Changpeng Zhao (CZ), the Co-Founder of Binance, has shared his views on India’s ongoing currency crisis, saying that the best way to enhance the economy is to be more competitive through innovation.

On September 11th, 2025, CZ wrote on X after learning that the Indian currency had fallen to a new historic low against the U.S. dollar.

The contrast in his tweet was between innovation and protectionism, which CZ adds that protectionist policies that curb competition hurt residents of the country and weaken the economy.

While CZ did not mention blockchain or cryptocurrencies by name, the fact that he is a blockchain pioneer indicates to me that he sees digital innovation as a potential solution to the economic crisis.

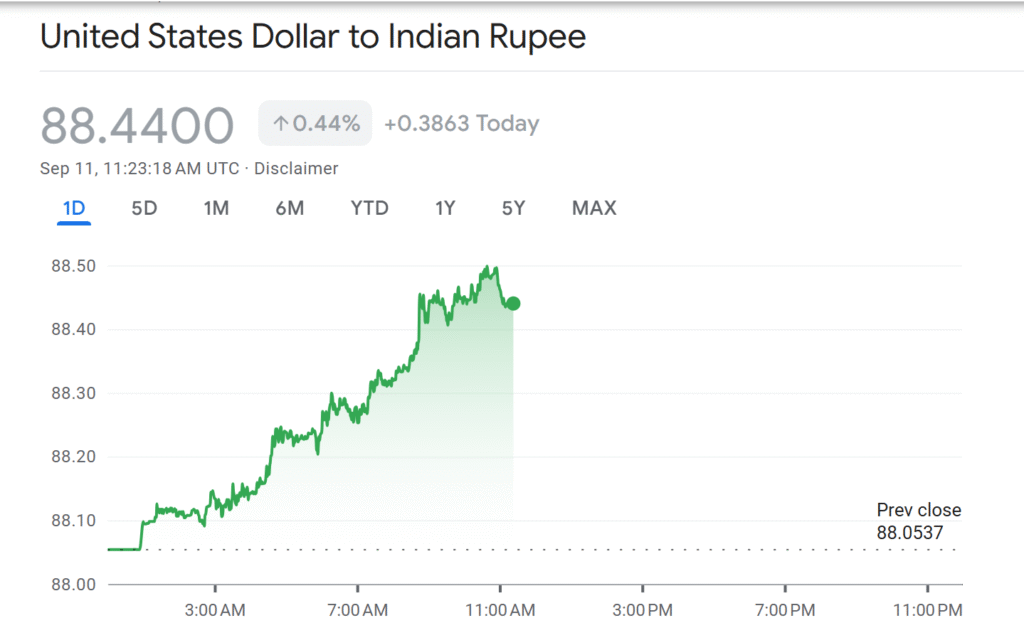

Rupee Slides to 88.44 Per Dollar as U.S. Tariffs Weigh on India

The latest decline in the rupee was caused by a combination of geopolitical and trade pressures, mainly corresponding to high tariffs by the United States on Indian exports.

According to reports of Moneycontrol and CNBC-TV18, foreign investors have withdrawn more than $11.7 billion from Indian markets in 2025, resulting in a further dent in confidence.

On Thursday, the rupee slumped to 88.44 per dollar, breaking the record low of 88.36 reached only days before.

While the Reserve Bank of India (RBI) has intervened by selling dollars to slow the volatility, analysts are sounding the alarm, saying the rupee will most likely trade in the range of 87–89 in the near term, indicating continued headwinds for Asia’s third-largest economy.

Blockchain Innovation as Potential Solution

CZ has identified innovation in relation to blockchain technology, and there is a growing interest in blockchain technology as a method for bolstering developing economies.

In addition, during uncertain economic times, digital assets have become alternative investments, with investors choosing to invest in them as a hedge against weakening currencies, alongside gold.

For India, the integration of blockchain into trade, finance, and governance could help counterbalance some of the vulnerabilities apparent in light of the rupee’s recent challenges.

Also Read: India’s Tax Authority Issues Notices To Crypto Traders On Unregistered Platforms

India’s Push Toward Digital Currency Adoption

Despite challenges in the foreign exchange market, India has made progress in bettering its embrace of financial innovation with the digital rupee pilot.

The Reserve Bank of India has recently revealed that its retail central bank digital currency (CBDC) project has now reached 5 million users and 420,000 merchant participants, showing a sustained growth trajectory in adoption, according to UnoCrypto.

New functionalities, including offline transactions and programmable properties, have been added, broadening the scope of this new financial tool.

All these show how India is already testing new innovative financial tools that would revolutionize its economy.

CZ’s comments remain valid,thereby encouraging them to scale new tech as it could be key in helping India strengthen its resilience against major shocks to the global economy.

Also Read: Indian Crypto Exchange Mudrex Resumes Crypto Withdrawals Following Platform Upgrade