According to on-chain analysis earlier today, this whale initially opened a position of 19,992 ETH at an average price of $2,550 back in January 2024.

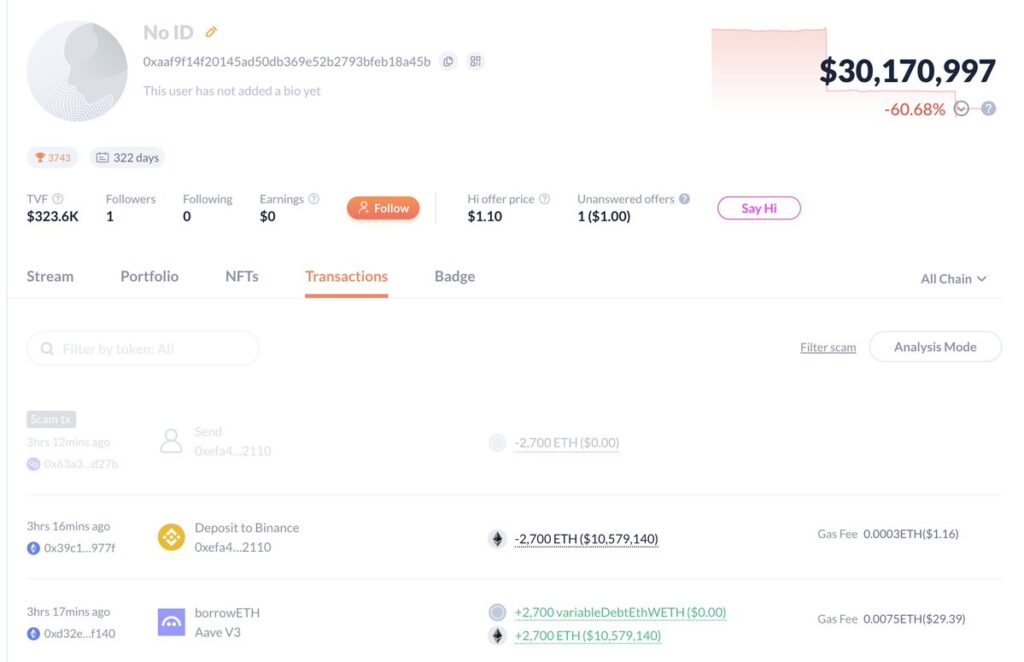

Three hours ago, the whale deposited 2,700 ETH (approximately $10.56 million) into Binance. If the whale chooses to sell this ETH, they stand to make a profit of $3.67 million.

Despite this substantial gain, the whale still maintains a sizable ETH holding of 13,162 coins.

Ethereum Price Fluctuations and Whale’s Potential Strategy

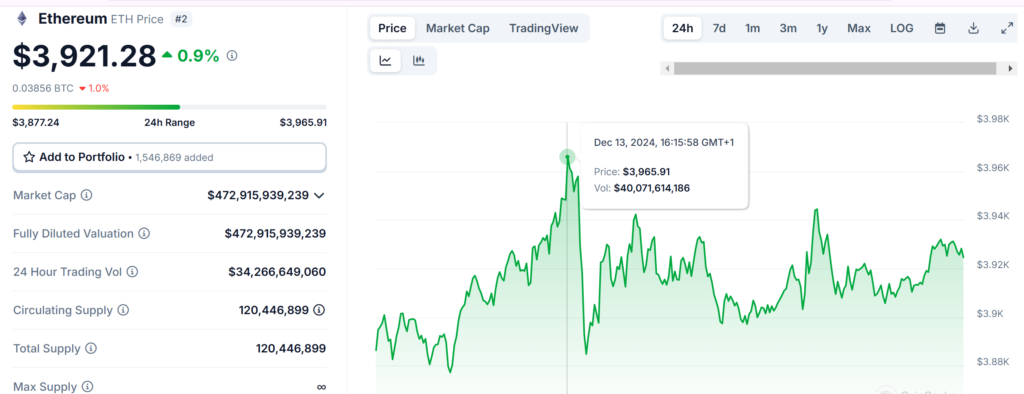

The Ethereum price has been fluctuating around $3,900 over the past two days. Given the recent rebound in the ETH price, it is reasonable for this whale to consider selling a portion of their holdings to lock in profits.

However, the whale’s decision to retain a significant ETH position suggests a long-term bullish outlook on the cryptocurrency.

Also Read: Ethereum Co-Founder Vitalik Buterin Pushes Back on Plans to Reduce Decentralization, Here’s Why

Ethereum Price and Market Cap Update

At the time of writing, Ethereum (ETH) is priced at $3,923.04, representing a 0.92% increase in the last 24 hours.

The 7-day price change shows a 1.55% decline. Ethereum’s current 24-hour trading volume stands at $34,266,649,060, and its market capitalization is $472,915,939,239, based on a circulating supply of 120 million ETH.

Other Whale Movements and Profits

In a separate incident, another Ethereum whale transferred 60,078 ETH ($234 million) to the Bitfinex exchange.

This whale had acquired the ETH at just $154 per token back in 2019, representing over 2,100% in gains as Ethereum now trades at an average of $3,338.

Additionally, an Ethereum whale secured a $1.8 million profit by selling 11,257.7 ETH at $3,649 in a single day, marking their 19th successful trading round with a record of 15 wins and 4 losses.

Implications and Insights

These whale activities highlight the significant profits that can be generated through strategic Ethereum investments and trades, even during periods of market volatility.

The ability of these large investors to time the market and capitalize on price fluctuations demonstrates their market expertise and access to advanced trading tools and analytics.

For smaller investors, these examples serve as a reminder of the long-term potential of Ethereum and the importance of maintaining a disciplined investment approach.

Also Read: Ex-Ethereum Co-Founder Jeffrey Wilcke Sends 20,000 ETH Worth $72.5M to Kraken, Will He Sell It?