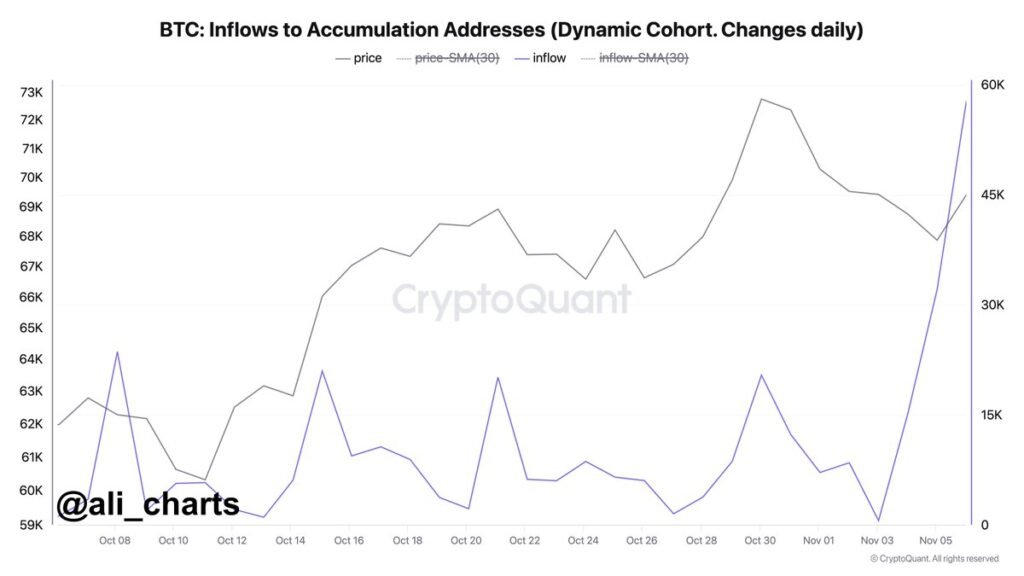

According to crypto analyst ALI, over 57,800 BTC, worth approximately $4.16 billion, have gone into accumulation addresses in recent days.

This data point provides valuable insight into the behavior of long-term Bitcoin investors and their confidence in the cryptocurrency.

Detailed Analysis of Accumulation Patterns

ALI’s analysis includes a chart that visualizes the relationship between Bitcoin’s price (black line) and the inflows to accumulation addresses (blue line).

The chart reveals the following key observations:

- The Bitcoin price has fluctuated significantly over the period shown, ranging from around $60,000 to $72,000.

- The inflows to Bitcoin accumulation addresses also exhibit substantial volatility, with large spikes and drops across the time period.

- The 30-day simple moving average (SMA) of the inflows (purple line) provides a smoother view of the accumulation trends, showing periods of intense inflows followed by periods of reduced inflows.

Potential Implications for Bitcoin’s Future

The chart suggests that there have been substantial inflows of Bitcoin to accumulation addresses.

This potentially indicates long-term investor interest and confidence in Bitcoin, despite the price volatility. This could be a positive signal for the cryptocurrency’s future performance and adoption.

Recent Bitcoin Price Movements

In the broader context, the price of Bitcoin (BTC) has seen an increase in recent times. This upward trend in BTC price has been ongoing since the pro-crypto candidate, Donald Trump, won the U.S. presidential election.

As of today, the Bitcoin (BTC) price stands at $76,157.80, representing a 1.38% increase in the last 24 hours and an 8.61% increase in the past 7 days.

With a circulating supply of 20 Million BTC, the overall Bitcoin market cap is valued at $1,506,358,407,159.

Also Read: Gold & Bitcoin Expected To Boom Under Trump Presidency, Say JPMorgan Analysts