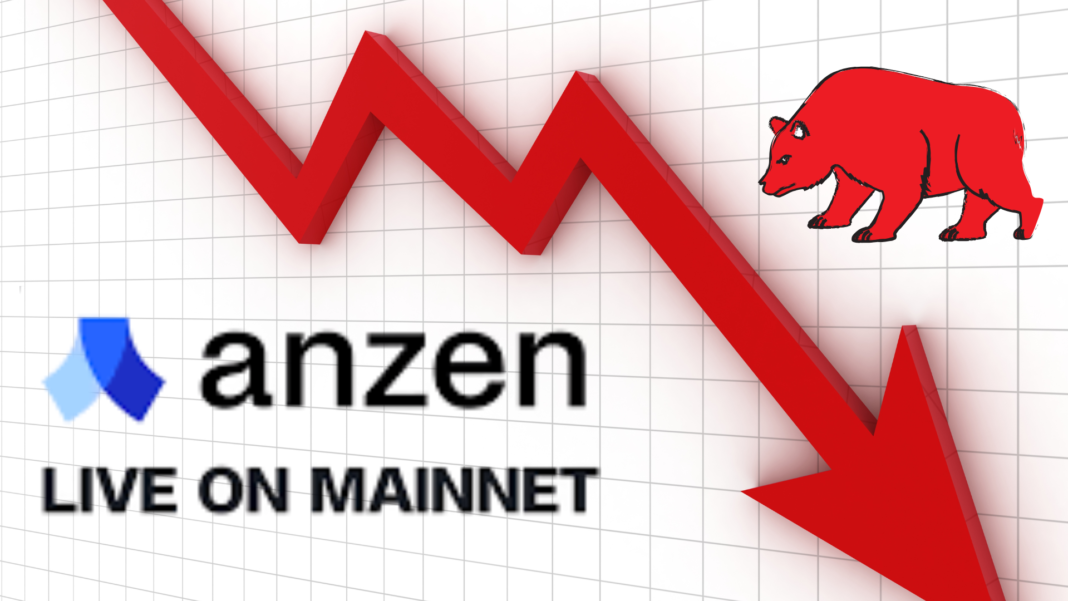

The price of Anzen’s USDZ stablecoin is currently below its targeted peg of $1.00 due to recent market turbulence.

Concerns have been raised by the excessive volatility of USDZ, which is currently trading at about $0.9534, as per official data.

The token has not been able to sustain its stability, which is a crucial feature of stablecoins, even if it is supported by $122 million in cash, cash equivalents, and credit portfolios.

Although there are roughly 120 million USDZ in total supply, market confidence is being tested by this volatility.

What’s Behind USDZ’s Market Volatility

Circle Ventures, a reputable brand in the cryptocurrency industry, supports USDZ. According to recent market activity, even with significant support, stablecoins are susceptible to volatility and debugging concerns.

Shifts in the general mood of the market, difficulties with liquidity, or worries about the stability of the assets supporting USDZ could contribute to the debugging problem.

The difficulties that many stablecoins encounter in keeping its peg during times of market stress are highlighted by the USDZ’s recent volatility.

Regulators and industry participants will probably examine the mechanisms underlying stablecoin stability as the cryptocurrency market develops further to make sure they remain resilient during volatile periods.

Also Read: Crypto Exchange MEXC Invests $20 Million In Ethena’s USDe To Boost Stablecoin Adoption

USDZ Faces Harsh Market Competition

Newer projects like USDZ have also been impacted by competition from more established stablecoins with significant liquidity and solid track records, such as Tether (USDT) and USD Coin (USDC).

Additionally, the capacity to maintain its peg may be impacted by changes in market conditions, therefore liquidity issues could be a major problem. USDZ may be losing market traction as a result of the market’s increasing preference for more stable and extensively used alternatives.

It might yet have trouble becoming widely accepted in the fiercely competitive stablecoin industry until USDZ can stabilize and win over investors.

Stablecoin Market Reality: What is Happening?

As many projects compete for dominance in the cryptocurrency market, stablecoin rivalry is getting more intense.

Prominent stablecoins with substantial market capitalizations, great liquidity, and trustworthiness, such as Tether (USDT) and USD Coin (USDC), have solidified their market positions.

More confidence and acceptance are ensured for these well-established businesses thanks to regulatory oversight and alliances with significant financial institutions.

Newer competitors, like Anzen’s USDZ, are attempting to establish a niche by providing distinctive features. In order to compete with the widely used heavyweights in the stablecoin field, these newcomers must retain stability, liquidity, and confidence.

Also Read: Tether Backs Mansa With $10M To Drive Stablecoin-Powered Cross-Border Payments