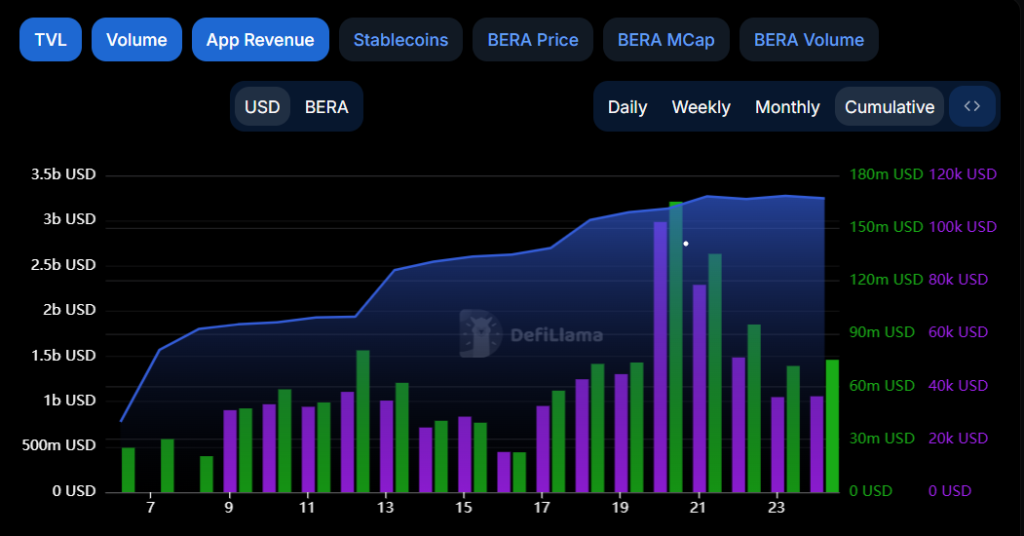

Berachain blockchain has seen a skyrocketing rise in TVL. Official data suggests that as of February 24th, with $3.25 billion in total value locked (TVL), the Layer-1 Blockchain Berachain beat both Base and Arbitration.

At the press time, the blockchain has seen a total 24 hours volume stand at $71.7 million and a 24 hr revenue of $36.3K. These data highlight Berachain’s quick rise in the blockchain market, which has been fueled by its creative consensus process and scalability characteristics.

The platform’s market position has been further strengthened by its emphasis on decentralized finance (DeFi) and decentralized apps (dApps).

Berachain’s Market Popularity: What’s Behind It?

With an astounding $3.25 billion in Total Value Locked (TVL), the Layer-1 blockchain Berachain has already surpassed established projects like Base and Arbitrum in the cryptocurrency sector.

This increase in TVL demonstrates Berachain’s rising popularity and allure for investors and developers alike. The blockchain is a fierce rival in the rapidly changing blockchain ecosystem because of its distinctive design, which maximizes scalability, security, and decentralization.

Its novel consensus system, which combines Proof-of-Stake with Proof-of-Work, has drawn interest for increasing transaction volume and lowering power usage.

Furthermore, a variety of decentralized apps have been drawn to Berachain due to its emphasis on DeFi and interoperability, which has increased its value and uptake.

Berachain’s ascent indicates the rising need for effective, scalable, and sustainable blockchain solutions as more developers and projects jump into the ecosystem. If it keeps going in this direction, Berachain might grow into a major force in the larger cryptocurrency market.

Also Read: Crypto Trader Makes Profit in Less Than Two Hours by Shorting $BERA After Its Listing

Berachain Market Impact

Berachain, a layer-1 blockchain that would compete with Ethereum and Solana, was founded by three anonymous developers and debuted its mainnet on February 6, 2025.

Proof-of-liquidity, a new consensus process used by the network, attempts to improve chain security and better align the incentives of network participants.

With “meaningful interactions” for users and early apps from the start, the new EVM-identical blockchain sought to address the “cold start problem” that most early blockchains encounter.

Factors That Can Help TVL Rise

Most blockchains have to perform well on a couple of criteria in order to become market popular. Out of these, a blockchain’s scalability and performance are essential; more users and projects are drawn to blockchains that can manage larger transaction volumes and faster speeds.

Another crucial component is security; networks with robust security protocols win over developers and investors. TVL development is also fueled by a flourishing ecosystem of DeFi protocols and decentralized apps (dApps), where users lock their assets to participate in governance or receive rewards.

Furthermore, the blockchain’s tokenomics—such as rewards for staking or liquidity provision—can persuade users to lock up more money. A network’s popularity and TVL are further increased by strong community support, strategic alliances, and interaction with other blockchains.

Essentially, TVL growth on a blockchain is fueled by a confluence of ecosystem development, incentives, security, and performance.

Also Read: Aptos vs. Monad: Debate Over Blockchain Tech And Allegations Of “Coping Code”