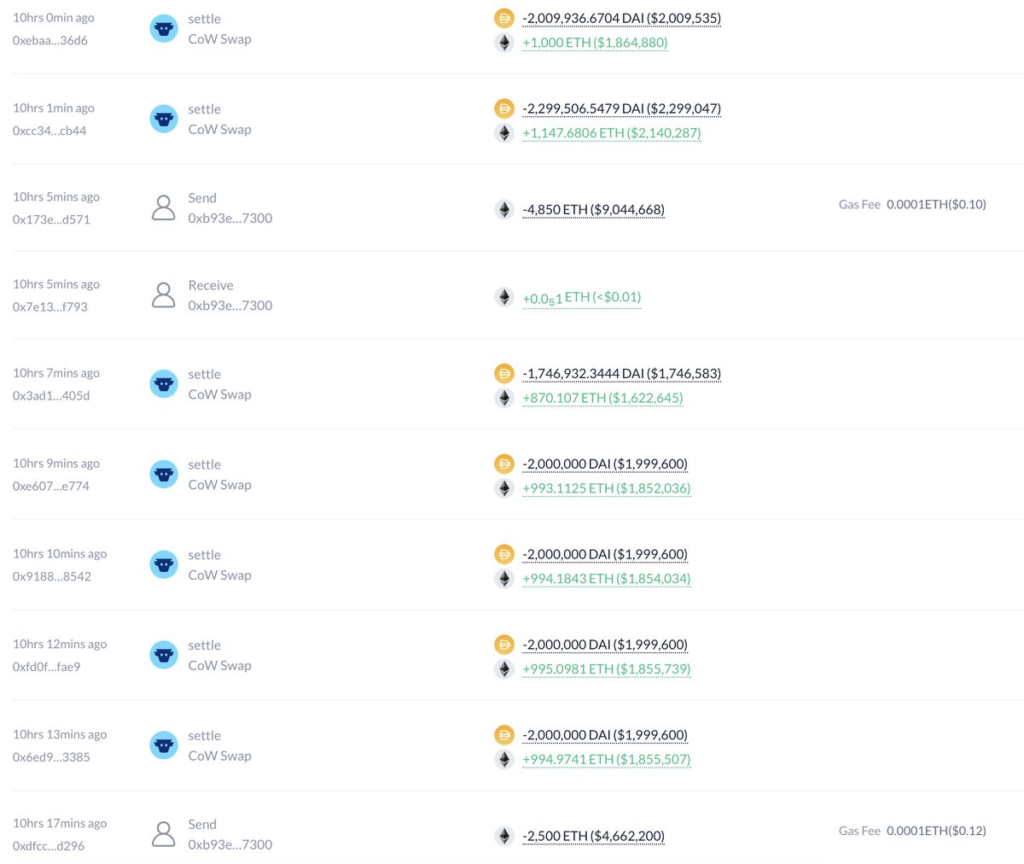

A major cryptocurrency investor, often referred to as a “whale,” has suffered an immediate $2.2 million loss after purchasing 15,292 Ethereum ($ETH) by selling his $30.8M DAI holdings.

According to blockchain analytics platform Lookonchain, the whale bought ETH at a price of $2,014 per token.

However, a sharp decline in Ethereum’s price has reduced the value of the holdings to $28.6 million, marking a substantial short-term loss.

The move highlights the risks associated with large-scale cryptocurrency investments, especially in volatile market conditions.

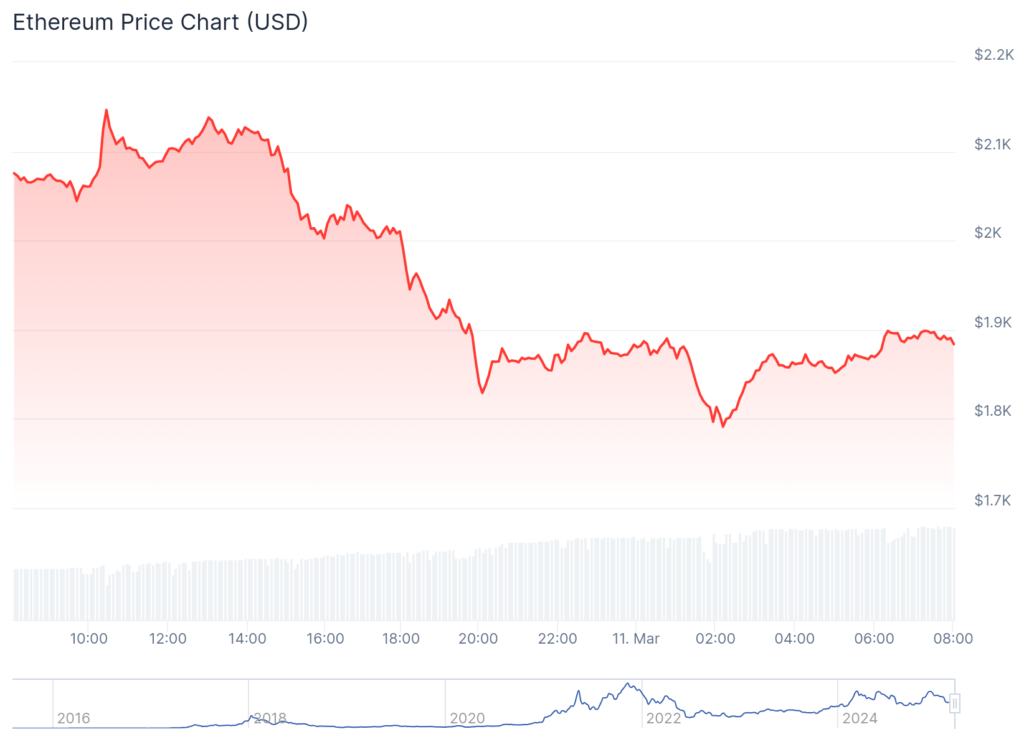

Ethereum Price Drops Over 9% in 24 Hours Amid Market Downturn

Ethereum has experienced a significant price decline, contributing to the whale’s losses. As of today, ETH is trading at $1,883.64, marking a 9.24% decrease in the past 24 hours and a 10.55% decline over the past week.

The sharp drop in price has also impacted Ethereum’s overall market capitalization, which now stands at $227.86 billion.

Despite a 24-hour trading volume of over $41.9 billion, the bearish momentum suggests further price instability in the near term.

Many investors are now closely monitoring the market for potential support levels or further downward trends.

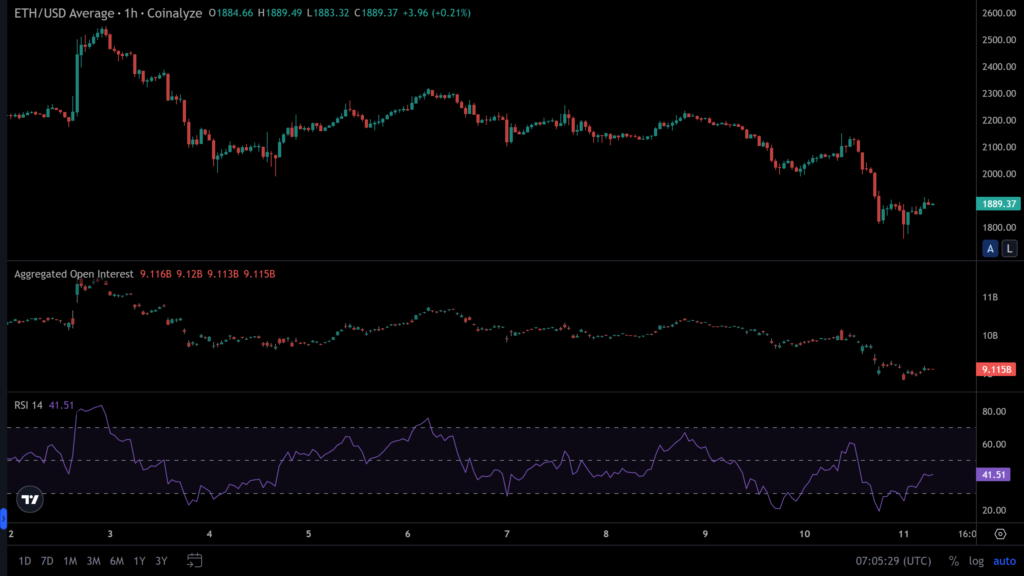

Market Indicators Show Increasing Bearish Pressure on Ethereum

Several technical indicators suggest Ethereum may continue facing downward pressure.

The token’s Relative Strength Index (RSI) has dropped to 41.51, signaling growing bearish sentiment.

Typically, an RSI below 50 indicates a market favoring sellers over buyers. Additionally, the open interest of ETH, another key metric used to gauge market strength, has fallen by 8.33% to $9.1 billion.

The decline suggests that traders are pulling back on leveraged positions, further contributing to ETH’s weakening momentum. If bearish sentiment persists, ETH may struggle to recover in the short term.

Broader Implications for the Crypto Market and Large Investors

This significant loss underscores the inherent risks associated with large-scale cryptocurrency transactions, particularly in volatile market conditions.

Whales often influence price movements, but even they are vulnerable to sudden downturns. ETH Whales continue to massive profits on ETH amid the market downturn.

The declining ETH price could also have ripple effects across the broader crypto market, potentially affecting investor confidence and trading strategies.

As market conditions evolve, analysts will be closely watching whether Ethereum can stabilize or if further losses are on the horizon.

Large investors may need to reconsider risk management strategies to avoid substantial losses in uncertain market conditions.

Also Read: Crypto Investor Increases Long Positions in SOL, ETH, WIF, BTC, and kPEPE Amid $14.39M Floating Loss