Japanese investment firm Metaplanet has successfully raised 12.97 billion yen ($87 million) to significantly increase its Bitcoin holdings.

The funding was secured through the large-scale exercise of stock acquisition rights, primarily from EVO FUND, and was accompanied by the early redemption of 2 billion yen worth of ordinary bonds.

After completing these financial maneuvers, Metaplanet now has 10.96 billion yen available, which it plans to deploy for additional Bitcoin purchases.

The company has reaffirmed its commitment to accelerating its Bitcoin acquisition strategy while ensuring a steady and well-executed financial approach.

Breakdown of Stock Acquisition and Early Bond Redemption

Metaplanet’s latest fundraising effort involved the exercise of two major stock acquisition rights—its 13th and 14th series.

The 13th series, issued on February 17, 2025, was fully exercised by March 3, 2025, resulting in the issuance of 3,009,000 new shares at an exercise price of 3,310 yen per share.

The 14th series saw 9,070 stock acquisition rights exercised, equating to 907,000 new shares, which represented 21.6% of the total available under this issuance.

Additionally, Metaplanet redeemed its 7th series of straight bonds ahead of schedule. Originally issued for 2 billion yen, these bonds were due for redemption on August 26, 2025.

However, the company opted to repay them early, using a portion of the newly raised funds to strengthen its financial standing before proceeding with its Bitcoin purchases.

Also Read: Japan’s Metaplanet Boosts Bitcoin Reserves with $12.9M Acquisition, Total Holdings at 2,235 BTC

Strategic Implications of Increased Bitcoin Holdings

Metaplanet’s aggressive Bitcoin accumulation strategy aligns with the growing institutional trend of using Bitcoin as a long-term store of value.

By allocating nearly 11 billion yen to acquire more Bitcoin, the company is reinforcing its commitment to the digital asset, potentially positioning itself as Japan’s version of MicroStrategy, a U.S. firm known for its extensive Bitcoin investments.

The move could attract more investors who view Bitcoin as a hedge against inflation and currency devaluation, further strengthening Metaplanet’s market position.

Moreover, the backing of EVO FUND and the firm’s ability to successfully execute stock acquisitions and debt restructuring suggest strong investor confidence in its vision.

Also Read: Japan’s Metaplanet Secures ¥4.0 Billion ($25.9M) Via Bond Issuance for Bitcoin Expansion

Bitcoin Market Performance Amid Metaplanet’s Announcement

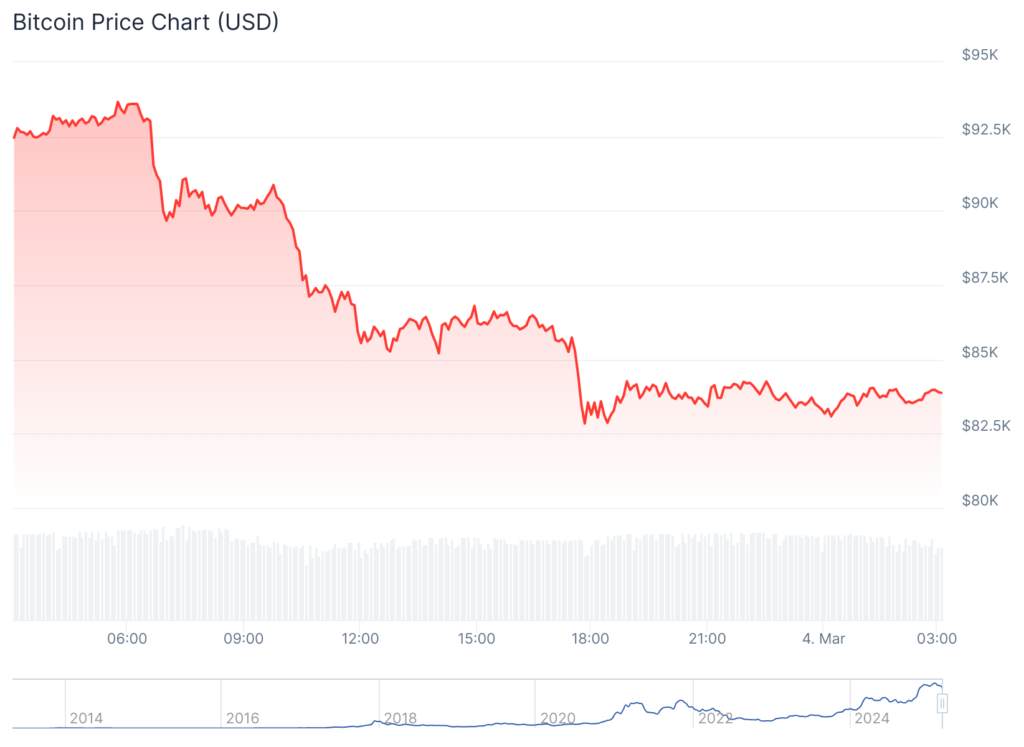

Despite Metaplanet’s substantial Bitcoin purchase plans, the broader cryptocurrency market has seen a downturn.

Bitcoin is currently priced at $83,880.40, marking a 9.29% decline in the past 24 hours and a 5.19% drop over the past week.

With a market capitalization of $1.66 trillion and a 24-hour trading volume of nearly $68 billion, Bitcoin remains the dominant cryptocurrency despite short-term fluctuations.

If Metaplanet follows through with its planned purchases, this could inject new bullish momentum into the market, potentially stabilizing Bitcoin’s price in the coming weeks.

Investors and analysts will be closely monitoring the company’s execution and the impact of its buying activity on the broader crypto landscape.