Arbitrum, the leading Layer 2 scaling solution for Ethereum, has reached a significant milestone by becoming the first Layer 2 network to surpass $300 billion in transaction volume on the Uniswap protocol.

The momentous achievement was announced by Uniswap Labs on their official X platform, highlighting Arbitrum’s growing influence within the decentralized finance (DeFi) space.

Arbitrum’s ability to facilitate high-volume transactions while providing faster and cheaper alternatives to Ethereum’s Layer 1 has propelled it to the forefront of the crypto ecosystem, solidifying its position as a key player in DeFi protocols.

Key Metrics Show Strong Growth on Arbitrum

As of the latest data, Arbitrum has accumulated a total of $302.59 billion in volume on the Uniswap protocol.

The platform’s impressive performance is complemented by other crucial metrics, including a Total Value Locked (TVL) of $3.531 billion and a market cap of $3.099 billion.

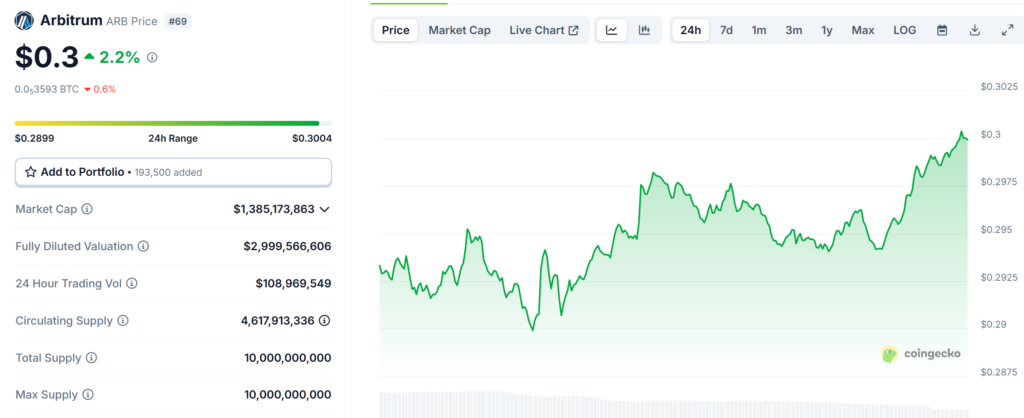

Arbitrum’s token (ARB) has also gained significant attention, with its price currently standing at $0.2999.

Over the past 24 hours, ARB has seen a modest price increase of 2.24%, although it has experienced a slight decline of 3.83% over the past week.

The increase in volume and TVL underscores the growing adoption of the Arbitrum network, with more users and liquidity flowing through the protocol.

Also Read: Berachain Overtakes Base and Arbitrum, Reaching $3.25B in Total Value Locked

Uniswap’s Impact on Arbitrum’s Performance

The Uniswap protocol has played a pivotal role in driving Arbitrum’s success. As the leading decentralized exchange (DEX) on Ethereum, Uniswap has provided the infrastructure needed for Arbitrum to scale and handle substantial volumes of transactions.

The relationship is reflected in the protocol’s data, which shows a remarkable $1.778 billion in 24-hour volume on Arbitrum, along with annualized fees of $612.33 million.

Arbitrum’s capacity to handle large volumes with minimal fees has proven attractive to traders, further boosting its adoption.

With over 5,900 active addresses in the last 24 hours, the ecosystem surrounding Arbitrum is flourishing, attracting both individual and institutional users.

Market Outlook and Future Prospects for Arbitrum

Despite a slight decline in ARB’s price over the past week, the overall outlook for Arbitrum remains strong.

With a circulating supply of 4.6 billion ARB tokens and a market cap exceeding $1.38 billion, the network is poised for continued growth.

The success of Arbitrum on Uniswap is a testament to its scalability and efficiency, positioning it as a top contender in the Layer 2 space.

As Ethereum continues to face scalability challenges, solutions like Arbitrum are gaining significant traction due to their ability to alleviate congestion and lower transaction costs.

As the DeFi ecosystem expands, Arbitrum’s ability to handle increasingly high volumes will be key to its sustained success and further integration into the broader blockchain ecosystem.

Also Read: PancakeSwap Tops Competitors To Become No.1 DEX With $1.639B Trading Volume, $CAKE Jumped Over 40%