The cryptocurrency market is closely watching the current state of Ethereum (ETH) trading, as a significant short squeeze appears to be on the horizon.

According to the ETH Exchange Liquidation Map, the cumulative short liquidation leverage has reached a concerning level that could trigger a major price movement.

The Extent of the Short Position Exposure

The data shows that if the price of ETH were to reach $3,760, a staggering $400 million in short positions would be liquidated.

This indicates a high concentration of leveraged short bets against the cryptocurrency.

When a large number of traders are positioned on the short side of the market, it creates the potential for a short squeeze, where a relatively small price increase can force these traders to close their positions, further driving up the price.

The “Squeeze” Trigger Price Level

The analysis reveals that the “squeeze” is likely to start at the $3,720 price level, where the cumulative long liquidation leverage begins to rise sharply.

This suggests that a breakout above this price point could lead to a rapid unwinding of short positions, potentially fueling a swift and sizable rally in ETH’s valuation.

Also Read: Ex-Ethereum Co-Founder Jeffrey Wilcke Sends 20,000 ETH Worth $72.5M to Kraken, Will He Sell It?

Current Ethereum Price and Market Dynamics

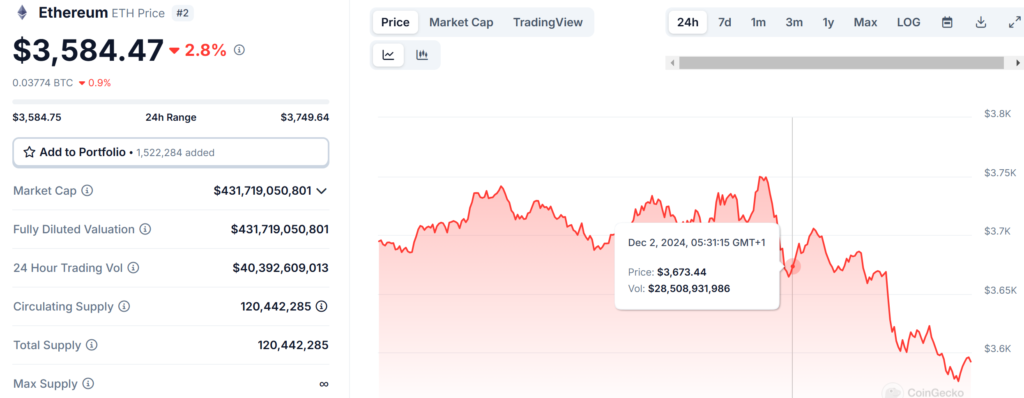

At the time of writing, the price of Ethereum (ETH) is $3,584.47, with a 24-hour trading volume of $40,392,609,013.

This represents a -2.82% price decline in the last 24 hours and a 3.18% price increase in the past 7 days.

With a circulating supply of 120 Million ETH, Ethereum is valued at a market cap of $431,719,050,801.

Institutional Positioning and Potential Impact

The report also provides insights into the current positioning of major exchanges, such as Binance and OKX, which hold significant long and short liquidation exposures.

This information alerts market participants to gauge the potential impact of institutional-level trading activities on the overall Ethereum market dynamics.

As large players unwind their positions, it can create significant volatility and price swings.

It’s important to note that while this data offers valuable insights, the cryptocurrency market is inherently volatile and unpredictable.

Traders and investors should exercise caution and thoroughly understand the risks involved in leveraged trading before making any decisions.

Prudent risk management strategies, such as diversification and the use of stop-loss orders, are crucial in navigating the complexities of the digital asset landscape.

As the Ethereum market continues to evolve, close monitoring of liquidation levels and market sentiment will be essential for investors and traders seeking to capitalize on potential opportunities or mitigate potential risks.

This latest development underscores the need for market participants to stay informed and nimble in their approach to the ever-changing cryptocurrency ecosystem.

Also Read: Ethereum Layer-2 Ecosystem TVL Skyrockets to $51.58B As ETH Price Crosses $3,600