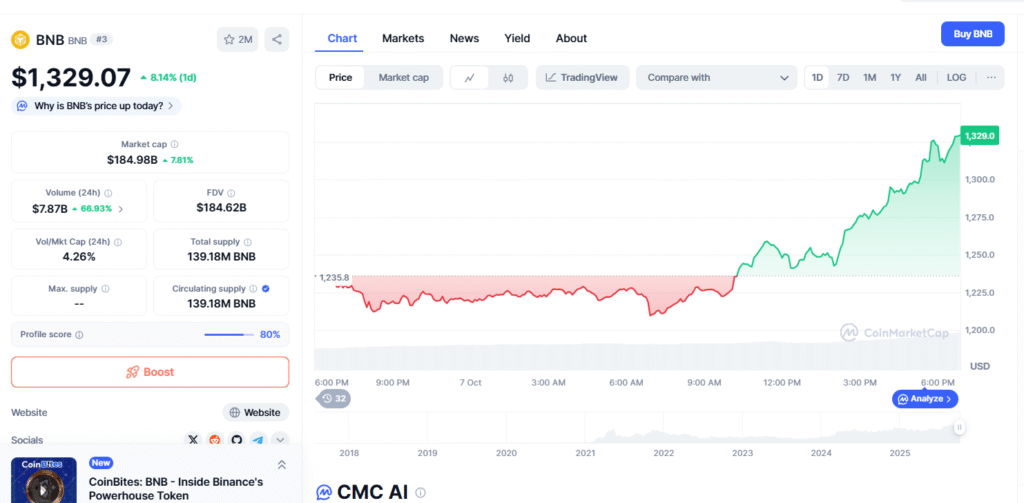

On Tuesday speculative investors pushed demand across the crypto market, lifting BNB to a new all-time high of $1,313.23 and moving it into the No. 3 spot on CoinMarketCap’s list.

Biance Coin ($BNB) global crypto market cap stood at $182.86 billion and 24-hour trading volume rose 64.36%, a surge tied in part to flows into crypto products during the ongoing US government shutdown.

BNB sets fresh records

BNB led large-cap tokens with a gain of more than 6% on Tuesday. The token has been climbing since July and keeps finding new highs.

At the time of writing, BNB is trading around $1,313.23. That price marked a new peak for the token and pushed it past XRP in rankings. Traders noted strong buying pressure in the token this week.

Market-wide surge

The wider market logged big inflows, and a weekly report from CoinShares showed crypto investment products saw about $5.95 billion in cash inflows, the highest weekly total in recent data.

That inflow helped lift prices across several tokens and raised overall confidence among short-term traders. Volume moved sharply higher, and markets reacted quickly.

Shutdown-linked flows

Part of the move came as the United States faces a government shutdown. That event has pushed some investors toward crypto as they look for quick opportunities.

Market watchers said uncertainty in traditional markets often drives speculative flows into digital assets. The recent stream of cash into crypto products was a clear sign that some investors are reallocating money amid the political disruption.

Token lineup and trading details

At launch spots, BNB, Bitcoin, Ether and other major tokens drew the most attention. BNB’s rise has been steady since July, with each new peak bringing fresh buying interest.

The token’s market cap and rank rose as traders piled in. Exchanges recorded higher orders and larger trades in BNB across the day.

Social media incident raises alarm

On October 1st, BNB Chain’s official English-language account on X(Twitter) was hacked. The account posted the phrase “4$ FOR THE MEME” along with an unknown wallet address and a photo of former CEO Changpeng Zhao.

Zhao warned users after the post and urged caution, and the incident caused concern in the community and added a note of risk even as prices climbed.

What the hack means for trust?

Hacks of official accounts can spook users and push some funds to safer custody. They can also trigger quick selling if users fear broader security lapses. In this case, the social post stirred concern but did not stop inflows.

Market participants said they would watch how exchanges and projects handle security and communication after such events.

Short-term outlook

At this point, the momentum is in favour of tokens that have retail interest. When the market moves with considerable volume, traders may continue to pursue profit.

However, if outside news or technical problems affect sentiment, volatility may return quickly. With the speculative money, market participants would foresee and expect the considerable swings.

The surge and the account hack highlight two sides of crypto’s current phase. One side is fast inflows and rising prices when cash pushes into the market. The other side is security risk and the need for careful account controls. Both will matter if more funds continue to move into digital assets.

Also Read: Kazakhstan Government Debuts Its National Crypto Reserve With BNB Treasury