Hut 8 (HUT) demonstrated robust financial growth in the third quarter of 2024, reporting revenue of $43.7 million, which fell slightly short of expectations by $5.5 million but nearly doubled compared to the previous year.

The company achieved significant operational efficiency, with energy costs per megawatt hour decreasing by 33% to $28.83 from $42.73 year-over-year.

Their financial position remains strong with 9,106 Bitcoins in reserve, representing a significant portion of their $576.5 million market capitalization, complemented by $72.9 million in cash holdings.

Their stock performance has been particularly impressive, showing an 8% increase at the time of reporting and maintaining a remarkable 105% gain year-to-date.

The company’s adjusted EBITDA of $5.6 million and GAAP earnings of $0.01 per share significantly exceeded the expected loss of $0.29 per share.

Also Read: Solana Mining Project ORE Sees Massive V2 Upgrade Adoption, 75% Tokens Transferred

HIVE Digital Technologies’ Mixed Results

HIVE Digital Technologies presented mixed financial results for the quarter, with an adjusted EBITDA of $5.6 million but facing a net loss from continuing operations of $7.7 million ($0.06 per share).

Their total revenue of $22.6 million fell short of the consensus estimate of $25.6 million, though they showed improvement in net loss before tax, reducing it to $7.3 million from $22.9 million in the previous year.

The company’s Bitcoin mining remained steady at 340 BTC for the quarter, maintaining a total holding of 2,604 Bitcoins.

Their digital currency assets were valued at $165.2 million, calculated at a Bitcoin price of $63,300. Despite a 2% decline in early Wednesday trading, HIVE’s shares have maintained a 16% increase year-to-date, with a market capitalization of $650 million.

Bitfarms’ Quarterly Performance

Bitfarms reported a mixed third quarter with revenue of $45 million, showing an 8% increase from the previous quarter but slightly underperforming analyst expectations.

The company posted a net loss of $37 million, or $(0.08) per basic and diluted share, which included a $6 million non-cash gain from warrant liability revaluation related to their 2023 financing.

Their adjusted EBITDA decreased to $6 million (14% of revenue) from $12 million in the second quarter.

The company maintains a strong liquidity position of $146 million, evenly split between $73 million in cash and 1,147 Bitcoins (valued at $73 million based on the September 30 BTC price of $63,300).

By October 31, their Bitcoin holdings had increased to 1,188 BTC. However, their stock performance has been challenging, with a 5.5% decline on Wednesday and a year-to-date decrease exceeding 10%, though they maintain a substantial market capitalization of $1.1 billion.

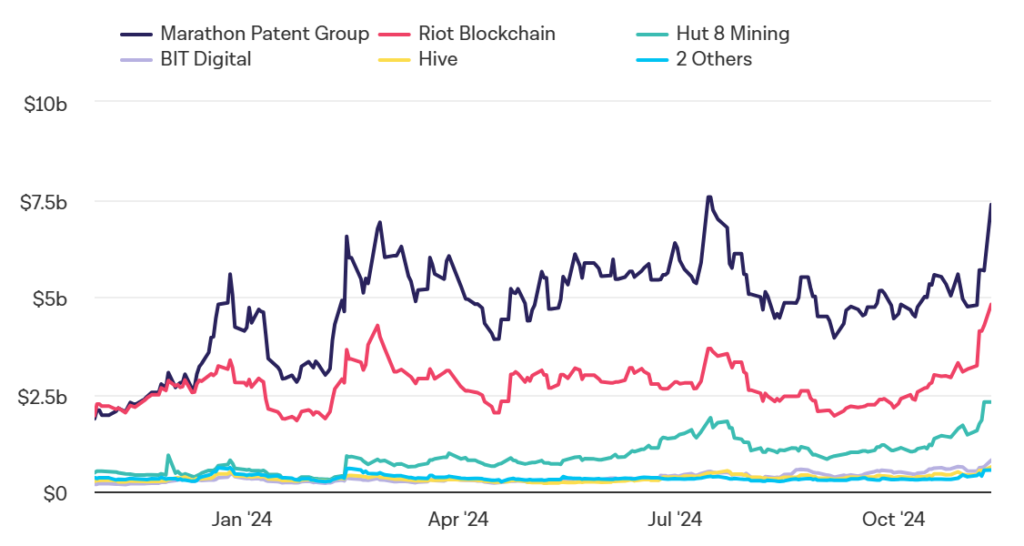

Comparative Analysis and Industry Overview

The combined performance of these three major Bitcoin mining companies reveals the current state of the mining industry, with a total Bitcoin holding of 12,898 BTC across their reserves.

Each company shows distinct operational strengths and challenges: Hut 8 leads in Bitcoin holdings and stock performance.

HIVE demonstrates improved loss management while maintaining significant digital assets, and Bitfarms shows revenue growth despite stock price challenges.

The variance in their performance metrics reflects the complex nature of the Bitcoin mining industry, where operational efficiency, Bitcoin price fluctuations, and market sentiment all play crucial roles in determining success.

Their combined market capitalization of approximately $4.25 billion underscores the significant scale of these operations in the cryptocurrency mining sector.

Also Read: Bitfarms Expands U.S. Operations With New Hosting Deal For 10,000 Mining Machines