AMINA Bank, a FINMA-regulated crypto bank headquartered in Switzerland with a global reach, today began offering custody and trading services for SUI, the native token of the Sui blockchain.

They plan to roll out staking in the coming months, and clients worldwide can access these services through AMINA’s compliant banking infrastructure, which combines rigorous deposit and withdrawal governance with no volume caps or trading limits, a capability driven by Sui’s renowned speed, scalability and enterprise-grade design.

Institutional Access to SUI

AMINA’s move gives its clients a regulated route into Sui’s token economy. The bank’s platform supports large position sizing without volume caps.

Clients benefit from audit-ready systems that meet compliance requirements. This early access comes before SUI gains broader exposure through public markets.

Sui is designed for latency-sensitive, high-throughput applications. In just two years, its total value locked reached $2.2 billion.

The blockchain’s architecture aims to replace legacy Web2 infrastructure in business settings. Institutions value its promise of reduced transaction costs and faster settlement times.

Also Read: Sui Network Resumes Operations After Two Hours Of Outage; SUI Price Tumbles 0.7% Meanwhile

ETF Filings Signal Growing Interest

Several SUI exchange-traded fund filings are under review. Canary Capital has submitted its proposal to the SEC. 21Shares has filed with the Nasdaq.

Bitwise has included SUI in its crypto index ETF. These steps show that institutional investors are taking Sui’s technical differentiation seriously.

Developer Growth and Global Outreach

The Sui ecosystem has registered an explosion of developer activity. Paris, Athens, Istanbul, Bangkok, and Vietnam events have attracted newcomers.

The Sui Summer 2025 campaign involved close to 3,000 developers, a 50 % increase over 2024. The growth points to the popularity of Sui among programmers and businesses in need of scalable blockchain technology.

Myles Harrison, AMINA’s Chief Product Officer, said the bank aims to enable institutional participation in breakthrough technologies before they hit mainstream markets.

He noted that Sui’s design sets it apart from other layer1 networks. Alonso de Gortari of Mysten Labs welcomed the move, saying that AMINA’s infrastructure and client base will speed up Sui’s global adoption.

SUI’s Price Actions

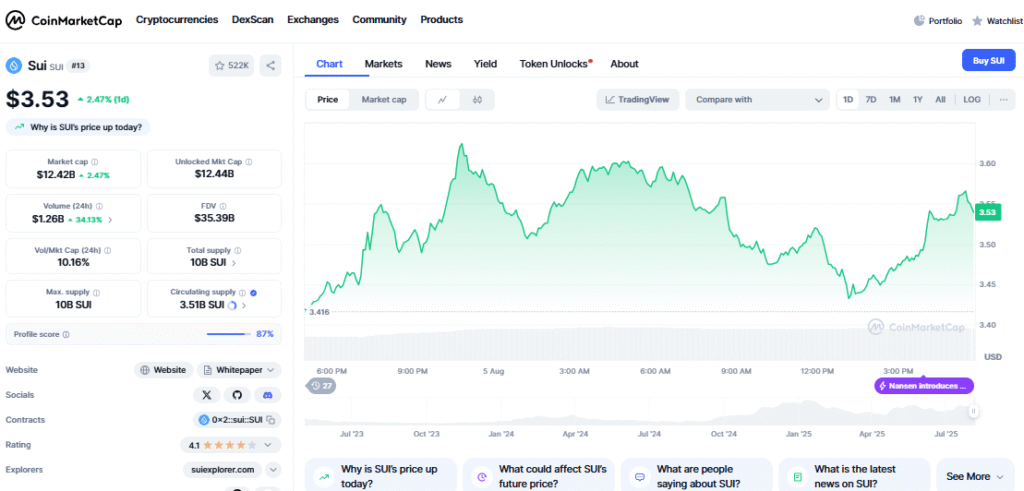

SUI is trading at $3.52, up 2.97 % in the last 24 hours. Its global market cap stands at $12.39 billion, while 24-hour trading volume is down 30.82 %. These figures reflect normal market swings as institutional interest broadens.

By offering regulated SUI access, AMINA reinforces its role as a trendsetter in crypto banking. The bank’s support for staking in the coming months adds a yield-earning option for clients.

As Sui gains traction among institutions and ETF filings move forward, AMINA’s regulated offering could shape how banks and enterprises adopt next-generation blockchains.

Also Read: Cetus Protocol Relaunches on Sui Network With New Roadmap After $223M Exploit