Clearer regulations have made it possible for the cryptocurrency industry to attract more attention from traditional finance, and this has led to US bank SoFi Technologies starting to offer its clients cryptocurrency trading services.

SoFi said on Tuesday that its cryptocurrency service began a staggered release on Monday to offer dozens of cryptocurrencies, including Bitcoin and Ether. More users will be able to use it in the upcoming weeks.

Anthony Noto, CEO of SoFi, told CNBC’s Squawk Box on Tuesday that his bank is the first and only nationally chartered bank to provide cryptocurrency trading to customers. This move was prompted by the Office of the Comptroller of the Currency’s relaxation of its regulations on banks’ involvement with cryptocurrency in March.

“One of the holes we’ve had for the last two years was in cryptocurrency, the ability to buy, sell, and hold crypto. We were not allowed to do that as a bank. It was not permissible,” he said.

In order to secure a bank charter in a more stringent regulatory setting, SoFi withdrew from the cryptocurrency market in 2023. In June, the bank made a comeback to cryptocurrency by introducing international payment alternatives that included fiat-to-cryptocurrency conversions and blockchain transmission.

Additionally, SoFi intends to include cryptocurrency into its lending and infrastructure services for borrowing and quicker payments, as well as launch SoFi USD, a stablecoin guaranteed dollar-for-dollar by reserves.

“We believe blockchain and cryptocurrencies are a super cycle technology just like AI, and it will be pervasive across the financial system,” Noto said.

Also Read: SoFi To Use Bitcoin Lightning and UMA For Low-Cost International Transfers Starting In Mexico

The run for stablecoins

He added one more thing that, as long as stablecoins have liquidity and don’t have duration or credit risk, they would significantly alter payments.

“I actually worry quite significantly about stablecoins from operators that are not banks. Where are the reserves sitting? Is there duration risk for those reserves? Is there credit risk for those reserves? Are those reserves bankruptcy remote?” he said.

“That’s three elements that you have to think about with whatever stablecoin you use. Just because it’s back dollar for dollar doesn’t mean those dollars will be there when you try to liquidate.”

Noto disclosed that he had set aside 3% of his own portfolio for cryptocurrency, mostly Bitcoin, and that 60% of the bank’s members expressed interest in making cryptocurrency investments.

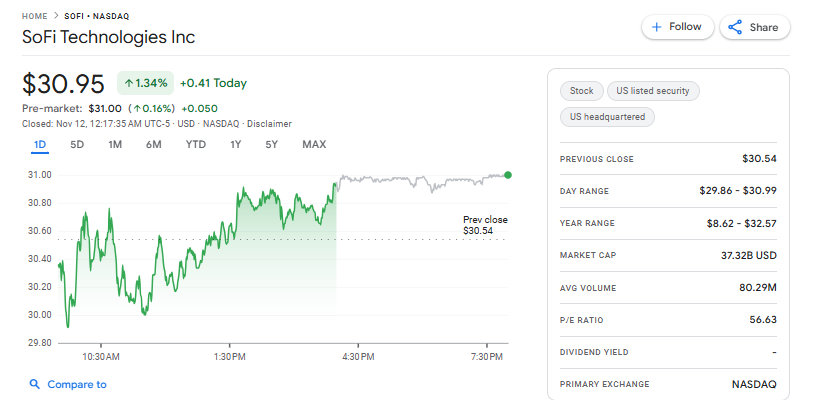

SOFI share price, revenue and assets

SoFi Technologies Inc. (NASDAQ: SOFI) closed Tuesday at $30.95, up 1.34% (a rise of $0.41) on the Nasdaq, according to exchange data.

In early pre-market trading, the stock ticked up further to $31.00, an increase of 0.16% (about $0.05) and the market cap went up $37.36 billion

According to the financial measure portal Business Quant, SoFi’s assets total more than $41 billion. According to the bank’s third-quarter figures, it has 12.6 million members and $962 million in net revenue.

Also Read: Bank Of England To Publish Stablecoin Consultation In November, Vows To “Keep Pace” With U.S.