Chainlink on Tuesday, October 22nd, revealed its new CCIP Private Transactions, a privacy-preserving feature that allows financial institutions to transact across blockchain networks while maintaining data confidentiality, data integrity, and regulatory compliance.

The decentralized computing platform said the new Chainlink Blockchain Privacy Manager drives the new feature. Interestingly, as part of the Monetary Authority of Singapore’s (MAS) Project Guardian program, the Australia and New Zealand Banking Group (ANZ) will be one of the first financial institutions to test the cross-chain settlement capacity of tokenized real-world assets (RWAs).

How Will Chainlink’s New Feature Work?

Institutions can now use the public Chainlink CCIP network to link private chains to other public and private blockchains, as well as the Chainlink Platform to link corporate and TradFi systems to private blockchains.

A long-standing privacy issue in the blockchain sector is resolved by achieving this connectivity while only disclosing the on-chain data that the institution determines is required to conduct each transaction.

A blockchain interoperability protocol, Chainlink CCIP lets programmers create safe apps that can move coins, messages (data), or both between chains.

With a track record of protecting tens of billions of dollars and facilitating over $14 trillion in on-chain transaction value, Chainlink’s industry-standard oracle networks power CCIP, which has defense-in-depth security due to the inherent hazards of cross-chain interoperability.

LINK Token Sees Slight Recovery

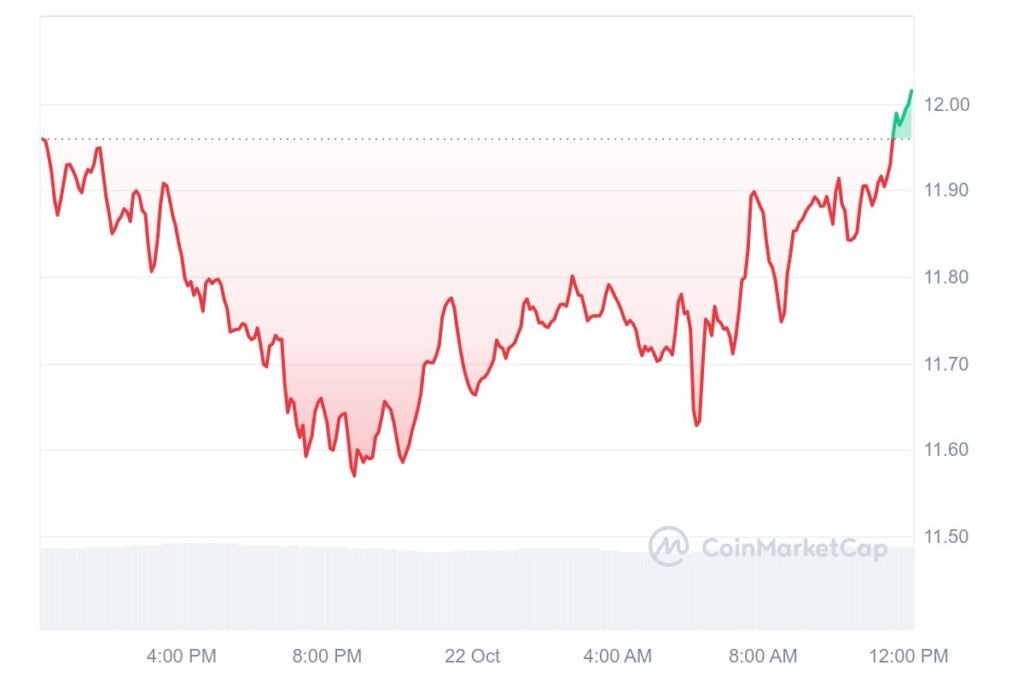

Soon after the new collaboration was announced, Chainlink’s native token LINK reversed its course to trade in green, after previously bleeding in red.

At the press time, the token is trading at $12.01, up 0.36% as compared to the same time last day.

In the coming month, Chainlink token is expected to increase by 16.56% to hit the $13.88 level. According to technical indicators, the Fear & Greed Index for LINK is currently at 70 (Greed), and the sentiment is neutral.

Over the previous 30 days, Chainlink saw 14 out of 30 (47%) green days and 5.27% price volatility. The overall mood of Chainlink price prediction is neutral, with nine technical analysis indicators indicating bearish indications, while 22 indicating bullish signals.

However, market sentiments also predict that Chainlink’s 200-day SMA will decline during the course of the upcoming month, reaching $12.94 by November 21, 2024. During the same period of time, Chainlink’s short-term 50-Day SMA is predicted to reach $11.88.

One widely used indicator to determine if a cryptocurrency is overbought (above 70) or oversold (below 30) is the Relative Strength Index (RSI) momentum oscillator. The RSI reading is at 54.20, indicating a neutral posture for the LINK market.