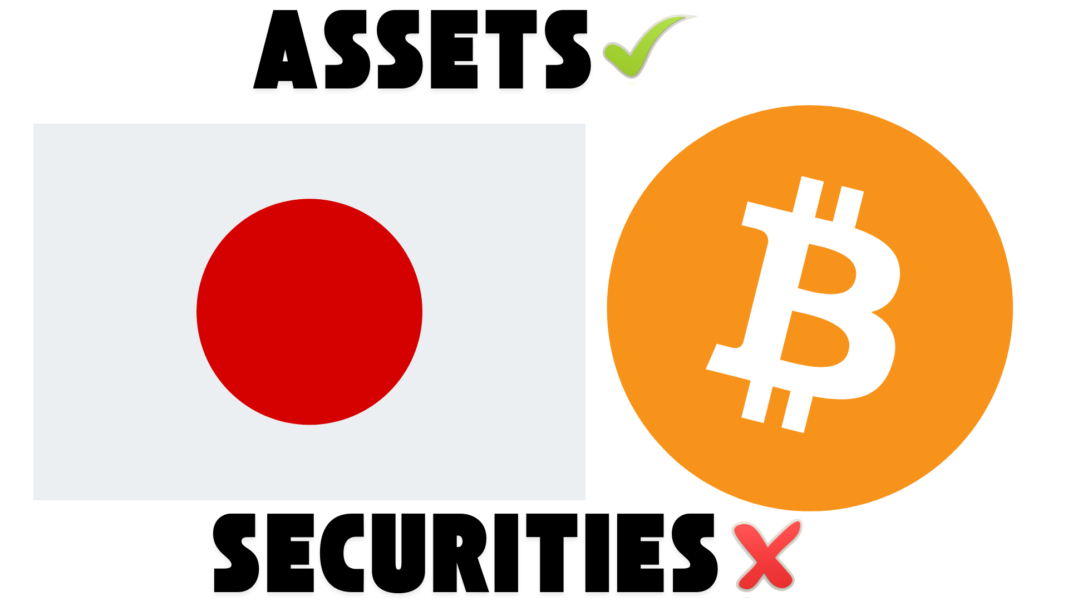

Japan’s ruling party has introduced a groundbreaking proposal to establish a new regulatory framework for cryptocurrencies under the Financial Instruments and Exchange Act.

If approved, this framework would classify digital assets as a unique asset class rather than securities, marking a pivotal shift in Japan’s approach to cryptocurrency regulation.

The proposal aims to create a more favorable and structured environment for crypto investments, distinguishing them from traditional financial securities.

Startale CEO Sota Watanabe, who shared the proposal on the X platform, emphasized that this change could significantly impact taxation policies and investment opportunities in the Japanese crypto market.

By working closely with industry leaders, the government seeks to balance innovation with investor protection, reinforcing Japan’s position as a key player in the global digital asset ecosystem.

Crypto ETFs and Lower Tax Rates Could Transform Japan’s Crypto Investment Landscape

One of the most promising aspects of the proposed framework is its potential to enable cryptocurrency exchange-traded funds (ETFs) in Japan.

By recognizing crypto as a distinct asset class, regulators could open the door for financial institutions to introduce ETFs, making it easier for retail and institutional investors to gain exposure to digital assets in a regulated manner.

Additionally, the proposal suggests a major reduction in taxation on crypto-related earnings, lowering the maximum tax rate from 55% to 20%.

The tax cut could incentivize more Japanese investors to engage in on-chain markets, providing a significant boost to liquidity and market participation.

The combination of regulatory clarity, ETF accessibility, and tax reductions is expected to make Japan a more attractive destination for cryptocurrency investments.

Also Read: SBI VC Trade Secures First-Ever License To Handle Stablecoins In Japan

Collaboration with Industry Leaders Signals a Progressive Regulatory Approach

Unlike past regulatory frameworks that focused on stringent controls and classifying cryptocurrencies as securities, this proposal reflects a shift toward a more progressive stance on digital assets.

By actively collaborating with blockchain experts, fintech leaders, and major crypto firms, Japanese regulators are aligning policies with industry needs while ensuring financial stability and investor protection.

The cooperative approach highlights the government’s recognition of the growing importance of cryptocurrencies in mainstream finance.

If the framework is successfully implemented, it could set a precedent for other nations looking to establish more favorable crypto regulations, positioning Japan as a leader in blockchain adoption and financial innovation.

Potential Impact on Japan’s Crypto Market and Global Influence

If approved, the proposed regulatory framework could significantly boost Japan’s crypto industry by attracting both domestic and international investors.

The lower tax rates and potential introduction of ETFs would encourage greater institutional adoption, enhancing overall market stability and legitimacy.

Sota Watanabe expressed confidence that the new rules would drive more Japanese investors toward crypto, further integrating digital assets into the country’s financial ecosystem.

Japan is already recognized as one of the most crypto-friendly nations, and this regulatory shift could solidify its status as a global leader in digital asset innovation.

With major Japanese firms such as SBI Holdings, Gumi Inc., and Metaplanet making substantial investments in the crypto sector, the country’s commitment to blockchain development and digital finance is stronger than ever.

Also Read: Japan’s Govt Cautious on Bitcoin Reserves Amid Uncertainty, Prioritizes Safety and Liquidity