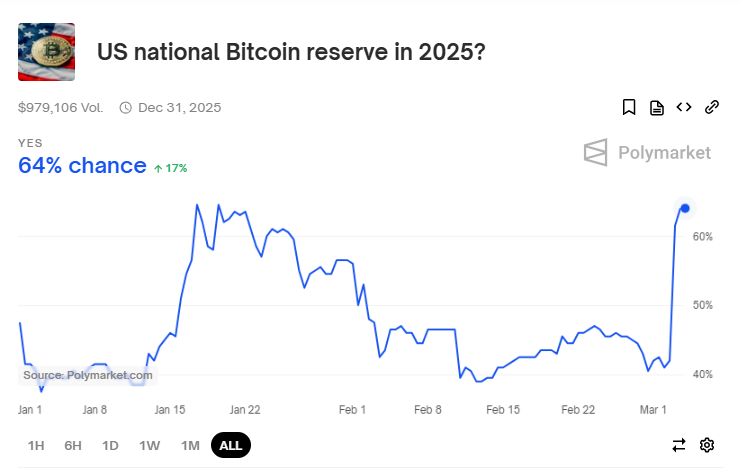

The probability of the United States establishing a national Bitcoin reserve by 2025 has surged on Polymarket, jumping from 42% to 63%. This rise suggests growing market confidence in Bitcoin’s potential adoption as a strategic asset by the U.S. government.

The shift in sentiment follows President Donald Trump’s recent social media post, where he revealed five digital assets he expects to include in the country’s new strategic crypto reserve.

Trump’s Announcement Triggers Market Rally

On Sunday, Trump disclosed that his executive order on digital assets would establish a stockpile of Bitcoin, Ethereum, XRP, Solana, and Cardano.

The names had not been previously announced, making the revelation a significant moment for the crypto industry.

The announcement triggered an immediate bullish reaction across the market. Bitcoin surged past the $90,000 mark for the first time in a week, climbing 6.68% in 24 hours to reach $91,536.34. Ethereum also experienced a strong rally, rising 5.30% to $2,324.60. Solana saw an 11% increase, trading at $157.92.

Among the biggest gainers were XRP and Cardano, which saw massive price spikes. XRP jumped nearly 14% in a single day, trading at $2.55, while Cardano skyrocketed by 41%, reaching $0.945.

The market reaction demonstrated the growing influence of political decisions on the crypto space, with investors quickly moving in response to policy developments.

Also Read: ConsenSys CEO Confirms Trump’s $250M ETH Purchase for DeFi Venture

Industry Experts React

James Butterfill, head of research at CoinShares, expressed surprise that assets beyond Bitcoin were included in the reserve. He noted that unlike Bitcoin, which is often viewed as digital gold, the other assets listed by Trump function more like technology investments.

Butterfill suggested that the move signaled a broader embrace of blockchain innovation, with the administration showing interest in multiple digital assets rather than just Bitcoin.

However, not everyone is convinced. BitMex founder Arthur Hayes dismissed the announcement, arguing that without congressional approval or changes in gold valuation, the reserve plan remains speculative. He suggested that without these factors in place, the U.S. government would have no clear source of funding to acquire Bitcoin or any other digital assets.

Uncertain Path Forward

While the announcement has fueled excitement and pushed crypto prices higher, the path to an official U.S. crypto reserve remains unclear. Any formal adoption of a Bitcoin reserve would require approval from Congress, which has historically been divided on digital assets.

Despite the uncertainty, market sentiment remains strong. The surge in Polymarket odds and the sharp rally across major cryptocurrencies indicate that investors see potential in the U.S. embracing digital assets at a national level.