Kaito AI is facing backlash after on-chain data suggested it may have misappropriated tens of millions of user subscription funds related to the launch of Limitless.

Blockchain researcher @0xleng1 flagged Kaito transferring funds that were supposed to be allocated to Limitless into Binance Earn, a wealth-management platform, suggesting that the funds may have been used for unauthorized purposes.

Per community updates, the Limitless fund has now exceeded $90 million, further complicating the allegations.

Critics suggest that some of the user funds used for access to the subscription service may have been deployed for profit-seeking purposes without consent.

Kaito Staff Respond, Citing Temporary Custody Arrangements

Following increased criticisms of a lack of transparency, Kaito staff stated that user funds were “briefly custodied” with Binance for the sake of storage, while custody services with FalconX would be reinstated.

The Kaito team asserted that they would, as always, migrate user funds back on-chain and custodied at FalconX once this process is finished, as they have since the platform launched in July.

Kaito has also provided a reference address (0xcaD…cA099) for the interim transaction, though skepticism about the perceived overall transparency on how the platform has interfaced with user assets remains.

Also Read: Odin.fun Suspected Hack Debunked by Dev Bob Bodily, Reasons For Delayed Withdrawals Yet Stated

Community Questions Transparency Amid Rising Token Price

While Kaito assured, some observers in the crypto community still expressed skepticism. Commentators, like ‘Fearless’ stated that they indicated that once funds are deposited in Binance, how the money is being used becomes opaque to outside observers and their considerations.

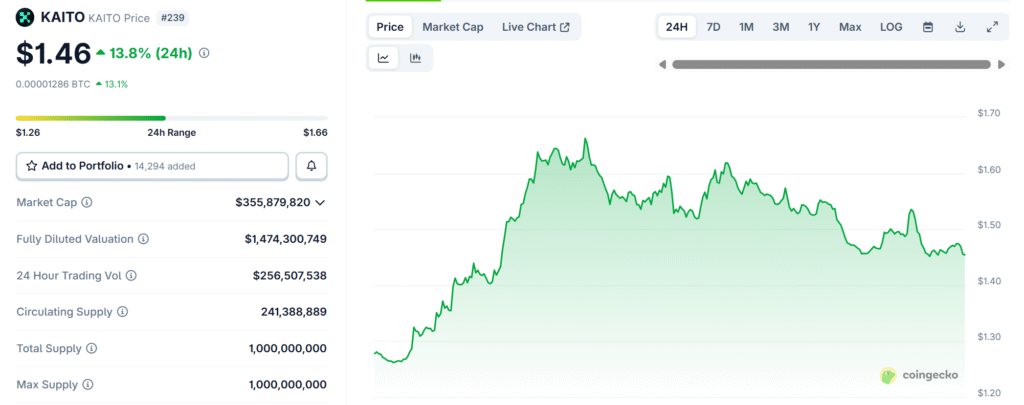

This indicates that funds could be deployed into wealth management, arbitrage, or high-risk trading with no way to credibly observe the process. Interestingly, the KAITO token has not been affected by the controversy.

In fact, the KAITO token price has actually risen 14.36% in the past 24 hours to $1.46, 41.62% over the last week, and has a market capitalization of $355.8 million with trading volume.

The token also boasts over $256 million in daily trading volume.

Security Concerns in Crypto Markets

Kaito is facing allegations at a time of heightened scrutiny in the crypto ecosystem, where multiple protocols and platforms have been forced to respond to suspected hacks and mismanagement of funds.

For context, Ronin Network announced an investigation into a suspicious breach worth an apparent $9.33 million on August 6, and while documents were leaked discussing the breach, it is unclear if they were a white hat test or malicious, according to UnoCrypto.

Most recently, on September 26th, we reported that there were unusual outflows from Hypervault totaling $3.6 million, with some funds moved through Tornado Cash in a manner similar to a rug pull.

These examples raise the importance of establishing additional governance safeguards for custodial assets and greater regulatory guidance as the crypto markets continue to drive innovation along with risks.

Also Read: Iran’s Nobitex Crypto Exchange Loses $48M In Suspected Israeli Hacker Attack