The International Monetary Fund (IMF) has placed new restrictions on El Salvador’s public sector, preventing the government from increasing its Bitcoin holdings as part of a $1.4 billion financing agreement.

The decision underscores the IMF’s longstanding concerns over El Salvador’s pro-Bitcoin policies, which began in 2021 when the country became the first in the world to adopt Bitcoin as legal tender.

While the IMF has repeatedly warned about the risks associated with heavy reliance on cryptocurrency, El Salvador has continued to accumulate Bitcoin as part of its financial strategy.

The latest restrictions signal the IMF’s intent to curb Bitcoin-related financial activities within the Salvadoran government, reinforcing traditional fiscal oversight.

IMF’s Conditions Limit Bitcoin-Linked Debt and Tokenized Instruments

As part of its proposal submitted on March 3, the IMF introduced several conditions to regulate El Salvador’s fiscal policies under the loan agreement.

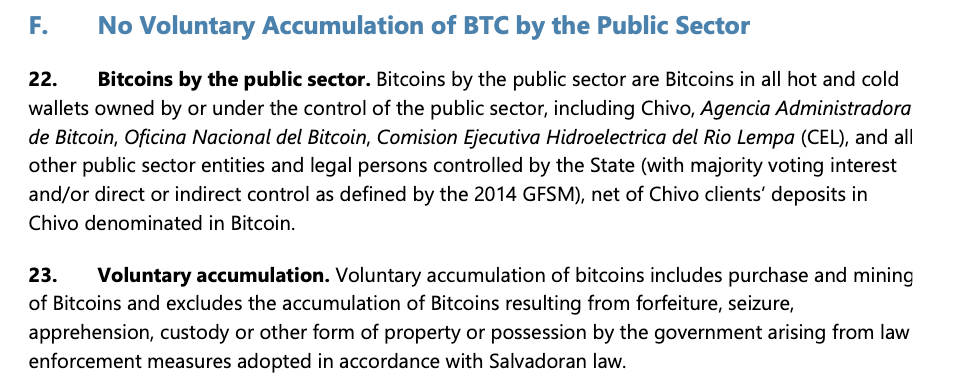

One key requirement outlined in the technical memorandum states that the government must refrain from increasing its Bitcoin reserves.

Beyond direct purchases, the IMF has also imposed restrictions on issuing government debt or tokenized financial instruments tied to Bitcoin, aiming to limit exposure to the cryptocurrency’s volatility.

These measures reflect the IMF’s broader strategy to stabilize El Salvador’s public finances, ensuring that traditional financial mechanisms remain the foundation of the country’s economic policies rather than crypto-based alternatives.

El Salvador’s Ongoing Bitcoin Strategy Faces New Challenges

El Salvador’s Bitcoin adoption has been a contentious issue, drawing both praise for its innovation and criticism for the financial risks involved.

The IMF has previously urged President Nayib Bukele’s administration to reconsider its Bitcoin policies, citing concerns over financial instability and regulatory uncertainty.

While El Salvador agreed to the IMF’s loan conditions, recent events suggest the government remains committed to Bitcoin.

In January, despite ongoing negotiations with the IMF, the country defied loan restrictions by purchasing 12 additional Bitcoins.

Furthermore, El Salvador’s Congress approved modifications to its Bitcoin law, making BTC optional for businesses, a move designed to align with IMF guidelines while still keeping Bitcoin as part of the national economy.

Future Implications and El Salvador’s Next Steps

The IMF’s new restrictions raise questions about the future of El Salvador’s Bitcoin strategy and how the government will navigate these limitations.

While the loan conditions prevent the government from directly increasing its Bitcoin holdings, it remains uncertain whether alternative methods, such as private sector involvement, could circumvent these restrictions.

Additionally, the IMF’s ban on Bitcoin-linked debt instruments could hinder El Salvador’s ability to raise funds through crypto-backed financing.

However, the country has shown resilience in its pro-Bitcoin stance, with reports suggesting it plans to acquire 20,000 additional Bitcoins despite IMF objections.

As El Salvador adapts to these financial constraints, the global crypto community will closely monitor how the country balances IMF compliance with its continued embrace of Bitcoin.

Also Read: Bitget Secures Bitcoin Service Provider License In El Salvador, Expands Global Presence