Arbitrum, a leading layer-2 scaling solution for Ethereum, has launched a significant proposal aimed at deepening its integration with the DeFi ecosystem. The proposal, as revealed on Snapshot, outlines plans for token swaps with a selection of blue-chip projects.

This initiative, known as the Arbitrum Token Swap Pilot proposal. This represents a strategic move towards enhancing the long-term effectiveness and sustainability of ecosystem support programs within the broader Arbitrum ecosystem.

By prioritizing mature protocols on Arbitrum, often referred to as “Arbitrum Blue Chips,” this pilot phase seeks to establish stronger ties with key players in the DeFi space.

Proposal Details and Implementation

The proposal sets clear parameters for the token swap initiative. The total swap budget allocated is set at 2,000,000 ARB tokens for this planned proposal. However a cap has been set for individual projects at 500k ARB.

This structured approach aims to ensure a balanced distribution of resources across selected projects. Interestingly, the proposal also includes an incentive mechanism for users who still hold more than 50% of their original ARB airdrop tokens, potentially rewarding long-term supporters of the Arbitrum ecosystem.

The token swaps are envisioned as a complementary mechanism to existing incentive programs, allowing Arbitrum DAO to actively participate in the development and success of its ecosystem projects. This approach could potentially lead to deeper integrations and collaborations within the Arbitrum network.

Current Voting Status and Community Response

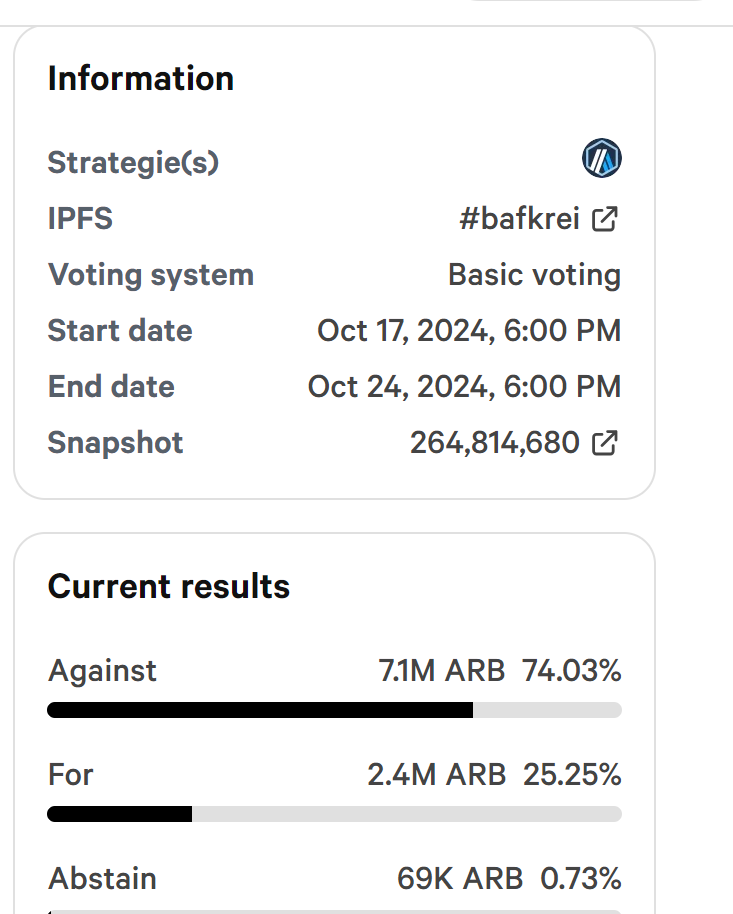

As of the latest data, the proposal has faced significant opposition from the community. Over 70% of votes cast are against the proposal, compared to 25% in favor.

This stark divide highlights the controversial nature of the initiative and the diverse opinions within the Arbitrum community regarding the best path forward for ecosystem development.

The voting period is set to conclude on October 24th, leaving time for potential shifts in sentiment or further discussions among stakeholders. The high level of engagement in the voting process demonstrates the active participation of the Arbitrum community in governance decisions, a positive sign for the project’s decentralized ethos.

Market Impact and ARB Token Performance

Despite the ongoing debate surrounding the proposal, Arbitrum’s native token, ARB, has shown positive price movement. As of the latest data, ARB is trading at $0.5607, marking a 0.36% increase in the last 24 hours and a more substantial 4.28% rise over the past week.

With a circulating supply of 3.6 billion ARB, the project currently boasts a market capitalization of $2,028,907,369. The trading volume of $210,299,856 in the past 24 hours indicates significant market activity.

This positive price action, occurring alongside a controversial governance proposal, suggests that investors and traders may be viewing the ongoing developments as potentially beneficial for Arbitrum’s long-term prospects, regardless of the proposal’s outcome.