In a recent development, Aster Chain’s native token, ASTER, spiked over 400% as part of a strong push from YZi Labs, a venture associated with the former CEO of Binance, Changpeng Zhao (CZ).

In a unique show of support, CZ took to the X platform and posted a chart of ASTER and added the comment, “Well done! Good start. Keep building!”

Aster Chain, which launched in July, is a new crypto decentralized derivatives exchange (DEX) that aims to directly compete with existing leaders, Hyperliquid and PancakeSwap, which have been staples of the decentralized trading arena.

ASTER’s Market Performance Reflects Soaring Investor Interest

At the time of this report, ASTER is valued at $0.66, which equates to a 302% gain over the last 24 hours.

Despite the market’s turmoil, the token has also made significant gains over the last week.

Currently, trading volume is $941,662, and with a circulating supply of 1.7 billion tokens, ASTER boasts an impressive market capitalization of over $1.12 billion.

This massive increase in the value of ASTER demonstrates investors’ confidence in the viability of the project’s backers to compete against already well-established players in the decentralized derivatives marketplace.

Also Read: Ethereum Price Breaks Previous Records As It Surges To A New All Time High Of $4,885.61

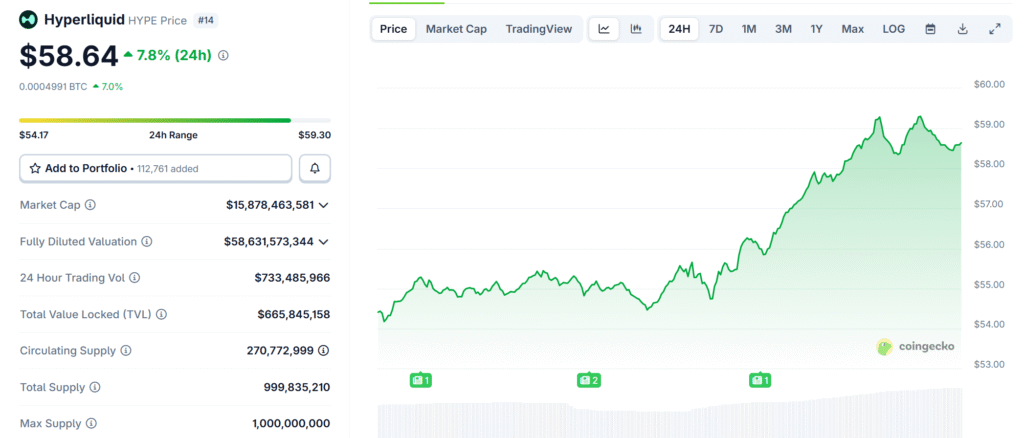

Hyperliquid Hits New ATH Amid Market Optimism

While ASTER made a splash with its explosive launch, rival DEX token Hyperliquid (HYPE) also set its own record high.

On Thursday, Hyperliquid reached an all-time high of $59.30, then pulled back before settling at $58.44.

With a trading volume of $733 million over the last 24 hours and a circulating supply of 270 million tokens, Hyperliquid now boasts a market cap of almost $15.9 billion.

The DEX, known for its perpetual futures trading model, has been steadily gaining traction as altcoins benefit from broader market optimism fueled by recent U.S. Fed rate cuts.

Industry Leaders Weigh In on Hyperliquid’s Growth

Crypto veteran and BitMEX founder Arthur Hayes celebrated Hyperliquid’s milestone, describing it as “All-time Hype.”

In past comments, he estimated a 126x potential upside for Hyperliquid as he projected annualized fees increasing from $1.2 billion to over $258 billion with stablecoin growth as the primary driver.

Analysts have noted growing market share for Hyperliquid, and a recent report showed that Hyperliquid captured 50% of Bybit’s perpetual futures volume and 21% of Binance’s.

While the project’s daily volume of $790 million is still well below Binance’s $34 billion, it is steadily encroaching on the market share of centralized exchanges.

Also Read: TRX Monthly Transfer Volume Soars to $121.2B, Sets New All-Time High, Will Price Follow?

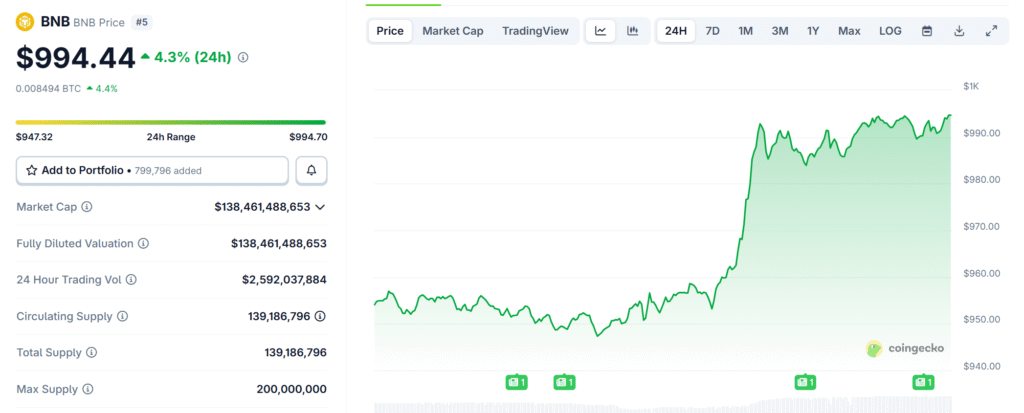

Binance Coin (BNB) Joins the Rally With New ATH

In addition to all the market excitement, Binance Coin (BNB) also reached a fresh all-time high.

BNB is trading at $989.92 and has gained 4.17% in the last 24 hours and over 10% in the last week, with a volume of $2.53 billion.

The market cap has also expanded to an impressive $137.8 billion. Part of the price increase can be attributed to BNB’s decisive break of the $942 resistance level, providing additional optimism among traders.

With ASTER behind CZ, Hyperliquid continues to chase the momentum progression and now sees BNB outperforming the other markets.

The competition is ramping up extremely fast for the DEX and derivatives trading space.