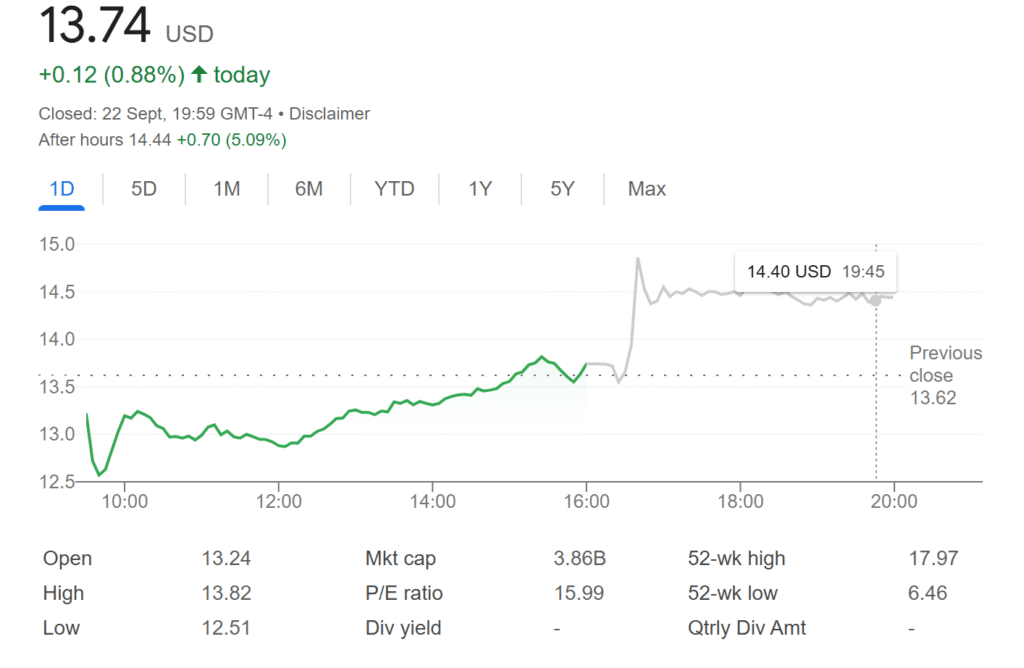

CleanSpark (CLSK), a Bitcoin mining company based in the United States, saw its stock price rise 5% in post-market trading after announcing a $100 million financing agreement with Coinbase Prime.

The deal allows CleanSpark to raise more capital by using a small portion of its almost 13,000 Bitcoin holdings as collateral.

The company’s stock price finished trading at an even $13.74 a share on September 22 before quickly reaching $14.44.

This was a strong signal from investors demonstrating confidence that CleanSpark is able to use its Bitcoin reserves for its growing operations.

The funding highlights an expanding partnership between CleanSpark and Coinbase Prime, which has had a significant impact on miners’ financing.

Loan to Fuel Bitcoin Mining, HPC, and Energy Growth

CleanSpark executives say the new money will be used to expand the company’s Bitcoin mining business as well as its high-performance computing (HPC) business in addition to its energy portfolio.

Many mining companies have moved aggressively into AI-type computing, but CleanSpark Chief Business Officer Harry Sudock said the company’s goal is not to balance out its mining and HPC efforts but to maximize the utility of each asset.

This includes a thorough evaluation of its land holdings, energy contracts, and power infrastructure to determine what use cases will be the most profitable.

CleanSpark intends to foster sustainability and growth through diversification in the rapidly changing digital asset space.

Versatility as a Core Strategy for Future Expansion

According to Sudock, CleanSpark’s focus on flexibility enables the company to take advantage of opportunities in multiple areas.

While certain energy resources may not be optimum for Bitcoin mining, there is a significant opportunity for those same resources to be used for high-performance computing systems.

By cultivating both capabilities in its portfolio, CleanSpark maximizes the long-term value of its energy and infrastructure assets.

This flexible approach, as Sudock noted, enables CleanSpark to scale more rapidly and sustainably than if it focused exclusively on either mining or computing.

“Flexibility provides maximum opportunity,” he said, reinforcing that adaptability will be a primary driver of the firm’s competitive advantage over the next couple of years.

Expanding Bitcoin-Backed Financing Strategy

The $100 million agreement is a continuation of CleanSpark’s pattern of using Bitcoin holdings for strategic financing.

The company has raised about $300 million in BTC-backed loans with Coinbase Prime. Sudock said CleanSpark’s belief is about actively putting its Bitcoin reserves to work for its investors versus holding them.

However, he stressed that only a portion of its nearly 13,000 Bitcoins is being used as collateral, so the company can maintain a healthy balance sheet while continuing to raise capital to grow.

The agreement follows the record-breaking third quarter for CleanSpark in which it produced $198.6 million in revenue on the back of mining 657 BTC in the month of August, an increase of 37.5% year-over-year.

Bitcoin Treasury Strategies Boost Other Companies’ Shares

CleanSpark’s financing achievement follows a growing trend of companies looking to Bitcoin for treasury and financing purposes, consistently resulting in a jump in stock prices.

According to UnoCrypto, on July 24th, London publicly listed gold miner Nativo Resources announced it will hold Bitcoin in addition to its gold reserves, resulting in a 23.5% jump in its stock price.

Also, on September 13, we reported that the biotech company Prenetics announced it would have a new Bitcoin treasury of 228.42 BTC ($26.1 million) and began a daily accumulation plan, resulting in a 13% gain in its stock price.

As companies from different sectors increasingly adopt Bitcoin-backed strategies, CleanSpark’s recent financing of $100 million serves as a reminder that digital assets continue to support corporate growth, financial innovation, and market performance.

Also Read: SharpLink Gaming Increases Ethereum Holdings with Additional $2 Million Stake, Share Price Up 28%