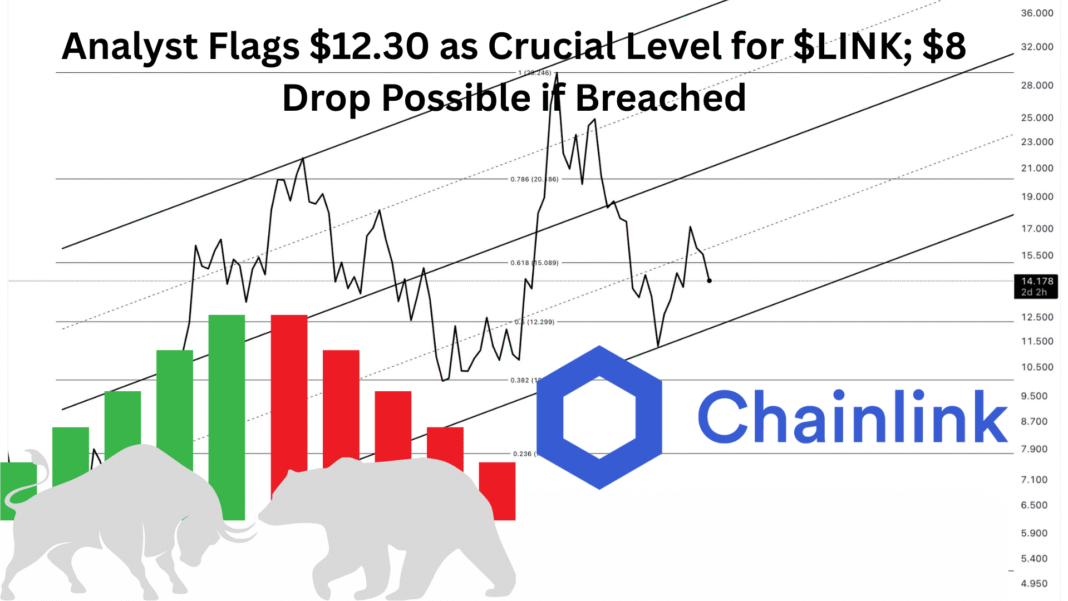

Chainlink ($LINK) is currently at a crucial technical level that cryptocurrency expert Ali Martinez has identified, indicating that the token may find short-term support at $12.30.

Martinez claims that the price action of LINK has been guided by a falling price channel, with the level being the lower boundary of that channel.

Investors may experience temporary respite if the token is able to maintain this support and maybe recover. The outlook, however, becomes extremely pessimistic if LINK is unable to hold this level.

At the press time, $LINK is trading at $13.68, down 5.95% as compared to the same time last day.

Chainlink Risks Sharp Drop Below $12.30, Could Fall to $8: Analyst

A significant decline below $12.30 would lead to a sharp drop for $LINK. Martinez projects that if the token fails to hold the level, a further downside target of about $8 is possible.

This would be a significant drop that would indicate a more profound change in the market’s perception of the altcoin.

In recent months, Chainlink’s performance has been erratic, with price fluctuations influenced by both macroeconomic variables and advancements in the decentralized oracle market.

Bulls and bears now view the $12.30 mark as a pivotal battleground. The conclusion of this support zone could influence LINK’s course in the upcoming weeks, therefore, traders and investors are encouraged to keep a careful eye on it.

Also Read: Chainlink Introduces DeFi Yield Index To Enhance Market Transparency And Capital Efficiency

Chainlink Falls 5.6% to $13.71 Amid Mounting Technical and Fundamental Pressures

Chainlink (LINK) has dropped 5.6% in the last day and is now trading lower, at about $13.71. Both technical and fundamental forces are contributing to the decline.

Large holders have been dumping LINK, and selling pressure has increased as whale activity has increased. The 50-day and 100-day EMAs are among the important technical support levels that LINK has dropped below, and momentum indicators like the RSI and MACD also point to a negative outlook.

Furthermore, the sell-off was accelerated by a recent fault in Chainlink’s oracle system that resulted in forced liquidations totaling more than $500,000.

Technical weakness, operational issues, and whale exits have all contributed to increased volatility and short-term tremors in investor confidence.

Adoption, Partnerships, and Market Recovery Key to Chainlink’s Rebound

Strong collaborations, wider market recovery, and more adoption can all help Chainlink regain momentum.

Demand for its oracle services may increase as a result of integration with top blockchain platforms and DeFi initiatives. Improvements in staking, scalability, and security features are examples of positive advancements that could draw in investors.

Furthermore, a resurgence of interest in interoperability and tokenization of real-world assets may establish Chainlink as a major infrastructure supplier. Market mood is important because altcoins like LINK might follow if Bitcoin and Ethereum gain ground.

A bullish reversal that attracts buyers back into the market might also be triggered by a rally from important technical support levels.