A prominent crypto whale has amassed an astounding floating profit of approximately $26 million by employing a meticulously crafted trading strategy on HyperLiquid, as reported by Onchain Lens. #

The impressive gain was achieved through a total of 48 perpetual futures positions, consisting of 47 short positions and a single long position.

Despite the substantial number of trades, only three of these positions are currently in the red, while the remaining 45 are yielding significant profits.

The remarkable success highlights the whale’s keen market intuition, precise execution, and ability to capitalize on price fluctuations in the highly volatile cryptocurrency sector.

Whale’s Portfolio Dominated by Heavy Short Positions

An in-depth analysis of the whale’s portfolio reveals a strong bearish outlook, with substantial short positions spread across multiple digital assets.

The largest of these positions is in Ethereum (ETH), with a valuation of approximately $11.96 million, followed by Solana (SOL) at $2.16 million.

Additional notable positions include ENA ($897,837), kBONK ($456,075), and TAO ($615,250), alongside smaller allocations in tokens such as PNUT, POPCAT, and PENGU.

The widespread short exposure indicates a calculated bet on declining prices across various cryptocurrencies, suggesting the trader is profiting from market downturns while leveraging precise risk management techniques.

Also Read: Massive Short Position on Hyperliquid Yields $44M in Unrealized Profits as Ethereum Price Plummets

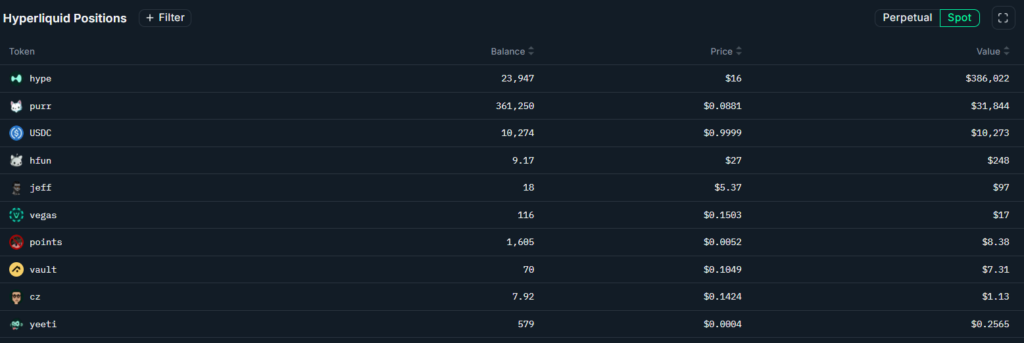

Spot Holdings and Token Investments Reveal Broader Market Strategy

Despite maintaining a largely short-biased trading approach, the whale has also built significant spot holdings within the HyperLiquid ecosystem.

The trader currently holds 23,947 HYPE tokens valued at approximately $386,000, along with an additional 361,250 tokens worth $31,800.

The dual approach suggests a more nuanced market strategy, where the whale balances high-stakes short positions with long-term investments in promising assets.

By diversifying their exposure through both derivatives and spot holdings, the trader demonstrates a sophisticated risk management framework that ensures profitability across varying market conditions.

Market Implications and Strategic Insights

The success of this whale’s trading approach underscores the immense profit potential within the cryptocurrency derivatives market, particularly during bearish trends.

The fact that 45 out of 48 trades are profitable highlights the effectiveness of precise market analysis, timely execution, and disciplined risk management.

Also Read: Crypto Whale Bags $8.3M Profit From SOL, ETH, BTC Short Positions on Hyperliquid

Moreover, such a heavy short-bias raises concerns about broader market sentiment, indicating that major traders may be anticipating further declines in key assets.

The development has caught the attention of other investors and analysts, as the whale’s strategic approach may set a precedent for future trading patterns on HyperLiquid and similar platforms specializing in perpetual futures trading.

Other Major On-Chain Profits Reflecting Market Trends

The crypto landscape has witnessed several other notable profit-making trades in recent times.

A PEPE investor recently secured $406,000 in floating profits after investing $3.95 million WETH to acquire 20,511 AAVE tokens at $193 per token, capitalizing on a 25.6% price surge within 24 hours.

Meanwhile, an Ethereum whale has generated a staggering $58 million in unrealized profits by executing a highly leveraged 50x ETH short position at $3,220, further emphasizing the volatility and high-stakes nature of crypto trading.

Additionally, another smart investor holding $14.84 million in AI16Z and ARC tokens is sitting on $4.38 million in unrealized gains, reflecting strong market demand for these assets following their recent price surges of 52.75% and 93.31%, respectively.

These trends demonstrate the growing opportunities for skilled traders to capitalize on market swings, leveraging both short-term speculation and long-term investments to maximize profitability.