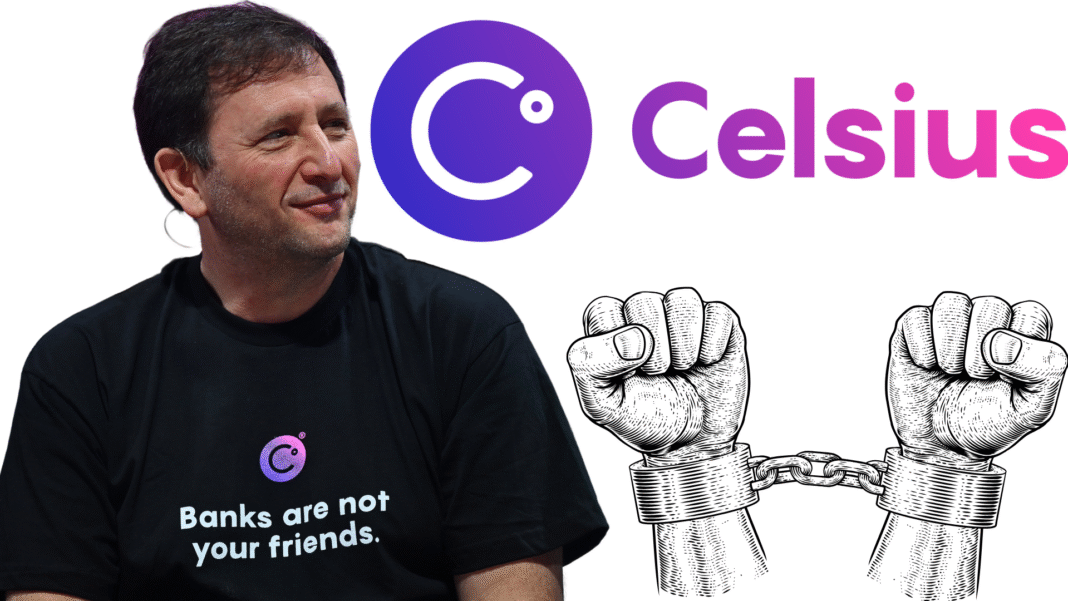

Alex Mashinsky, founder and former CEO of Celsius Network, could receive up to 20 years in prison after U.S. prosecutors asked the court for a severe sentence. The Department of Justice filed its sentencing memo on April 28, 2025, in the Southern District of New York.

The DOJ described Mashinsky’s actions as “deliberate, calculated” fraud that left nearly $7 billion of customer funds unrecoverable and thousands of investors ruined.

DOJ’s Call for a Harsh Sentence

In its 97-page memo, the DOJ urged Judge John Koeltl to impose the maximum term. Prosecutors noted that Celsius suspended withdrawals on June 12, 2022, trapping about $4.7 billion in user assets.

They called Mashinsky’s conduct a long-running campaign of lies and self-enrichment. “The Court should sentence Alexander Mashinsky to twenty years’ imprisonment as just punishment,” the memo stated, pointing to the widespread harm he caused.

Admissions and Profits

Mashinsky pleaded guilty in December 2024 to leading the fraud at Celsius. He admitted that his scheme cost investors over $550 million in direct losses and that he gained more than $48 million.

Prosecutors highlighted this personal profit as evidence of his intent. They stressed that while customers believed their funds were safe, Mashinsky secretly sold large amounts of the platform’s CEL token at high prices.

Also Read: Celsius Seeks Reversal of Court Ruling That Denied Its $444M Claim in FTX Lawsuit

Crash of a Crypto Giant

At its high point in 2021, Celsius managed more than $20 billion in crypto holdings. Mashinsky had pitched it as a safe, high-yield alternative to banks.

Instead, the platform made uncollateralized loans, took risky trading bets, and used customer assets to manipulate token prices. When the house of cards fell apart in July 2022, the platform filed for bankruptcy and left users unable to reclaim a significant share of their investments.

Victims’ Voices

The DOJ received over 200 victim impact statements describing personal and financial devastation. Letters detailed families forced to pause education plans, retirees unable to cover living costs, and small business owners left with massive shortfalls.

Prosecutors noted that, adjusted for post-2024 crypto prices, losses swell toward $7 billion, deepening the crisis for those who entrusted Celsius with their savings.

Looking Ahead to Sentencing

Mashinsky’s sentencing hearing is set for May 8, 2025. As Jay Clayton, the interim U.S. Attorney for Manhattan, observed in an April 23 letter, the flood of victim statements underscores the human toll of the collapse.

Judge Koeltl will weigh the DOJ’s recommendation against Mashinsky’s guilty plea and any mitigating factors he may present.

The request for a 20-year sentence highlights how seriously U.S. authorities view large-scale crypto fraud. For investors, the trial serves as a sobering reminder of the risks in digital finance.

As Mashinsky awaits his fate, the broader crypto world watches closely, knowing that the outcome could shape enforcement and trust in the industry for years to come.

Also Read: Celsius Network Distributes $2.5B To Creditors Amid Bankruptcy Closure