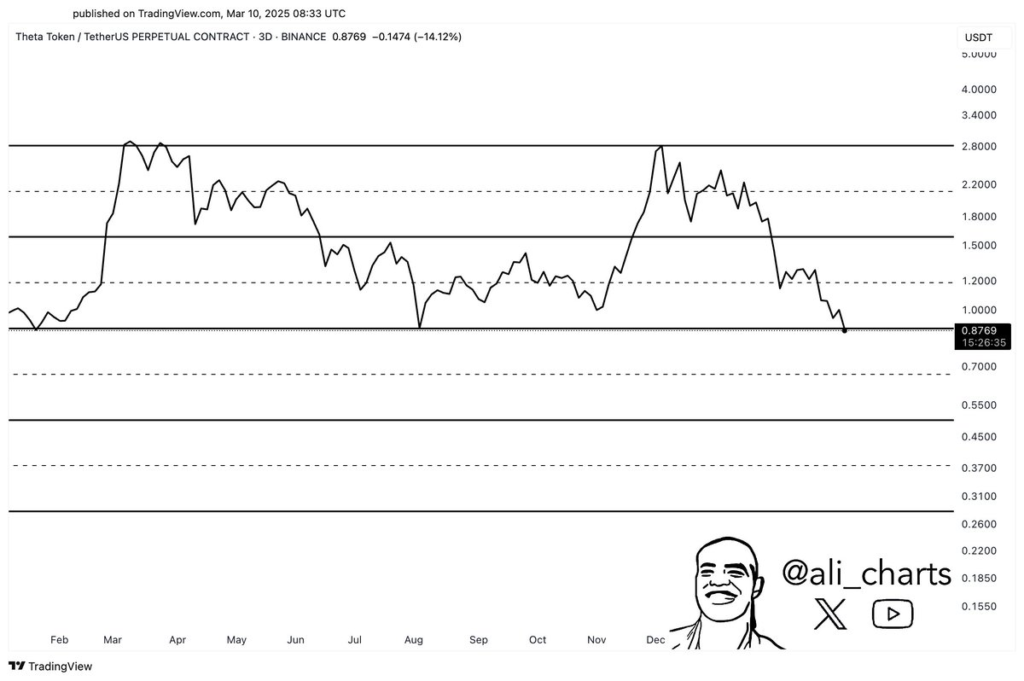

Renowned crypto analyst Ali Martinez has issued a bearish warning for Theta Network (THETA), suggesting that the token is breaking out of a parallel channel and may face a steep decline.

Based on his technical analysis, THETA has already moved below its previous support level of $0.8769, signaling a potential continuation of its downward trend.

Martinez’s projection places the token at a possible low of $0.30, which would represent a substantial drop from its current price.

If this scenario unfolds, it could mark a significant downturn for THETA, raising concerns among traders and investors about the token’s near-term performance and market stability.

THETA Price Declines as Market Sentiment Weakens

Theta Network’s price has experienced a notable decline today, currently trading at $0.8197. The token has dropped by 9.70% in the past 24 hours, extending its losses to 18.93% over the past week.

The downward movement indicates increased selling pressure and growing uncertainty among market participants.

With a circulating supply of 1 billion THETA tokens, the project’s total market capitalization now stands at approximately $824.1 million.

The continuous price decline has fueled speculation about whether Martinez’s bearish prediction will fully materialize or if buyers will step in to prevent further losses.

Also Read: Crypto Analyst Predicts Dogecoin Surge to $2 If Key Support Level at $0.16 Holds

Technical Indicators Suggest Further Downside Potential

Martinez’s analysis of the parallel channel breakout suggests that THETA’s market structure is shifting toward increased volatility and potential price corrections.

A bearish breakout typically signals a strong downward momentum, and if the trend continues, THETA could struggle to regain higher price levels.

A decline to $0.30 would represent a massive 65% drop from current levels, potentially shaking investor confidence and triggering broader market concerns.

The token’s relative strength index (RSI) has fallen to 41, indicating increased bearish pressure, while the open interest of THETA has dropped by 6.85% to $13.6 million, further confirming weakening momentum.

Investors Monitor Key Levels and Market Reactions

With THETA currently in a downtrend, investors and analysts are closely monitoring market reactions to gauge the token’s next move.

While Martinez’s bearish outlook suggests continued losses, some traders may view lower prices as a buying opportunity, leading to short-term rebounds.

Additionally, broader market conditions, including Bitcoin’s price action and sentiment across the altcoin sector, could influence THETA’s trajectory.

As the market digests Martinez’s forecast, traders will be watching key support and resistance levels to determine whether the bearish prediction plays out or if THETA finds stability and reverses its downward trend.

Also Read: Crypto Analyst Ali Sees $0.30 Target For $OP As Optimism Breaks Out Of Pattern