Binance, the world’s leading cryptocurrency exchange by volume, has announced that it will delist four tokens, Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB), and Wing Finance (WING), effective May 2, 2025.

The delisting decision follows Binance’s routine asset review process, which evaluates key metrics such as trading volume, liquidity, development activity, and compliance with platform standards.

The affected tokens will be removed from all trading pairs on Binance, and associated services like Spot Copy Trading and Trading Bots will also cease support.

The move underscores Binance’s commitment to maintaining a high standard of listed assets, while sending a clear signal to projects that fail to meet ongoing performance or regulatory expectations.

User Guidance and Withdrawal Deadlines Issued

To support a smooth transition, Binance has provided detailed instructions for users holding the delisted tokens.

Starting May 5, 2025, deposits of ALPACA, PDA, VIB, and WING will no longer be accepted, and users have until July 4, 2025, to withdraw their holdings.

After the withdrawal deadline, Binance may attempt to convert any unclaimed token balances into stablecoins on users’ behalf, though this is not guaranteed and could result in unfavorable conversion rates.

Users are strongly advised to disable any automated services such as Trading Bots and Spot Copy Trading well before the cutoff date to avoid market-rate liquidation or loss.

These operational safeguards reflect Binance’s effort to protect users from abrupt changes and minimize disruptions in portfolio management.

Token Prices Plunge Over 20% Following Announcement

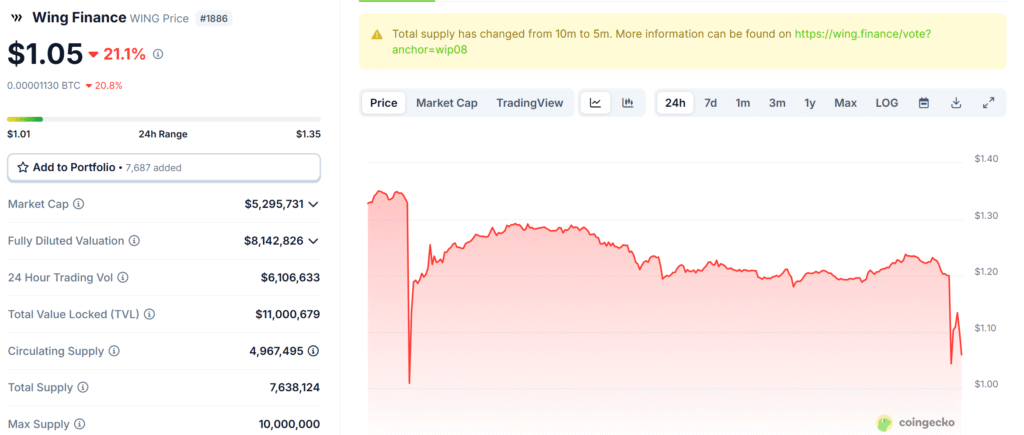

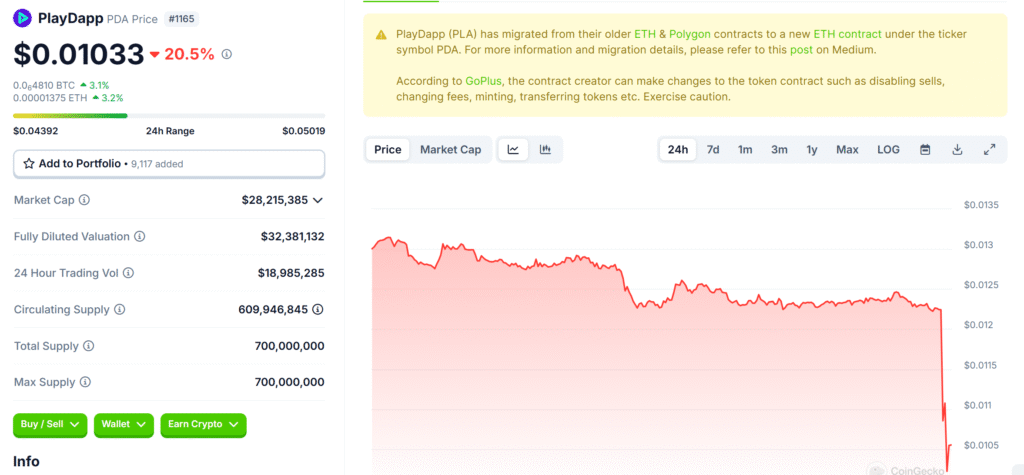

The delisting news sent immediate shockwaves through the market, with all four affected tokens experiencing sharp price declines of over 20% in a single day.

Alpaca Finance (ALPACA) fell by 20.20%, trading at $0.03433, while Wing Finance (WING) dropped by 21.60% to $1.04. Viberate (VIB) was the hardest hit, falling 25.79% to $0.01704.

Even PlayDapp (PDA), which had shown a modest weekly gain, plunged by 21.30% to $0.01023.

Market capitalizations for these projects have plummeted, with VIB dropping to just over $3 million.

These steep losses highlight the significant influence major exchanges like Binance have over token viability and investor confidence, particularly for smaller or underperforming projects.

Broader Delisting Ripple Effects Across the Market

Binance’s delisting decisions have had a ripple effect across the crypto market, affecting not just the four primary tokens, but also other struggling projects.

Vite Labs, the developer behind the VITE token, has announced a potential shutdown following its own delisting from Binance and the withdrawal of market-making support from DWF Labs.

VITE’s price has dropped 30% in a week, and with development roadmaps suspended and financial reserves dwindling, the project’s future remains uncertain.

Similarly, the REEF token fell 9% after Binance announced the termination of its REEFUSDT perpetual futures contracts, forcing traders to settle their positions and absorb sudden losses.

These events underscore how Binance’s delisting decisions can serve as a major inflection point for project survival, investor sentiment, and overall market health.

Also Read: Binance Suspends $USDT Spot Trades in Europe, Keeps Perpetual Contracts Open