A high-profile Ethereum (ETH) trader has once again demonstrated their expertise in leveraged trading, securing a $1.8 million profit in just 50 minutes through a high-stakes 50x long position.

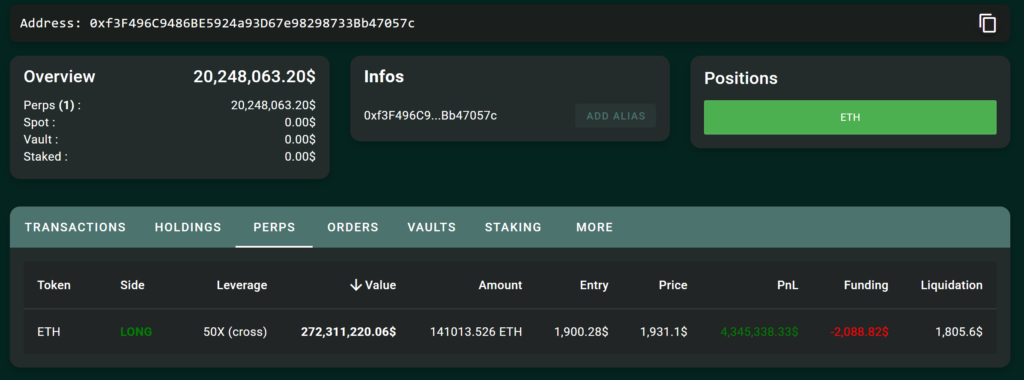

The trader, identified by wallet address 0xf3f4, utilized aggressive margin trading techniques on the Hyperliquid exchange, capitalizing on rapid price movements.

Despite initial speculation about a potential exploit or hack, it was clarified by Hyperliquid on X that no such incident occurred.

Instead, the trader skillfully withdrew funds to reduce their margin before ultimately being liquidated, ensuring a profitable exit.

However, their aggressive trading led to a $4 million loss for Hyperliquid LP (HLP), highlighting the inherent risks associated with leveraged trading strategies.

Hyperliquid has stated that after this trade they are updating their leverage to 25x and 40x.

The trader’s average entry price for this position was $1,931.1 per ETH, with a liquidation point set at $1,805.6.

The rapid closure of the trade for substantial gains highlights the traders advanced market timing and risk management strategies, reinforcing reputation.

Consistent Success in High-Risk Leveraged Trading

This is not the first time this Ethereum trader has executed highly profitable leveraged trades. In previous transactions, they placed a massive $145 million long position using 50x leverage on the Hyperliquid exchange, further solidifying their dominance in high-stakes trading.

Another previous trade saw the whale generate a staggering $9.28 million profit through similar leveraged maneuvers.

Additionally, they have longed over 175,000 ETH with 50x leverage by depositing $15.23 million USDC, showcasing their aggressive market strategies.

In another instance, they briefly opened a 20x long position on Bitcoin before closing it early.

At one point, their Ethereum positions ballooned to over $300 million in value, leading them to withdraw $8 million USDC while allowing a portion of their remaining ETH holdings to be liquidated.

The trader’s ability to repeatedly secure massive profits has led to speculation about whether they are leveraging advanced algorithmic trading tools or privileged market insights.

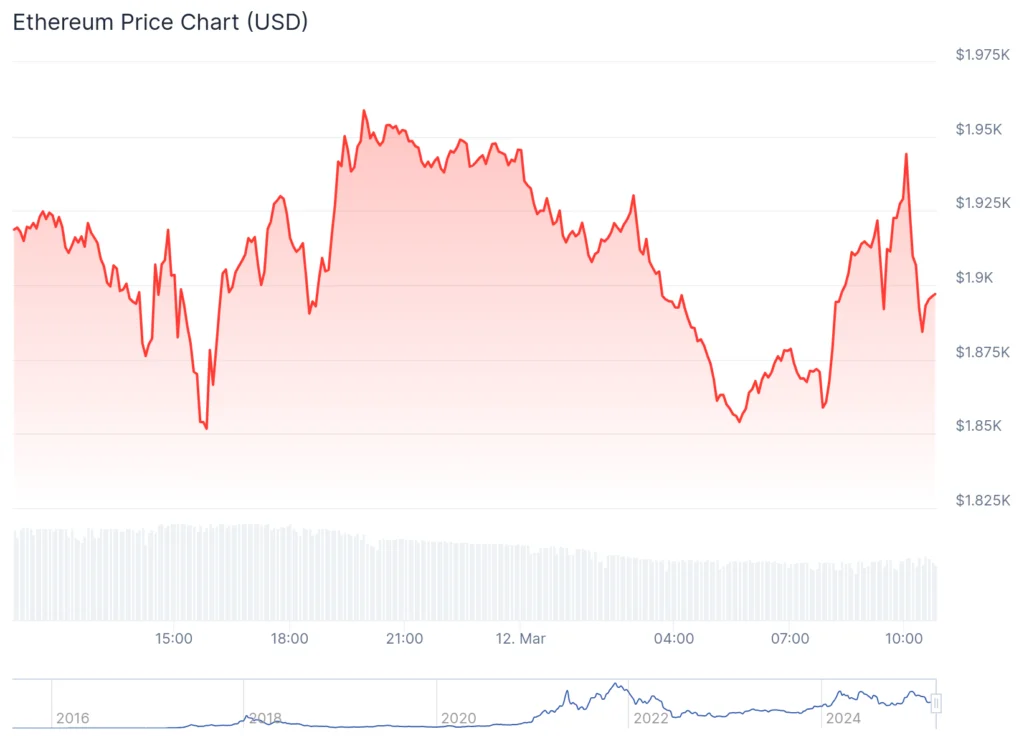

Ethereum’s Price Decline Amid Large-Scale Trading Activity

Despite the success of this high-profile trader, Ethereum’s overall market performance has been under pressure.

As of today, Ethereum (ETH) is priced at $1,896.31, reflecting a 1.12% decline over the past 24 hours and a sharp 14.17% drop over the past week.

The cryptocurrency’s 24-hour trading volume remains substantial at $25.72 billion, with a total market capitalization of $228.9 billion.

The recent price declines suggest that while individual traders may be profiting from aggressive leverage strategies, the broader market is experiencing increased volatility and bearish sentiment.

Large-scale leveraged trades, particularly those from whales, have contributed to heightened market fluctuations, leaving investors uncertain about Ethereum’s short-term trajectory.

Also Read: ETH to BTC exchange rate dips under 0.023, marking its lowest point in over four years

The Risks and Speculation Surrounding High-Leverage Trading

While leveraged trading can yield extraordinary profits, it carries immense risks, particularly when utilizing 50x leverage. Even a small unfavorable price movement can lead to liquidation, wiping out an entire position.

The ability of this particular trader to consistently profit from these trades suggests either exceptional technical expertise or access to proprietary data that helps them time the market with precision.

However, retail investors attempting to replicate such strategies without extensive knowledge and risk management mechanisms could face devastating losses.

As Ethereum’s price continues to fluctuate, traders remain watchful of whale activity, as their movements can significantly impact market trends.

The growing reliance on leveraged positions also raises concerns about potential market manipulation, with sudden liquidations and reversals triggering cascading effects across the market.

Other Ethereum Whale Trades and Their Market Impact

Ethereum’s leveraged trading activity continues to generate both immense profits and significant losses for different traders.

In one case, a crypto investor who swapped $30.8 million worth of DAI for 15,292 ETH at $2,014 per token suffered an immediate $2.2 million loss after Ethereum’s price dropped over 9% in a single day.

On the other hand, a whale who shorted Ethereum at $3,220 with 50x leverage is now sitting on an unrealized profit of $92 million as ETH has plummeted to $1,800.

Meanwhile, another trader recently closed a 50x leveraged short position on Hyperliquid, securing a $2.15 million profit in just 40 minutes, leading to a brief Ethereum price spike.

These instances highlight the highly volatile nature of leveraged trading, where fortunes can be made or lost within minutes.

As more traders employ aggressive leverage strategies, market manipulation concerns continue to grow, prompting debates about the long-term stability of Ethereum’s price movements.

Also Read: Crypto Investor Increases Long Positions in SOL, ETH, WIF, BTC, and kPEPE Amid $14.39M Floating Loss