Ethereum (ETH) witnessed a sharp price spike following a major leveraged trade on the Hyperliquid platform, where a high-profile trader secured a staggering $2.15 million profit in just 40 minutes.

The trader initially opened a 50x leveraged short position, strategically entering at a critical price point before rapidly switching to a long position.

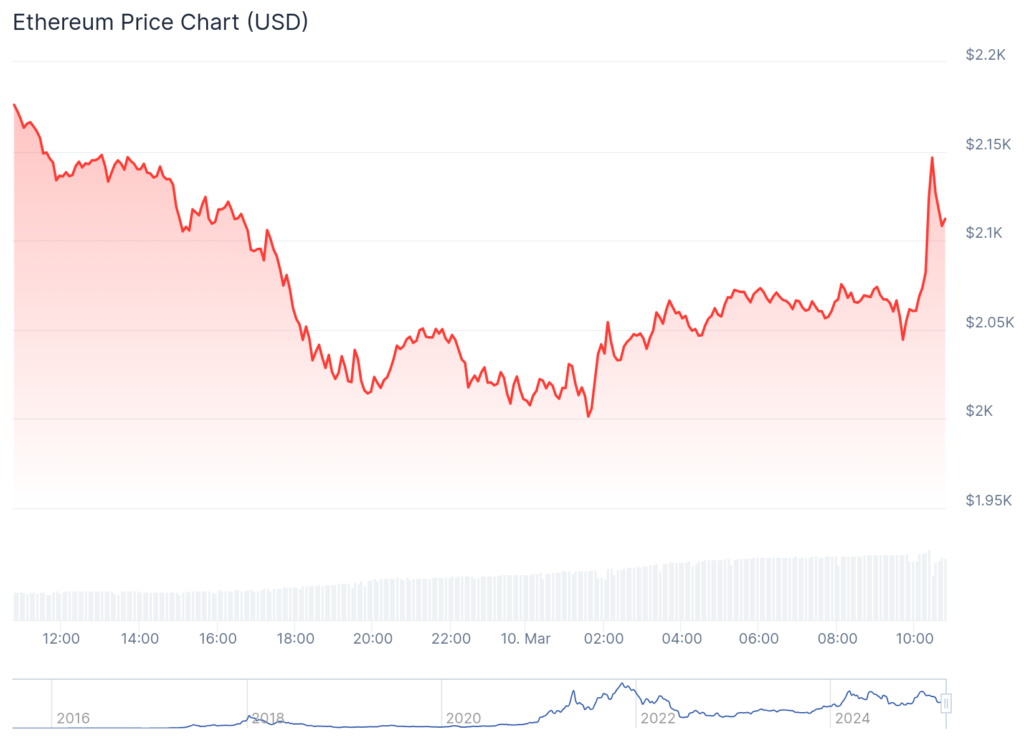

The move pushed Ethereum’s price to a high of $2,149, creating a ripple effect across the market. Shortly after reaching this peak, the trader closed all positions to lock in their profits, a move that quickly gained traction on social media.

High-Risk, High-Reward: The Impact of Leveraged Trading

The use of 50x leverage in such a volatile market highlights the extreme risks associated with margin trading.

With leverage this high, even a small $50 drop in ETH’s price could have triggered a complete liquidation of the trader’s position. However, the successful execution of this trade has once again demonstrated the profit potential of high-stakes strategies.

On-chain data reveals that the trader deposited 1.95 million USDC as margin before opening the long trade at an entry price of $2,057.49, acquiring 27,809 ETH worth approximately $57.88 million.

Their liquidation price was set at $2,008, meaning any substantial downward move could have resulted in massive losses. This level of trading activity can significantly impact Ethereum’s price, often leading to sharp fluctuations within short timeframes.

Also Read: Ethereum Trader With 83.3% Winning Rate Looms In $385K Floating Loss Amid 1,958 ETH Purchase

Concerns Over Market Manipulation and Insider Knowledge

The rapid price spike following the trader’s move has raised questions within the crypto community regarding potential market manipulation or insider trading.

Some traders speculate that certain individuals might have access to privileged information or possess an uncanny ability to predict price movements, leading to what some call a “God’s perspective” on the market.

Repeated instances of profitable high-leverage trades by the same individuals have fueled concerns about the transparency of leveraged markets.

While leveraged trading is a widely used strategy, critics argue that its outsized impact on price action can create artificial volatility, making it difficult for regular investors to navigate the market fairly.

Ethereum’s Price Struggles Despite Temporary Volatility

Despite the dramatic surge caused by this high-leverage trade, Ethereum’s broader market performance remains bearish.

As of today, ETH is trading at $2,113.09, reflecting a 2.70% decline over the past 24 hours and a 9.67% drop over the last week. The current market capitalization stands at $254.8 billion, with a 24-hour trading volume of approximately $24.9 billion.

While leveraged trades can trigger short-term price movements, the overall trend suggests continued uncertainty for Ethereum.

Investors and analysts are closely watching whether ETH can break past key resistance levels or if bearish pressure will continue to dominate in the near future.

Another 50x Leverage Position Generates $58M in Unrealized Profits

In a separate instance, another Ethereum whale is currently sitting on $58 million in unrealized profits from a 50x leveraged short position.

The trader initially opened a $3.1 million short position at an entry price of $3,220, benefiting from Ethereum’s recent price decline.

While this trade remains open, the massive unrealized gains highlight the impact of leverage on market movements.

The use of high leverage continues to be a double-edged sword—while it can generate enormous profits, it also exposes traders to extreme risks, contributing to the overall volatility in the crypto market.