Prominent crypto trader Ansem (@blknoiz06) has suffered losses exceeding $325,000 after liquidating massive holdings of two meme coins, dogwifhat ($WIF) and Fartcoin ($FARTCOIN).

Blockchain transaction data reveals that Ansem sold 2.97 million $WIF for $2 million USDC, incurring a $294,000 loss, while his 3.6 million $FARTCOIN sale for $1.06 million USDC resulted in an additional $31,461 loss.

These trades were executed through Jupiter Aggregator Authority and Wintermute, two major trading platforms.

The decision to offload such large amounts suggests a reaction to market downturns or a broader strategy to rebalance his portfolio.

Given the volatility of meme-based assets, this sell-off underscores the challenges traders face when dealing with highly speculative tokens.

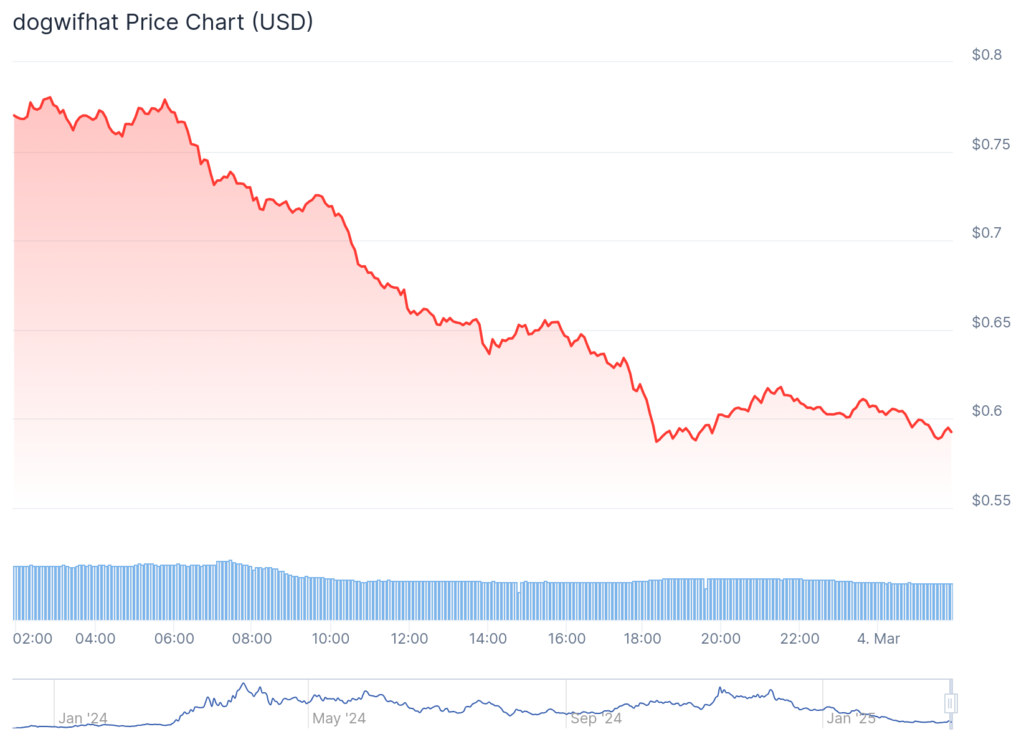

$WIF Liquidation Strategy and Market Impact

Ansem’s approach to liquidating his $WIF holdings was methodical, spanning 13 hours to minimize price slippage.

He executed multiple trades, transferring batches of 587,131 and 600,000 $WIF across trading platforms, with each transaction valued between $413,000 and $427,000.

The staggered strategy aimed to prevent significant market impact, yet the overall price of $WIF still declined sharply.

Notably, just a day before the sell-off, Ansem had received a deposit of 507,715 $WIF worth $393,426, hinting at a possible short-term trading attempt that failed.

As of today, $WIF is trading at $0.6063, reflecting a sharp 20.40% decline over the last 24 hours, despite an 11.99% increase over the past week.

Ansem’s losses, combined with the token’s downturn, suggest that market sentiment for $WIF remains fragile.

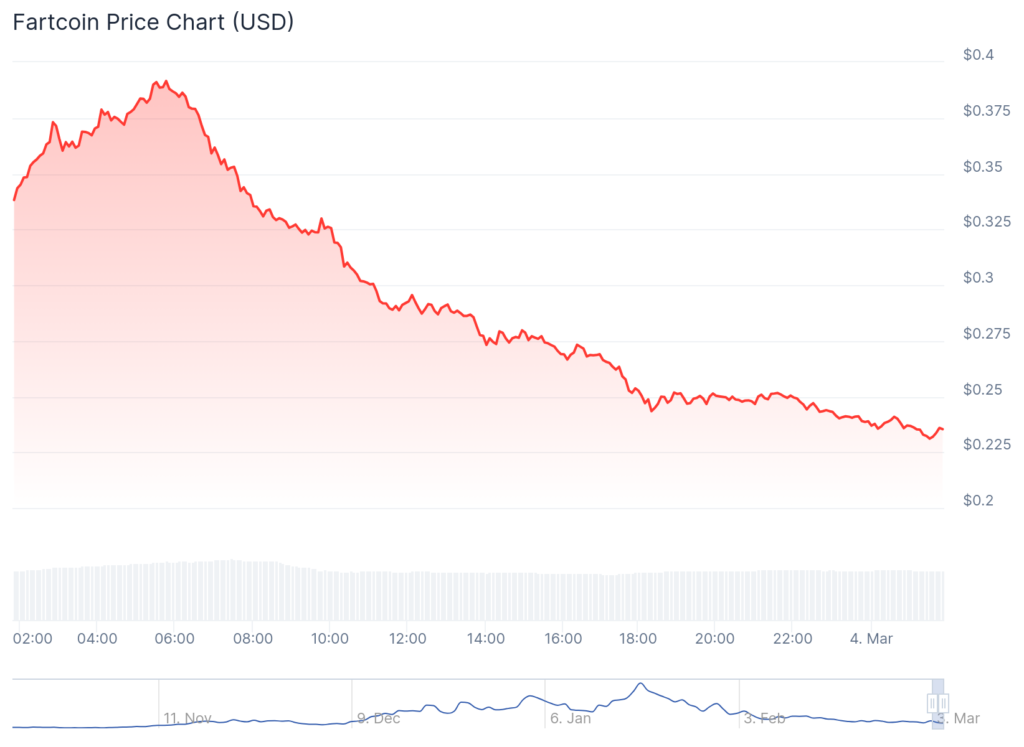

Ansem’s Sudden Shift in $FARTCOIN Strategy

A similar pattern emerged in Ansem’s $FARTCOIN liquidation, where he sold 3.6 million tokens through Jupiter Aggregator Authority, sustaining a $31,461 loss.

Interestingly, just days earlier, he had aggressively accumulated 1.9 million $FARTCOIN worth $584,637, followed by another 1.6 million purchase valued at $478,949.

The abrupt transition from accumulation to liquidation signals a shift in sentiment, potentially indicating a lack of confidence in $FARTCOIN’s short-term potential or an urgent need to free up liquidity.

The token’s price has suffered a 27.79% decline in the past 24 hours, dropping to $0.2388, while its 7-day decline stands at 11.72%.

Ansem’s rapid sell-off may have exacerbated the price decline, triggering concerns among investors about meme coin stability in the current market climate.

Broader Market Implications and Other On-Chain Losses

Ansem’s losses highlight the extreme volatility of the cryptocurrency market, particularly in speculative assets like meme coins. His decision to sell at a loss suggests potential uncertainty in the meme coin sector or a strategic effort to reposition assets.

The broader market has also seen similar turmoil, with other high-profile traders facing massive losses. A crypto whale dealing in Mantra ($OM) recorded a floating loss of $4.7 million after accumulating $143.1 million worth of tokens before a price decline.

Another investor suffered a staggering $17.5 million loss due to long positions in Bitcoin ($BTC), Solana ($SOL), and multiple altcoins, demonstrating the high risks associated with leverage trading.

Additionally, fears of a potential market crash have emerged as 116.62 million $BAN tokens were transferred to an exchange, with investors facing a possible $5.63 million loss as the token’s price plummeted by 38% in a single day.

These events underscore the unpredictable nature of crypto markets and the risks traders face in high-stakes trading environments.