In a significant market movement, two prominent cryptocurrency whales have executed substantial sales of AI16Z tokens ($AI16Z), converting their holdings to Solana (SOL) and securing combined profits of $25 million.

The first whale, identified by wallet address E9uDt…bY9cf, conducted a sale of 1.9 million $AI16Z tokens, receiving 17,533 SOL valued at $3.75 million.

The trader maintained a significant position with 17.5 million $AI16Z tokens worth $32.63 million while booking an impressive profit of $23.48 million.

The second whale followed suit, selling 1 million $AI16Z tokens for 9,765 SOL ($2.09 million), resulting in a $2.28 million profit.

These strategic moves have demonstrated the sophisticated trading approaches employed by large-scale investors in the cryptocurrency market.

Market Performance and Price Dynamics

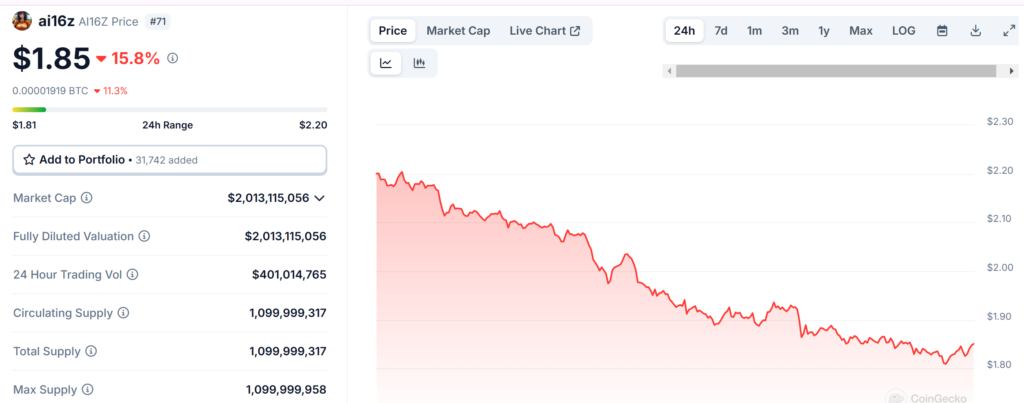

The substantial whale activity has triggered notable market reactions, with the $AI16Z token experiencing a 15.82% price decline over 24 hours, settling at $1.85.

Despite this short-term downturn, the token has maintained a positive seven-day performance with a 2.32% increase.

The current market capitalization stands at approximately $2.01 billion, supported by a circulating supply of 1.1 billion tokens.

The price movement pattern suggests that while the market has absorbed the immediate impact of the whale sales, it has demonstrated resilience in maintaining broader stability, indicating sustained investor interest despite the significant selling pressure.

Historical Context and Market Trajectory

The recent whale activity follows a series of significant developments in the AI16Z ecosystem.

Previous notable events include a remarkable $37 million profit secured by a crypto trader through combined positions in AI16Z and Fartcoin, achieving returns of 6,400x and 1,490x respectively.

The token’s market presence was further strengthened by its listing on Bybit’s Spot trading platform, which triggered an 8% price surge.

Additionally, the broader AI memecoin sector, including AI16Z, has shown substantial growth, contributing to a total market capitalization of $10 billion and demonstrating 26.4% growth in 24-hour trading volumes.

Strategic Implications and Future Outlook

The whales’ decision to convert substantial AI16Z holdings into Solana reflects a strategic reallocation of assets that may signal broader market sentiment.

The movement aligns with previous market activities, such as an earlier $2.68 million AI16Z sale that resulted in $1.66 million in profits, with proceeds being reinvested in emerging tokens like $SWARMS and $ZAILGO.

The persistent trading activity and strategic repositioning by major holders suggest continued market dynamism, while the conversion to Solana indicates confidence in established blockchain platforms.

These movements, combined with AI16Z’s historical resilience and the broader AI memecoin sector’s growth, present a complex picture of market dynamics that traders and investors must navigate carefully.