MARA Holdings Inc. reported that it produced 736 BTC in September, a 4% increase from the previous month. The company also confirmed that it secured 218 blocks on the Bitcoin network during the same period.

Despite identifying as a net seller in September due to what it called “digital asset management activities,” the firm’s Bitcoin reserves still increased. Holdings climbed from 50,639 BTC at the end of August to 52,850 BTC by September 30.

Also Read: MARA Holdings to Sell Up to $2B in Stock for Bitcoin Expansion

Role as miner and treasury

MARA positions itself as both a Bitcoin miner and a treasury operator. This dual approach means the company mines coins while also treating them as part of its balance sheet.

Its latest update confirms it remains the second-largest corporate holder of Bitcoin among publicly traded firms. The only company ahead is Strategy, which holds 640,031 BTC, giving MARA a strong position in the treasury landscape.

Trading and stock update

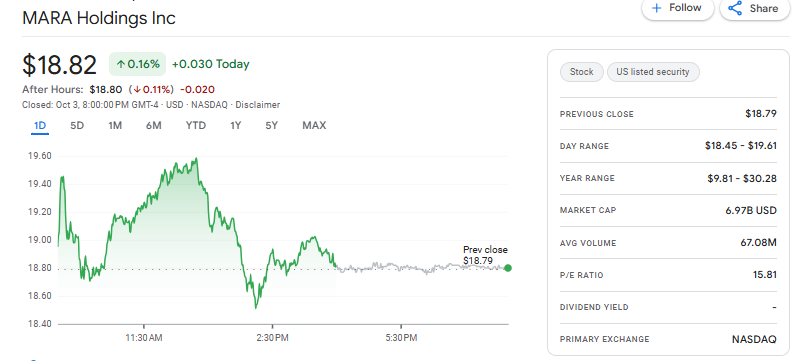

On Friday, MARA’s shares traded lower during U.S. market hours, though the drop was marginal. According to market data, the stock closed at $18.82, a daily gain of 0.16% or $0.03.

The minor movement reflects how the market is digesting the firm’s September production update along with other corporate developments.

Capital raising activity

On July 28th, UnoCrypto reported that MARA closed a large fundraising deal, issuing $950 million in convertible senior notes due in 2032.

The private offering, which carried a 0.00% coupon, was sold to qualified institutional buyers under Rule 144A of the Securities Act.

The additional funds were described as part of a strategy to strengthen the balance sheet and fuel expansion.

Market implications

MARA’s September report indicates that the company’s operations remain consistent, with an increase in production, and the company is growing its reserves during this period of asset sales.

The simultaneous increase in both mining and treasury confidence may increase the confidence of investors, factoring in the company’s dual role as both miner and Bitcoin treasury holder.

The dependence on financing indicates the need for the company to manage the delicate balance of growth and stability.

MARA Holdings, still positioning as one of the prominent players in the sector of Bitcoin mining and treasury management, is highlighted in the September report, which captures not only the expansion of production, the company’s growth its consolidated total assets while also managing the sale of digital assets to finance future operations.

Closing share prices at $18.82, the company also consolidates its position as the second-largest public holder of Bitcoin in America, reinforcing its sustained growth while operating amidst market uncertainties.

Also Read: Trump’s Portrait Embedded in Bitcoin Block By Bitcoin Miner MARA, Costs A Whopping $127K in Fees