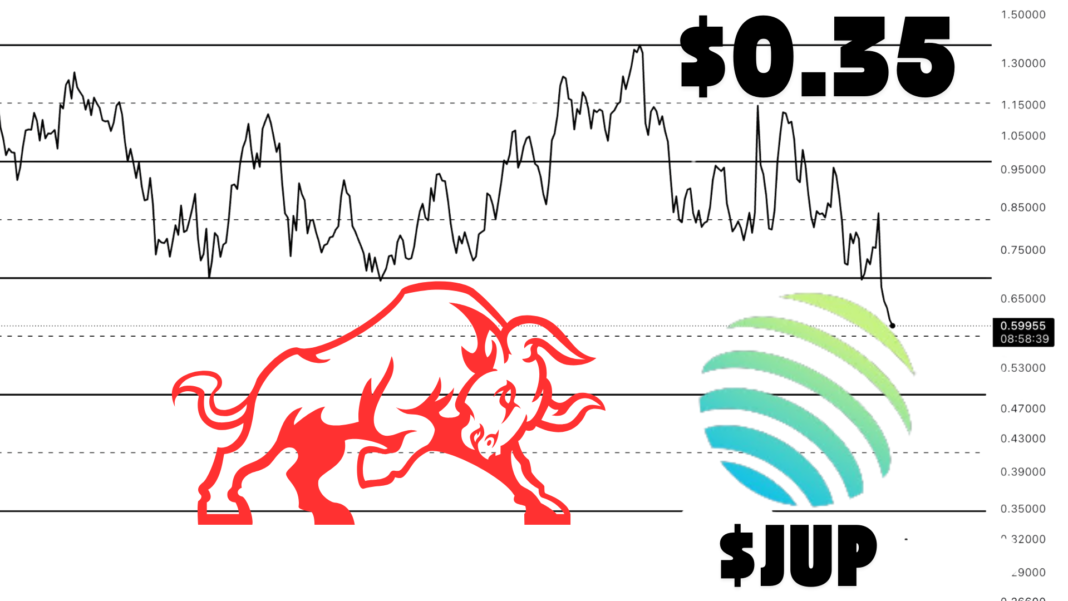

Renowned crypto analyst Ali Martinez has issued a warning about the potential downside of Jupiter ($JUP) following its bearish breakout from a parallel channel.

The crucial technical indicator, which had previously provided strong support for the token, has now turned into a signal for further decline.

Martinez’s analysis suggests that JUP could fall to as low as $0.35, a sharp decrease from its current price.

The breakdown of the parallel channel typically indicates that selling pressure is outweighing buying momentum, raising concerns among investors about the token’s near-term future.

Traders are now closely monitoring JUP’s price action to determine if the bearish trend will continue or if buyers will step in to stabilize the market.

Jupiter’s Sharp Decline and Market Performance

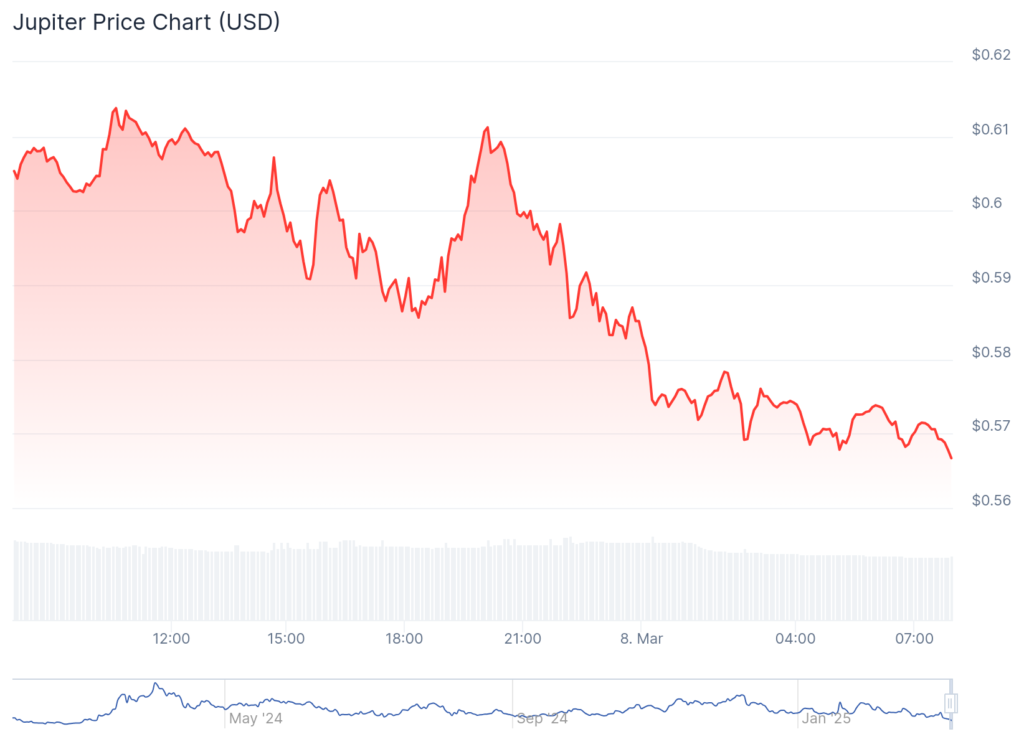

The bearish outlook for Jupiter has already begun to materialize in its market performance. At the time of writing, JUP is trading at $0.5658, reflecting a 6.38% decline in the past 24 hours.

The weekly chart paints an even more concerning picture, with the token losing approximately 23.87% of its value.

The downtrend has significantly impacted its market capitalization, which now stands at $1,527,543,222.

With a circulating supply of 2.7 billion JUP, traders holding large positions are growing increasingly cautious.

The drop in price and market cap suggests waning investor confidence, and if the trend continues, further sell-offs may occur, exacerbating the decline.

Bearish Momentum Targets $0.35 Price Level

Martinez’s prediction of JUP reaching $0.35 is rooted in the bearish technical structure. The breakdown of the parallel channel, combined with increasing downward momentum, suggests that the token could struggle to find solid support in the near term.

If the selling pressure continues, JUP’s next major support level lies at $0.35, which would represent a significant loss from its recent highs.

The token’s inability to hold above key resistance levels has fueled concerns about sustained bearish pressure.

Investors and analysts are now assessing whether the broader market conditions could influence JUP’s trajectory, potentially prolonging the decline or offering a turnaround opportunity.

Market Reactions and Investor Sentiment

Jupiter’s ongoing downtrend has sparked intense debate within the crypto community, with investors weighing their options amid heightened volatility.

While some traders see the dip as a buying opportunity, the prevailing market sentiment remains bearish. Open interest in JUP futures contracts has plummeted by 11.58% in the past 24 hours, now valued at $80.2 million.

Additionally, the Relative Strength Index (RSI) for JUP has dropped to 38, signaling increasing selling pressure and a weakening market structure.

If bearish sentiment continues to dominate, Martinez’s $0.35 target could soon become a reality.

The next few trading sessions will be critical in determining JUP’s short-term price direction, with traders closely watching for any signs of stabilization or further breakdowns that could confirm the downward trajectory.

Also Read: Crypto Analyst Forecasts Potential Surge for QTUM To $6 if It Maintains $2.20 Support Level