A significant market event has occurred in the PENDLE token ecosystem, with a major investor (“whale”) depositing 312,500 PENDLE tokens into a centralized exchange (CEX).

According to monitoring data, this substantial movement represents a position worth approximately US$1.76 million at current market prices, with an average token value of US$5.64.

What makes this transaction particularly noteworthy is the investor’s holding pattern – they had maintained this position for two and a half years, having accumulated these tokens between April 28, 2022, and April 28, 2023.

The initial investment was relatively modest at $46,179, resulting in a remarkable profit position of $1.71 million, highlighting the significant appreciation in PENDLE’s value over this period.

Current Market Impact and Price Analysis

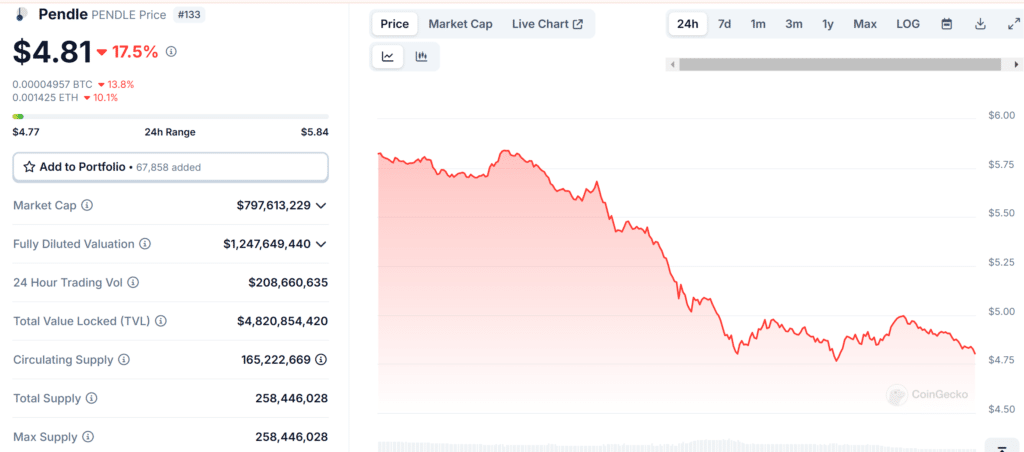

The market has responded decisively to this large token movement, with PENDLE’s price experiencing substantial downward pressure. The current trading price stands at $4.77, accompanied by a robust 24-hour trading volume of $208,660,635.

The price point represents a significant decline of 17.79% over the past 24 hours and an even more substantial decrease of 21.25% when viewed over a seven-day period.

Within the broader market context, PENDLE maintains a substantial presence with a circulating supply of 170 Million tokens, resulting in a market capitalization of $797,613,229.

These metrics suggest that despite the recent price decline, PENDLE remains a significant player in the cryptocurrency market.

Also Read: AAVE Investor Bags $3.18M Worth of AAVE, Unrealized Profits Hit $15.3M

Historical Context of Team Movements

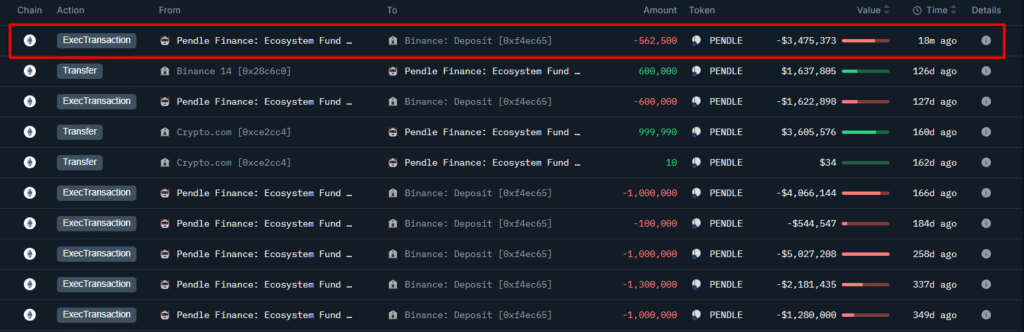

The recent whale movement follows another significant token transfer that occurred previously, involving a wallet associated with the Pendle team.

In this earlier instance, the team-associated wallet transferred 562,500 PENDLE tokens to Binance, with a value of approximately 3.47 million USD.

The proximity of these two large transfers – one from a long-term investor and another from a team-associated wallet – presents a notable pattern of significant token movements into centralized exchanges, potentially indicating a shift in market dynamics or investor sentiment.

Market Implications and Investment Analysis

The combination of these token movements provides valuable insights into PENDLE’s market dynamics.

The original investor’s position represents a remarkable return on investment, with an initial investment of $46,179 growing to $1.76 million over approximately two and a half years.

However, the decision to move these tokens to an exchange, coupled with the team wallet’s similar action, has contributed to significant downward price pressure.

The substantial trading volume of over $208 million in 24 hours suggests active market participation and potential repositioning by various market participants in response to these movements.