The International Monetary Fund has asked El Salvador to overhaul its Bitcoin regulations making it yet another side-eye comment on the crypto world by an international organization.

In a press conference held on October 3rd, IMF’s director of communications department stated that the organization is in talks with El Salvador to promote economic stabilization, but suggested: “A narrowing of the scope of the Bitcoin law, strengthening the regulatory framework and oversight of the Bitcoin ecosystem, and limiting the public sector exposure to Bitcoin.”

Program conversations between El Salvador and the International Monetary Fund prioritize bolstering reforms, but tackling the risks associated with bitcoin use is still a major topic of conversation between the two.

Crypto Laws in El Salvador Were Aimed at Better Economic Growth

El Salvador became the first nation to legalize Bitcoin in 2021 when its legislature passed the bill approving it. Supported by President Nayib Bukele of El Salvador, it was thought that Bitcoin would help Salvadorans bank more easily and boost the country’s economy by drawing in foreign capital.

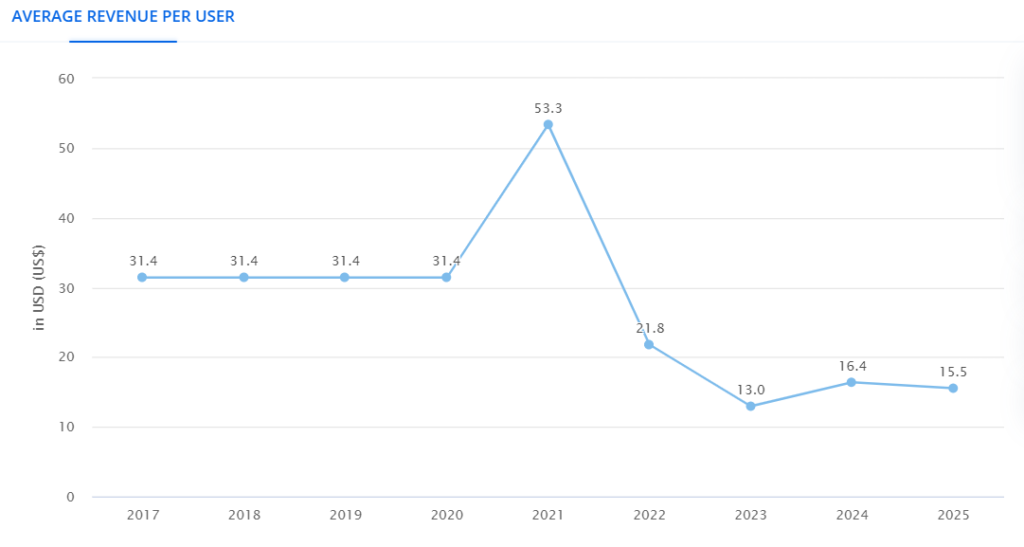

However, despite all the support, it looks like El Salvador was not able to push its economic growth idea in full swing. At present the revenue per user from crypto in the country is at a steep decline from its earlier levels.

Additionally, illicit activities in the region also grew on the back of easily accessible Bitcoins. State-run Bitcoin businesses, such as Chivo Wallet in El Salvador, have been extensively exploited by transnational organizations to defraud consumers of millions of dollars in addition to transnational criminal activity, as highlighted by Georgetown Journal of International Affairs.

Is IMF Critical of Cryptocurrencies?

The pressure on El Salvador to look deep into its Bitcoin regulations comes at a time when IMF has already stated its critical stance on cryptocurrencies.

The main bone of contention between international regulatory bodies and the digital asset world resides in the idea of regulated markets are elimination of government control.

Even with the IMF, it is very difficult for the global regulator to oversee a digital financial market. The head of the International Monetary Fund had previously stated that because cryptocurrencies are risky for the stability of the financial system, they should be controlled.

IMF officials have time and again reiterated that the problem with the virtual asset world is that widespread adoption of cryptocurrency assets could jeopardize macroeconomic stability, as reported by Reuters previously.